The number of single-family homes and condos that traded hands across the Bay Area dropped an above average 10.5 percent from June to July and the recorded sales volume (7,900) was 13.5 percent lower than at the same time last year, the fifth straight month with increasing year-over-year declines, according to transaction data from CoreLogic.

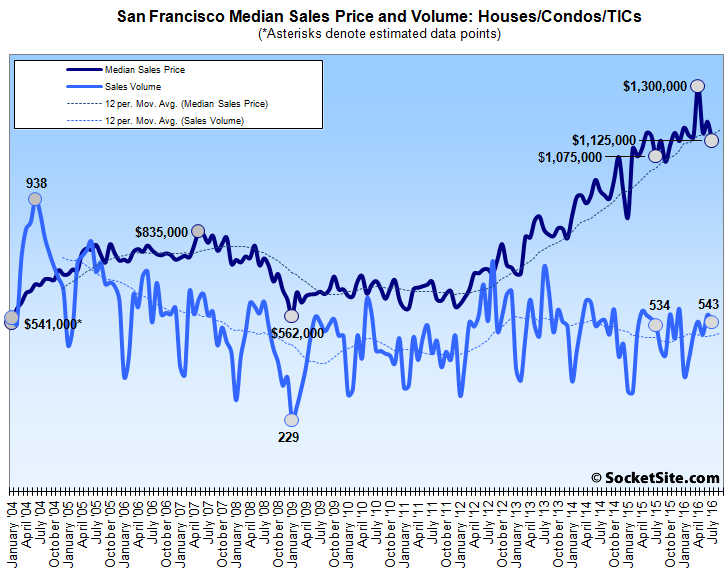

At the same time, while the recorded sales volume in San Francisco slipped 4.1 percent from June to July, it ticked up 1.7 percent on a year-over-year basis to 543 sales. And San Francisco was the only Bay Area County to have recorded a year-over-year gain in sales, driven in part by closings of contracts for new construction condominiums in the city.

Sales in Alameda County dropped 5.3 percent from June to July (1,722) and were down 8.4 percent versus the same time last year, while sales in Contra Costa county were down 19.1 percent on a year-over-year basis. Sales in Santa Clara County were down 17.5 percent, year-over-year.

The median sale price for the San Francisco homes that changed hands in July was $1.125 million, up 4.7 percent versus the same time last year but down 5.1 percent from June and 13.5 percent below April’s median sale price of $1.3 million.

The median sale price in Alameda was $687,000 in July, down 1.9 percent from June but 4.9 percent higher versus the same time last year.

The median sale price for a Bay Area home overall was $700,000 in July, down 1.4 percent from June but 6.3 percent versus the same time last year (versus 7.9 percent higher on a year-over-year basis in June).

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

Sales down, prices up. NIMBY homeowners reap the profits. Wake up san Francisco renters! Aaron Peskin is not your friend.

There’s no ‘reaping the profits’ unless the homeowner sells. Most stay in their homes. Can Socketsite tell us what percentage of homes get sold each year, and what’s the average time they were held?

Aaron Peskin is NO ONES friend. I can’t believe he’s back on the BoS, but Julie Christensen was utterly unqualified, had no personality or gumption.

As stated in the last paragraph, I think we are seeing changes in the mix affecting median prices. Homes >2m are sitting on the market longer.

I think the market this summer has been marked by the precise opposite of what you say there. Homes under 2M are selling more rapidly with multiple offers still. It is the luxury market that’s seen a 9 to 10 percent prices shift.

Reread what I wrote. Thats exactly what I said.

oh, so you did. sorry about that.