Buoyed by closings of contracts for new construction condominiums which are now ready for occupancy, recorded sales of condos and single-family homes in San Francisco were 13 percent higher in November as compared to the same time last year but dropped 14 percent from October, which is twice the typical seasonal decline for this time of the year.

Listed sales in San Francisco, which do not include the vast majority of new construction sales, dropped 19 percent from October to November and were down 7 percent versus the same time last year, as we reported earlier this month.

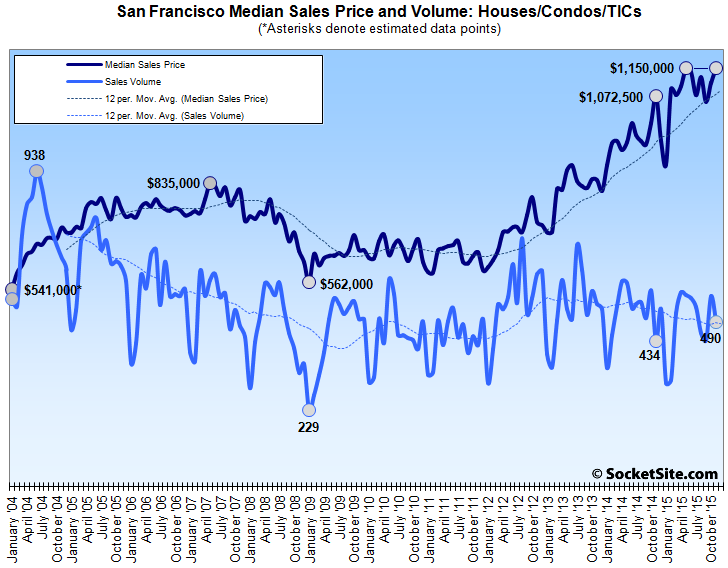

The median sale price for all the San Francisco houses and condos that changed hands this past November was $1.15 million, up 3.6 percent from $1.11 million in September to match the record $1.15 million mark set in May and 7.2 percent higher versus the same time last year, according to data compiled by Corelogic.

Across the entire Bay Area, recorded home sales dropped 16.8 percent from October to November but were 7.1 percent higher versus the same time last year with a median sale price of $649,000, up 6.0 percent versus November 2014. And the median sale price in Oakland was $550,000 last month, up 14.6 percent versus $480,000 at the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s in demand and selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix.

Another very strong month. Still seeing very, very little evidence of a slowdown or even crash as forecast by many and even presented by some as fait accompli.

At most, it seems a plateau, which may even be a pause before the next leg up in spring, as has typically happened in recent years.

No evidence of a slowdown, none at all?

Where did I say “no evidence”?

You’ll notice during the last bubble how sales volume peaked four years before prices did. You’ll also notice that sales volume for this current bubble peaked in 2012, which may indicate we are headed for a peak in values 2016.

There is an affordability ceiling for each market; last time it was pushed out by loose lending, this time it’s being pushed out by zero interest rate capital, but it always reverts back to the parameters of the real productive economy outside of speculative excess.

Yes, massive over- and mal-investment don’t just cause a “flattening out;” the consequences are a little more serious, viz the low, low prices at the pump as a result of the massive over-investment in domestic shale oil pumping.

How many ride-sharing or food delivery app unicorns are really justified by the economy? My answer: none, but even clearing out the many and leaving a few giants standing would still be a nuclear bomb on local jobs, and therefore RE.

Yep, Sidecar folded yesterday and Uber valuation was cut by 7% today. The investors are trying to prepare the market for a smooth exit, soft landing scenario, but the uncontrolled demise of 1-2 unicorns could really spook the whole market.

We seeing a bit of a slow down in that the market no longer seems crazy, but places are still selling. The last few places we have sold have gotten one strong offer at a good price, but no bidding wars.

I’m with REpornaddict at this point. From what I can tell (as a very casual observer), I’m not seeing any price softening. A couple of examples of recent sales not far from where I live:

4 Ord Ct: nice, but very little house (2BR, 1170 sf) in a great spot. Sold for $955,000 in 2008. Listed on 11/20/15 for $1.1m – which would seem pretty reasonable at >20% over the bubble peak. Sold for $1,525,000 on 12/18.

155 Hancock: tiny place (1BR, 1 Ba, 700 sf) great street. Sold for $760,000 in 2012. Listed on 11/7/15 for $869,000 and sold on 12/11 for $957,000.

Crazy selling prices in both cases.

Now, socketsite has been very good at spotting leading indicators. And there are some indications that things may start to slow soon – notably, declining sales volumes and places being de-listed with no sale. And they should decline (or at least level) as prices over the last couple years have just been insane. But I’m not seeing price declines just yet. As I’ve been saying for about a year, I would not buy now unless you have a cushion to withstand a significant decline.

[Editor’s Note: Keep in mind that 4 Ord Court, which was legally expanded and remodeled between sales, was listed well below market. But that’s not to say that we disagree with the characterization of the sale.]

Ed., you are right! 4 Ord Ct. was even tinier before. Shows how insane prices became in 2008 as well. Even more insane in 2015 that nearly $1000/sf can be considered “well below market,” although I agree that is the case.