The sale of 653 Duncan closed escrow today with a reported contract price of $2,251,000. Purchased for $1,550,000 in mid-2004, call it total appreciation of 45 percent for the Noe Valley home since 2004, roughly 4.3 percent per year, with some ups and downs between.

In 2006, prior to the big bust, the average annual appreciation for San Francisco homes since 1949 had been measured at 4.2%. From the “bubble-proof” titled piece by CNNMoney at the time:

If developers were allowed to go all out with building on San Francisco’s Treasure Island, Presidio and the Marin Headlands across the Golden Gate Bridge, the price of housing would fall close to the cost of construction. But those pristine natural amenities are the product of one of the most anti-development political cultures in the country – and a perennial magnet for the highest earners.

At least they got the parts about the Marin Headlands, Presidio (for the most part), and San Francisco being a magnet for the highest earners correct.

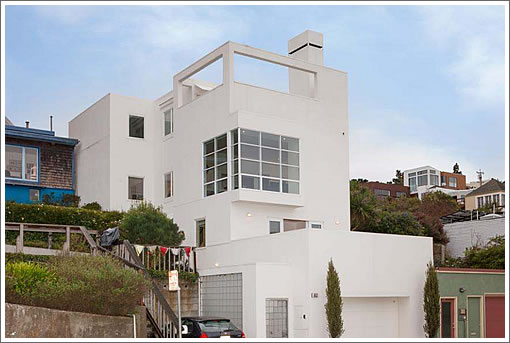

∙ A Walk Run-Through Of A Minimalist Noe Home [SocketSite]

∙ Expectation Setting: San Francisco Appreciation [SocketSite]

∙ SF Unemployment Rate Drops To 6.0% For First Time Since 2008[SocketSite]

I guess that’s supposed to be Streamline Moderne, but minus the curves.

Someone with some economic sense and local roots really needs to write a book knocking down and killing once and for all the absurdly pernicious idea that the parks and open spaces in San Francisco in particular and the Bay Area in general are somehow evidence of “one of the most anti-development political cultures in the country”.

You see the same kind of “well, if the market isn’t producing what it should, then the cause must be regulation” in the work of Ryan Avent, Ed Glaeser, Matthew Yglesias and the now infamous Timothy Lee:

Of course, we’ve discussed this before on ss, but the idea that if we just repealed regulations and let developers build on park lands and open space that “the price of housing would fall close to the cost of construction” is a new one for me and just as absurd.

I am totally opposed on building on parkland and public open space.

But I am not against relaxing the rules on zoning. The typical lot in residential areas is around 2500 to 3000sf. You could easily have 3 or 4 1000sf units where there are only SFHs today. And you’d still have a backyard.

This would cater one particular segment (families with 120K to 200K income). Some of it must be rentals.

Instead of this, the only option developers have is expand smaller houses into luxurious mini-mansions selling for 2 to 4M. And one more middle class family made the room for a millionaire.

This house and others similar in square footage are not “luxurious mini-mansions”. Far from it.

These are, for the most part, “typical” homes in good neighborhoods, and they are all selling.

More power to the developers and the seller.

And let’s not forget: quite often that “middle class family” became a millionaire by selling their little Noe house they owned since 1958 and bought for $18k, can now move out of The City and retire comfortably elsewhere.

And absolutely nothing wrong with that.

So this bubble started in late 2012 to early 2013 which means the next foreclosure crisis will start about 2016!

Why do you think that this is absurd Brahma? The SF Bay Area is one of the most anti-growth areas in the nation. Combine that with high income growth and you have all the classic makings of a squeeze.

It is not San Francisco in particular that is anti-growth, it is the whole region, all the way up to the “growth boundaries” which are the ring of parks around the inner suburbs. That is why all the growth has been occurring way out in places like Tracy, which is crappy for both people and the environment.

Preserving parks and open space is not anti-growth. What’s anti-growth is restricting new construction with tight zoning, low height limits, EIRs and endless architectural reviews. San Francisco excels at this – to the benefit of anyone who already owns a home or has a rent-controlled apartment locked in, and to the detriment of everyone else.

I find the use of the word “bubble” to be simpleminded. There are two forces at play in today’s market: cheap money and solid demand growth. Cheap money reduces the price of owning a house and, all else being equal, will boost the price. When money becomes more expensive, the opposite will happen. Growing demand, seen in job growth and population growth, will create higher prices through market forces. The effect will be more pronounced when supply is constrained, as it is in SF. When both of these forces are operating simultaneously (like now), expect to see prices rise rapidly. When one or both forces abate, prices will stabilize or fall, depending on the severity of the shift. To equate these forces with a “bubble” (think tulips) is missing the point.

This is a bubble for 3 reasons:

1.) Obama-Bernancke funny-money is at historic lows that is 1/5th the rate as when Reagan was president. If/when rates rise again to the normal range of 10%, housing prices are bound to fall by 50% or more. THis only benefits the developer-flippers.

2.) Facebook/Twitter/Zynga/Groupon overnight millionaires. THis sudden flood of new-found wealth inundated the area with new demand for nice-looking homes. This encouraged flipper-developers to make faux-improvements to dilapidated houses that will end up needing to be redone in 5-10 years because of the shabby work that many flipper-developers are doing.

3.) Flipper developers are speculating with investor money, combined with the ill-gotten gains from their previous flipjobs.

SF BOS and Mayor need to impose an immediate 25-50% excise tax to be assessed as a lien against every property sold, and only lifted with either payment of said lien, or upon forgiveness when the homeowner lives in the unit for 36 of the first 48 months of ownership of the property. Corporations and trusts shall be ineligible for the exemption.

@james: Wow. “Funny money is easily obtainable, “Ill gotten” “flippers using oh so readily available construction money,” “faux improvements” — all of that screams deep seated bias/hate and or complete misunderstanding. The excise tax notion is preposterous.

Nowhere do you mention scarcity? And if you think that loans are fueling this “bubble,” or that loans are easy to come by in this market, you’re alone.

As I said in a previous thread, I have officially dusted off my “bear” cap. Maybe I should resurrect my SanFronziScheme handle? Maybe in a year or 2.

– Too much cash is chasing to few assets.

– Professionals who made tons of profits are doubling up by reinvesting into bigger projects.

– Fence-sitters from the crisis saw they missed out are are jumping on the bandwagon, compounding the demand.

– Expectations of future increases are now baked in prices of fixers. Horrible places selling for $1000/sf+ are clear sign of speculation.

– preemptive 20 to 30% overbids are now more common than ever when the original asking seems reasonably set.

This will probably last another 18 to 24 months. After that, run for the hills.

Well if these price gains start reaching the Plan D neighborhoods then it will be a bubble for sure. Until then I suspect a lot of this is actually the mix of homes selling in SF right now. How a $2.2 million dollar sales can be considered a “perfectly average sale” tells you something about how the coverage of SF’s real estate market is skewed.

I agree with Rillion on this point. It is a bubble when it reaches into lesser hoods. Not sure what would constitute “plan D”, Excelsior?

I agree with Rillion.

The Excelsior can indeed be an example of a plan D. The latest Zillow numbers show that The excelsior lagged the ramp up that NV, BH or the Mission saw last year by a solid 6 months.

But it’s already catching-up: 20% since the trough of February 2012.

That’s to be compared with the roughly 45% for NV or around 30% for BH or the Mission. since their own trough in 2010 or 2011.

The parts of the Western Addition that are still the Western Addition and haven’t gotten a fancy new name are also lagging. In February of this year a 3bd/2ba condo in my complex sold for $400k, the last 3/2 that sold was in July of last year for $425k. So not really feeling this ‘bubble’ in my hood yet. In summer 2007 the 3/2’s went for around $700k and the 2/1 next to mine sold for $500k. That’s what a bubble feeels like.