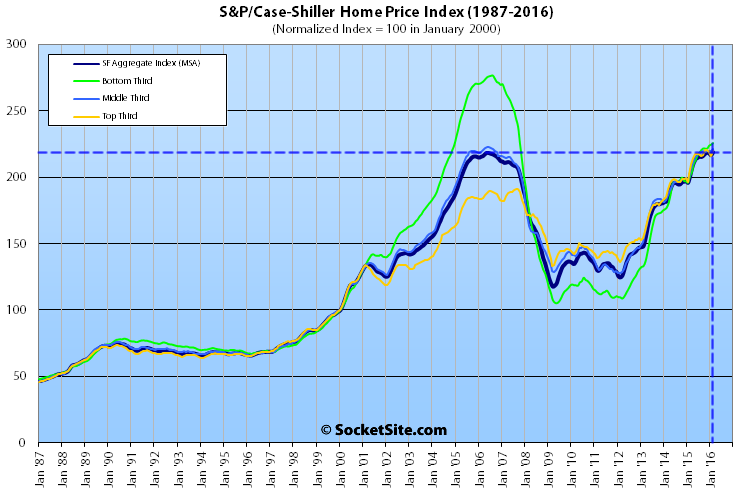

Driven by the top-third of the market, the Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area ticked up 1.1 percent in February to a new all-time high, surpassing the previous peak set ten years ago in May of 2006.

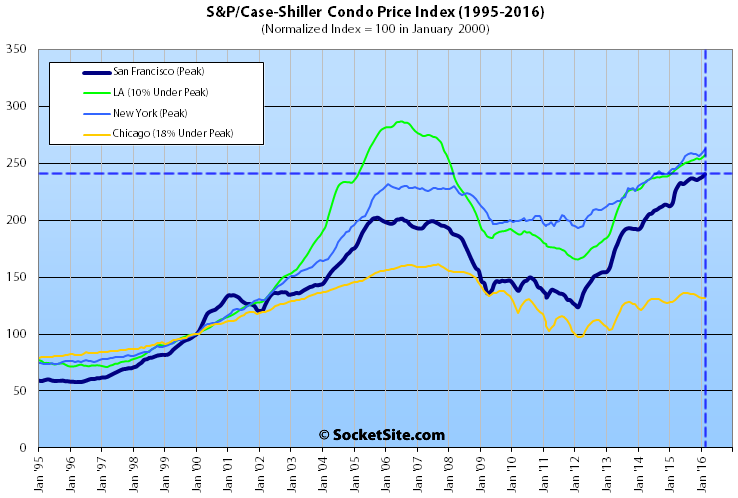

The single-family home index has gained 9.3 percent over the past year and 61 percent since January of 2010. And the index for Bay Area condo values has hit a new all-time high as well.

Single-family home values for the bottom third of the San Francisco market remain 18 percent below their 2006 peak values but ticked up 0.5 percent in February, are running 12.5 percent higher versus the same time last year, and have more than doubled since bottoming in 2009.

Having ticked up 0.7 percent in February, home values for the middle third of the market remain 1 percent below their 2006 peak but have gained 10.5 percent over the past year and 73 percent since 2009.

And reversing a two month slide, the index for the top-third of the market gained 1.8 percent in February, is running 8.6 percent higher on a year-over-year basis, and is now 14.8 percent above its previous cycle peak set in August of 2007 having gained 65 percent since bottoming in 2009.

The index for San Francisco condo values gained 1.0 percent in February and hit a new all-time high which is 11.6 percent higher versus the same time last year and 19.0 percent higher than in October 2005 which was the previous cycle peak.

The index for home prices across the nation was relatively unchanged in February, having ticked up 0.2 percent, and remains 5.3 percent higher on a year-over-year basis and 4.9 percent below its July 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

I’m sure this new high will change the recent narrative from:

‘We’re doomed, the bubble is busting!’

to

‘We’re doomed, the bubble is getting bigger and bigger and the bust will be worse than anything we’ve seen in the past!’

Ha!

Don’t worry, I’m sure the narrative lives on. We can’t let facts interrupt the bubble narrative

Here’s the evolving narrative. 2014: there’s no bubble in tech, everyone uses tech, it’s the future. 2015: maybe there’s a bubble in startups, but the big tech companies are solid. 2016: sure all the big tech companies just missed earnings, but they still are doing pretty good. 2017: nowhere to go but up.

What are you short?

Are you capitalizing on your view of the market(s) and economy?

Can a homeowner hedge his real estate holdings in the securities market? If so, how? If not, why not?

Is this a good time to borrow money?

These are honest questions. You seem to have a strong opinion. I am curious if you have thought about good ways to take advantage of your views. Would you like to share them?

I shorted some Facebook and Netflix recently and bought them back at a profit. I don’t know what to make of Apple at this valuation. The PE is down to 10. It looks a lot like a value play vis-a-vis the rest of the market. It seems like a better buy than a sell here.

Good luck to all.

Most of my capital is in hard assets on a long term horizon, given the trend of our currency towards toilet paper. I also swing trade on the daily charts using options. Right now still short Netflix 🙂 In the big picture, price discovery is a joke as long as the cost of borrowing is zero, it basically takes a black swan nowadays. Central banks have distorted the business cycle from up and down to boom and bust.

A key question about Apple relates to it’s 25% sales drop in China/Rest of Asia.

How much is this due to inventory reduction and currency fluctuations as their CFO suggested? How much is due to an Asian slow down? And how much is due to a shift in Chinese consumer sentiment about Apple?

As long as Apple keeps it’s product development mojo, I wouldn’t worry too much about them. It does seem worth keeping an eye on other companies china financials to try and take the temperature of the Chinese economy.

@Sabbie

What’s “hard assets on a long term horizon”? Is that Mexican gold coins? I’m genuinely interested.

If you’re really worried about currency inflation, wouldn’t it make sense to own income-producing real estate (at least in non-rent-controlled jurisdictions)? Wouldn’t, for example, owning a rental home with a 30 year fixed mortgage be a pretty good inflation hedge, while taking advantage of fixed borrowing costs?

How long do you think you will have to wait for another black swan?

Glad I bought back my Facebook shares, what with the stock up 9% after the close…

@Soccermon – my two cents. Owning income producing property in affordable markets with job and population growth is the way to go. I exchanged a home in California, not the Bay Area, for two in Ohio and doubled my rental income.I could have borrowed money and exchanged for 4 or 5 homes but am conservative and di a cash for cash exchange.

IMO the stock market is in a bubble and some RE markets are too. The Bay Area for instance.

Opportunities, IMO, are out there if you believe in real estate and want to diversify from the market. Many good markets are at their historic affordability levels.

Hard assets, if you feel inflation is coming or have problems with eh Feds fiat money, are real options.

F

Soccermom, yes when I said hard assets it is mostly rental property just as you described. And saving cash to buy more of it on the dip. I think we’ll get our black swan within the next year but you never know. If the economy improves, the Fed can’t put off a rate hike forever, but the rest of the world clearly cannot handle one. If the economy doesn’t improve, look at corporate earnings, they’re dangerously close to recession level (moving averages, debt vs cash flow). Nice call on FB.

@Sabbie But why do you own rental property if you think the market is going to drop? Are you invested outside of SF? Do you think a downturn would only impact SF?

Yes outside of SF. I don’t plan to sell for another 20-30 years or maybe ever, so I don’t care if the market drops, good chance to buy more. Honestly the main reason I am cheering for this bubble to pop is not for any financial reason, but because it has really changed San Fracisco for the worse, from my point of view. And I know I’m not alone in that sentiment.

Here’s a great article Robert Shiller just wrote in NYT about how recessions begin with one big event.

In 2008 it was the fall of one bank, maybe in 2016 it will be the fall of one unicorn? ValueWalk says nearly 4 of 10 US unicorns will need their next funding round in the final two quarters of 2016. What if the tech IPO market remains frozen and earnings continue to drop? Would it spook the entire herd if a unicorn gets changed back to a donkey?

Here’s some bubble talk from 2013

Looks spot on.

A cup & handle pattern is forming. I shall wait for the handle.

Can you talk cup and handle when the period is multiple years?

Also, running into what we call horizontal resistance.

Resistance is why a handle forms. Technical analysis can be applied to all time frames and asset classes.

It seems it’s my turn to break out the ‘Case-Shiller is three months old’ line. And it’s actually older than that. They use a three month moving average. So the February number has data from Dec 2015, Jan 2016 and Feb 2016.

Now being old and averaging out the data undoubtedly makes it more accurate. But it also means that you can’t draw correlations between recent data or market events and changes in the index value.

i.e. If some significant event affecting a company is announced and it’s stock has a major move the next day, you have some justification in concluding that the event caused the move or if there is no move in concluding that the market shrugged off the event.

But if you see some housing market news and the next day see the CS report, you can’t make the same conclusion. Since here we are almost in May and you’re seeing data from Dec-Feb.

Using a 3-month moving average (a period during which the stock market had plummeted about 8%), SFR prices were up 9.3% YOY and condo prices were up 8.6% YOY.

I just don’t see any indication of weakness here. The stock market took off in March (up about 8% since the end of Feb.), which is generally pretty good for housing. I’m no real estate cheerleader (I’ve been cautioning about buying into this market), but I can also see what is right in front of my eyes.

Maybe we will see a declining local market, and I expect that we should at some point. But I just don’t see this is happening at present from any of the recent numbers.

The leading indicators of weakness are showing up mostly in activity, not price. SFAR stats for March show that year over year, new listings were down 16.7 percent for SFR and 7.2 percent for Condo/TIC, while pending Sales decreased 16.4 percent for SFR and 22.0 percent for Condo/TIC. In the big picture, sales volume peaked in spring 2013 and has slid 25%.

And months supply of inventory remained flat for SFR but was up 22.2 percent for Condo/TIC. Remember, total listings are down.

Looks like the market is running out of both buyers and sellers. When that happens, there’s usually a sharp break in one direction. If you’re expecting it to break to the upside when affordability is at an all time low AND thousands of new construction condos are coming on the market, that’s not very realistic sorry.

[Editor’s Note: Price Reductions for Condos in San Francisco Proper on the Rise.]

Your information only supports a condo market slowdown theory. You cannot make a case for SFRs based upon what you’ve shown. That said, I tend to agree somewhat. I think the reason is every last builder has targeted luxury. If somebody would build with 1brs in the 500-600s, 2 brs in the 700- 800s, and 3 brs in the 900s-1Ms there would be all sorts of interest. If like a 555 Bartlett would come along now. I bet it would sell instantly. Instead you’ve got all these 1 and 2brs for well over 1M. It’s no wonder there’s a glut.

To your credit, after the dot com bust SFR actually held their uptrend while condos did not. But on the other side of the coin, SFR total sales have been in a downtrend since then, while condo sales have been in an uptrend and now make up the majority of transactions in SF.