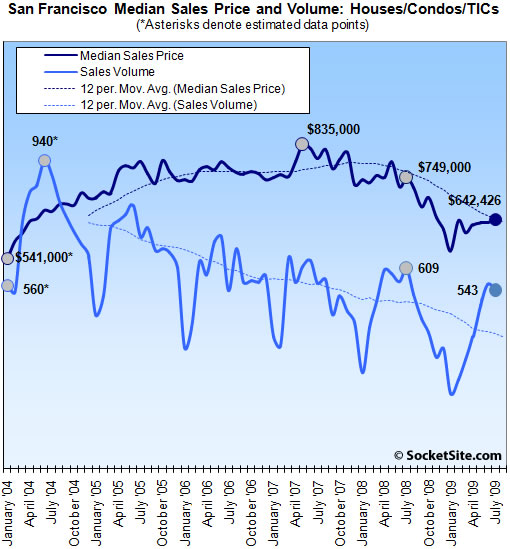

According to DataQuick, recorded home sales volume in San Francisco fell 10.8% on a year-over-year basis last month (543 recorded sales in July ’09 versus 609 sales in July ‘08) and fell 3.2% compared to the month prior. The difference between recorded and listed sales activity continues to be driven by unlisted new construction sales.

San Francisco was once again one of only two Bay Area counties to record a year-over-year decline in sales volume in July with Marin falling 4.3%. San Francisco’s median sales price in July was $642,426, down 14.2% compared to July ’08 ($749,000) and up 1.2% compared to the month prior.

For the greater Bay Area, recorded sales volume in July was up 15.6% on a year-over-year basis and up 1.5% from the month prior (8,771 recorded sales in July ’09 versus 7,586 in July ’08 and 8,644 in June ’09), while the recorded median sales price fell 16.0% on a year-over-year basis, up 12.2% compared to the month prior (the fourth uptick in 19 months).

The median’s $43,000 gain between June and July was mainly the result of a shift toward a greater portion of sales occurring in higher-priced neighborhoods. The trend has been fueled this summer by several factors, including: More distress in high-end areas, leading to more motivated sellers; more buyers sensing a bottom could be near; and increased availability of larger home loans, which had become more expensive and far more difficult to obtain after the credit crunch hit two years ago.

In another sign of a gradual comeback in home financing, the percentage of Bay Area homes purchased last month with an adjustable-rate mortgage rose to 6.6 percent – up from a record low of 3.0 percent in January 2009. The median sale price for homes purchased with those adjustable-rate loans last month was $766,500, while the median loan amount was $523,500. Adjustable-rate mortgages averaged about 61 percent of all Bay Area purchase loans this decade up until the credit crunch, after which they began to dry up quickly.

At the extremes, Santa Clara recorded a 32.5% year-over-year increase in sales volume (a gain of 639 transactions) on a 16.3% drop in median sales price while Solano recorded a 20.8% year-over-year increase in sales volume (a gain of 123 transactions) on a 27.3% drop in median sales price

As always, keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) many months or even years prior and are just now closing escrow (or being recorded).

∙ Bay Area home sales hit 4-year high; median price up [DQnews]

∙ San Francisco Recorded Sales Activity In June: Down 1.8% YOY [SocketSite]

∙ San Francisco Listed Sales Volume In July: Down 13% YOY [SocketSite]

∙ Infinity Sales Update: New Contracts Up But Driven By Discounts [SocketSite]

What I inteferred from these stats is that although volume of sales YOY has gone down, the median price has actually gone up ?!

Does that mean the sale is over in San Francisco ?

I am sitting on ca$h and bottom fishing here, as you might have already figured 🙂

Bide your time, Chad. I’d give it another year to 18 months and then start making aggressive below market cash offers (sounds like you’ve got the means to back up the offers). You’ll thank me for the advice next year 🙂

Chad:

no. SF’s median price is down. RE is highly seasonal. Thus it doesn’t work well to compare MOM or even QOQ data.

you should use YOY instead.

YOY, prices are down about 15% county wide.

the sales volumes are still down as well.

My guess is that bottom will come when:

YOY prices are up. (not down)

YOY sales volumes are up as well (not down)

YOY inventory is down (or at least flat)

I prefer to see all three.

**on a side note:

SF has a chance to start showing some YOY positive numbers sooon. Last year Oct through Dec was absolute carnage in the SF RE Market. (much of it seasonal, much of it due to the sudden credit crisis when Lehman fell).

this year, the YOY numbers will be in relation to 2008’s carnage. Thus, they have every opportunity to look much better.

in fact, I’ll go out on a limb and say that I expect Oct-Dec 2009 to outperform Oct-Dec 2008, although perhaps not by much.

I wouldn’t bet on it though. anything can happen these days given the continued deterioration of the economy and the over-reliance on mama-govt to subsidize everything. the green shoots ridiculousness may fall apart this Sept. then all bets are off.

only 2.5 more years left of RE pain per my original hypothesis back in 2006/7.

Median going up can mean subprime problem abating, effects of foreclosure moratoria + more properties at the higher end getting into trouble. A rising median has been expected for awhile, though I don’t know if this is being triggered by the expected causes.

Wait until February at the very least. If Christmas sucks (back to school is already dead), you’ll see the economy head down farther. At that point, it will be clear to the amateurs that things aren’t coming roaring back.

Thanks LMRiM and ex SF-er for the wealth of information / advice 🙂

I like the idea of “aggressive below market cash offer”.

I tried it (and it worked) on a smaller purchase. An 3 year old, “like new” Audi that I bought off of Craigslist earlier this year. I saw the listing, felt that the seller was distressed, called her on a Saturday, and offered her all cash deal after quoting a price that was 30% below her asking. She took it. I think what nailed it was when I told her “If you take this much of money, I can deliver the cash today and take the car off your hands at the same time.”

So I think I should try it like you suggested on the RE and hopefully something will work out.

I don’t get “attached” to homes, so even if I get rejected, I don’t mind 🙂

Thanks again folks. You make SS such a great forum too… !

Chad,

From this graph, bottom fishing would appear to be best during late fall/early winter. Volumes way down, prices following suit, before spring brings buyers and sellers back.

One caveat though: places you’ll find in the winter will sometimes be very high DOMs. Unfortunate casualties of the spring/summer months that are either incorrectly priced, have a serious flaw or are in need of a serious marketing effort. This might explain why prices are lower in the fall/winter too. I’d start my shopping in October/November but watch out for lemons. Have a nice hunting!

In general, I think it’s still too early to buy. This cycle is not finished. REOs are only trickling into the pipeline and many more to come. There could be another cliff run on the way sooner than later.

The difference between recorded and listed sales activity continues to be driven by unlisted new construction sales.

Is there really that much of a difference though?

I think listed sales were down 14% – but listed SFHs were at their highest level since October 2006.

SS,

I would love to see inventory added to this chart.

ex-SF-er also mentions inventory as the 3rd major indicator he would look at for signs of a macro bottom.

Just a simple MLS listing count would be good even though the “plugged-in” folks know there is new construction inventory and foreclosure inventory that is tough to quantify.

So here is what the professional economists over at ECRI have to say about the housing market:

“With U.S. home values far below their boom-time highs, most observers are resigned to an indefinite downdraft in home prices. It is this uncertainty about the ultimate bottom in home prices that has converted so many mortgage-related derivatives into toxic assets. Yet, at long last, the end of the home price downturn is in sight.

One key reason for the turnaround in the outlook is housing affordability, which is hovering around all-time highs. The current combination of drastically reduced home prices and very low mortgage rates has hardly ever been seen in living memory…

Most importantly, the U.S. Leading Home Price Index (USLHPI), designed to predict cyclical turns in real home prices, has now been rising for five months… But a three P’s analysis (see chart below) of the level of the USLHPI reveals an even more promising picture… the recent upturn in the USLHPI is almost as pronounced as the median in comparable past cycles… it is almost as pervasive; and … it is just as persistent. The implication is clear: this is a genuine cyclical upturn in the level of the USLHPI. Such an upturn in the USLHPI amounts to a forecast of a cyclical upturn in the level of home prices this year…”

These guys have accurately called all of the last three recessions and gave an “all-clear” on the stock market in the middle of March, when the gloom-and-doom crowd here on Socketsite was telling you to load up on cash. They are also calling for a strong recovery in Q4.

Personally, I am sitting on a pile of cash that I will probably use to buy rental property and I will not buy until the Cap Rate makes sense when compared to Muni bonds. That would mean at least 9%, which nothing in the Bay Area really meets right now. If I never find something, that is fine, I will just invest in other things.

If I was buying a home for myself, I would wait until prices were up YoY. Real estate tends to move in long cycles and while this one might be compressed a bit, the risk of buying too soon outweighs the risk of missing the bottom.

NVJ,

interesting post – but were you meant to add some links to charts?

I would love to see inventory added to this chart.

SF averaged around 7+ foreclosures per week for the 5 weeks that were part of July. A foreclosure a day keeps price inflation away…

Thank you guys for financial advise, we are the ones who have been patiently waiting for the opportunity (reading SS surely helped). I would agree that it might be too early to jump into the market this fall, but no one has brought up the issue of potential devaluation of the “piles of cash” some of us are sitting on. The outcome of the Inflation-Deflation debate is still unclear, at least as of today. Any thoughts would be appreciated.

Some thoughts:

1. By the time you see YOY price gain, you may have already missed the bottom. Not buying at the absolute bottom, however, is a lot better than catching a falling knife.

2. I noticed LMRiM and ex SFer have moved their time table up a notch or two. In April or May, you folks see the market continue to tank over the next two to three years or longer.

3. Chad: buying a car is a completely different transaction. First – you are lucky the seller owns the car outright. You couldn’t have bought the car with cash if she owes more on the car than you offered. That’s usually the case with real estate. Second – are you really going to buy a property paying ALL cash ?

4. It is interesting to hear all the recent home buyers in Solano and east Contra Costa County (I work there) talking about how happy they are about the price they just paid for their new home and how much money they think they will make on appreciation over the next year or two. Little do they know, the easy money has already been made. The 500K home from 2007 they bought for 275K last month was sold for under 200K less than 6 months ago. What they say about investors having short memory…

^^^I don’t think I’ve changed my timeline, Outsider. I think the “bottom” will happen (in nominal terms) well beyond end-2010. However, for a personal residence for most buyers, you don’t need to pick the absolute bottom, and you are going to want to watch the conflicting positives of locking in long term low cost financing versus getting the absolute bottom dollar price.

My guess is that aggressive under market cash bids towards the end of 2010 would get you a property that you won’t feel like a sucker for buying a few years later. If you’re financing, well, again I expect interest rates to rise at some point which will put some pressure on nominal prices. But if you buy 12-18 months out with a long term horizon, again I think you won’t feel like a sucker if the price goes down another 10-15% when you’ve got great financing locked in (and rents will start to rise at some point as well, so any price weakness will also be mitigated by the increasing shelter value of the place).

I could look it up, but I think I’ve always held to that end-2010 period on SS, but lately I am starting to think I might wind up being a little early.

I got this from the ECRI web site, this particular gem is currently on their front door:

http://www.businesscycle.com/home/

They are predicting a pretty strong recovery in general, it will be interesting to see if they blew it this time.

[Editor’s Note: Probably not too far off the mark with respect to average U.S. home values and areas where fundamentals have come back in line, likely a lot less accurate with respect to non-average areas like San Francisco where they have not.]

In the more near-term, and addressing JJ’s point about inventory, I see per redfin.com new listings in the last 24 hours have cracked 100 for the first time in quite a while. I wonder if the “post-Labor Day” bump in inventory will come a little early this year?

Also, I think the ed. has it right regarding home values and market fundamentals. Note in the DQ numbers that only SF and Marin continue to see sales declines YOY whereas the counties with $350k medians have seen pretty substantial YOY volume increases — yet prices continue to decline even there. SF continues to follow right in line with these places, but trailing by about a year. As I’ve said many times, it’s all a single market, and declines in neighboring counties get reflected here soon enough. I think the SF bottom is at least a year farther out than LMRiM’s pick. Just wait until all the market-propping efforts end (and they will soon).

“I will not buy until the Cap Rate makes sense when compared to Muni bonds. That would mean at least 9%…”

Out of curiosity, NVJ, what does this imply for SF prices? In other words, pick a Real SF property from the MLS and calculate the current cap rate based on asking price. How much would that price need to fall to get you 9% assuming rents and holding costs are static?

Hi Outsider. I don’t think a car and home purchase are complete different as far as negotiations are concerned.

Bargaining power remains the same / similar in both cases in situations where the Seller is distressed and the Buyer offers him/her an incentive to experience “instant gratification”. (I know right about now I sound like a salesman 😉

Anyways I wasn’t planning on doing ALL cash on the house, even though I can afford to. I was thinking more like what LMRiM suggested earlier i.e. “aggressive below market cash offers”. So I scout properties, pick one(s) I like, figure out the desperation, and then offer 30% to 50% Ca$h (%age will vary on the percieved desperateness of Seller or if the property is Bank Owned) and promise a quick sale.

What do you think ? I know some of you will call me a “Shark”, but let’s admit it folks, it is simply Darwin’s Theory (Survival of Fittest) playing out in RE.

Chad, I am a bit confused… A

recent post you mentioned that you were considering a 2nd place over in Jack

London Square in Oakland to take advantage of the sun on the other side of the

bridge however passed because of the Chinese Warehouse/Produce business in the

area. In your own words, "not so clean (read "filthy") Chinese vegetable

vendors," & "We live in SF, but were thinking of getting a place "on the side"

to visit on weekends in summer to get sunshine and such." Now this post you

are saying, "I am sitting on ca$h and bottom fishing here, as you might have

already figured." So, previously you were renting in SF and considering buying

in JLS to take advantage of the sunny days after a long week of work and to escape your place in SF? I mentioned before but you never responded, JLS and SF

is only about a 10 mile difference at the very most. Please tell me you are aware of

this?

Ok Chad … now you say – "What do you think ? I know

some of you will call me a "Shark." I wont call you a shark, but I think you are

one and I hope you are genuinely happy with yourself… based on some of your

post I have determined that somewhere in there is a very sad person. You have

gone from racist remarks, to mentioning gang bangers in Oakland (Oakland is not

LA! ), now to flattering everyone with your all cash offer on a home which we

all know is not a very intelligent investment decision unless you are in a very,

very small group of people in America/ or the world which I would imagine most would not

possibly be interested in moving to a loft in JLS.

Can someone explain why all cash on a home is a bad idea? This is probably elementary, but I’m not getting it.

Just Curious,

To everyone his own. If you can own your place free and clear and still have a diversified pool of assets, you’re more than fine.

Owning your home means you’re saving on rent and have less to worry about. But it also means you have no leverage effect if your property appreciates. Give and take, I guess.

From a finance point of view, it almost always makes the most sense for most circumstances to have as little cash as possible tied up in real estate. Financing rates are relatively cheap in real terms (due primarily to government interference and special tax advantages to the debt) and most importantly most states allow you to walk away from the debt without declaring bankruptcy in the event of trouble. This is a “free option” on depreciation of the asset in nominal terms or changed life circumstances, and to the extent that you put real $$ into it you are giving that portion of the option back and not really getting anything in return for it (maybe a very slightly better interest rate – but only material in the jumbo space of course).

In addition, real estate is highly illiquid, and financing is not always available (as we’ve seen) when you might need cash due to unforeseen circumstances. Think of people who stretched to purchase in 2005-7 with a large downpayment and subsequently lost a job or otherwise had a life change that necessitates liquidating the asset. I bet they wished they had put less down!

On the other side, for people who are poor managers of money, “building equity” is a nice way to “force savings”, so if you know you are likely to just blow the cash, invest it poorly or otherwise fritter it away, it’s probably better off sitting in a primary residence. Also, of course, for people without provable income/W-2 employment, high percentage of cash might be the only feasible way to go.

In Florida, cash might be preferred as a risk management tool, as all cash in a homestead is “bankruptcy-remote”. Just ask O.J. 🙂

All in all, there are many considerations, but I’ll stick with the idea that for most disciplined “average” income earners, as little cash as possible is the way to go.

Coincidentally, my wife & I just refi’d out of a 30-year fixed (@ 6.25%) into a 5/1 IO ARM @ 4.5% … thereby saving about $7k a year in interest costs and freeing up yet more cash that was being siphoned off into paying down principal.

The mortgage broker thought we were odd because ‘everyone’s getting a 30-year loan right now.’ Guess we’ll see how that turns out in 2014.

Our monthly mortgage payments are now lower than our monthly restaurant/entertainment tab used to be (pre-baby, of course! Now our restaurant/bar tab is $0).

I need some new bad habits to burn off all the excess cash …

NVJ- u can probably get 9% cap rates right now- on POS’s in the loin, like 9 units, all studios. crap bldg, no upside, less than steller tenants. don’t you think it’s worth trading high cap for a better quality bldg/location/tenant profile? those are the things that lead to eventual equity upside (a concept well known, and beloved by SS readers 🙂

alternatively, you can go slumming in lackluster hoods off el camino real somewhere in san bruno(?) south city, etc. maybe some deals there on 60’s motel style multi-units.

personally, i’ll stick with decent bldgs with upside in upcoming SF hoods. the big money is always made in SF in appreciation. the SS naysayers can quip all they want, but i’m the one that’s prematurely retired off SF RE 🙂 but like you said, let’s continue to stick with cash…right through the impending recovery…right through the consequental inflationary phase…and let’s look to buy when rates are high again and the bottom is clearly over! we’ll see how many bears will miss this completely. (note blowhards: i’m not saying buy now, but i do think lotsa you will mis-time this completely. go bears!)

Hipster,

Formerly retired off Paris RE and I went back to work because I got bored. I bailed out from most the RE in 2006 unlike a lot of perma-bulls blinded by the 2003-2007 anomaly.

My assets gained 30+% since mainly due to currency rebalancing and average boring safety 4%/Y returns. No significant stock market losses. And I can buy today 20% more SF RE than I could 2 years ago! Meaning my RE purchasing power grew by 60-70% in 3 years.

Let’s see how all of this plays out, but so far my instinct protected this bear pretty well.

30% from 06-09? you couldn’t get ~10%/yr w/o significant risk. currency balance (trading?) is high risk. and the mostly 2% boring MM accts would have gotten you nowhere. so which one is it? 30% in 3 yrs with risk, or much less safely?

45 yo hipster said:

“personally, i’ll stick with decent bldgs with upside in upcoming SF hoods. the big money is always made in SF in appreciation. the SS naysayers can quip all they want, but i’m the one that’s prematurely retired off SF RE 🙂 but like you said, let’s continue to stick with cash…right through the impending recovery…right through the consequental inflationary phase…and let’s look to buy when rates are high again and the bottom is clearly over! we’ll see how many bears will miss this completely. (note blowhards: i’m not saying buy now, but i do think lotsa you will mis-time this completely. go bears!)”

It sounds more like you’re trying to convince yourself about the soundness of your past RE investments than making a case for investors/buyers to enter the current market. The big money may make huge sums on SF appreciation, but more than most lose their shirts in downturns due to leverage and excessive carrying costs.

I realize that grammar, spelling and punctuation may not be staples for the hipster generation, but they generally aid most in the readability of your posts.

And by the way, hyperinflation won’t save you, but we can’t have that conversation until deflation’s over, right?

Stay ironic…. I guess… or maybe not…

I noticed LMRiM and ex SFer have moved their time table up a notch or two. In April or May, you folks see the market continue to tank over the next two to three years or longer.

Perhaps I haven’t been clear. I haven’t changed my timeline to my knowledge anyway. Since late 2006/early 2007 I’ve hypothesized that RE pressure would be in full force until Dec 2011. (based on Ivy Zellman’s study back in Jan 2007 on mortgage resets that I posted to Socketsite like 100 times). I still believe this to be the case.

In this thread above I said we still have about 2.5 years of this… 2.5 years from now is Dec 2011.

From a recession standpoint, I’ve long gone back and forth on whether or not we would have a long U or an L or a W shaped recovery. I have never believed in the V shaped recovery.

Earlier this year (maybe January?) I started reminding people that we may exit recession at the end of this year. This still might be the case, it’s iffy. But the end of recession does not mean the return of good times. On the contrary, I suspect a long “jobless” recovery or worse yet (and more likely) a “W”.

I still don’t see much structural improvement in our economy. All I see is companies beating estimates by cutting costs. But you can only cut costs for so long. And cutting costs decreases employment which kills the American consumer who is supposedly going to get us out of this. Somehow they’ve got to increase the top line…

No, all we’ve done is bandaged our economy by shifting an unbelievable amount of debt onto the Government’s balance sheet. (bailouts, MBS purchases, AIG/Fannie/Freddie guarantees, bank guarantees, cash for clunkers, stimulus, Treasury purchases, Quantitative Easing, etc). The Fed at this time still has no exit strategy.

Heck, I even gave in and bought a new car with that cash for clunkers program for a relative. why not, the govt is giving away “free” money (sarcasm) and as a very high income household I never get any of it. Might as well pick up a brand new car for $7k.

I’m desperately looking around for more stimulus money I can have too. If Goldman Sachs, the welfare goddess, can get hundreds of billions of dollars… I can haz bale-owt too?

=====

a note on the US mortgage statistics. The last I checked (I haven’t read the complete report), sales have surged across the US (on YOY basis) in the sub $100k market. They have improved significantly in the $100k-$250k market. But anything over $250k has done very poorly. The $1M and above market has been crushed and the $2M and above market has been slaughtered. (all national data).

which may partially explain why SF and Marin are lagging way behind the outer suburbs in sales volumes. All SF/Marin has to do is drop prices to nearer the outer bay pricing and you’ll get a huge sales volume bump. (duh!)

Jorge: big mouth strikes again.

“… and let’s look to buy when rates are high again and the bottom is clearly over! we’ll see how many bears will miss this completely. (note blowhards: i’m not saying buy now, but i do think lotsa you will mis-time this completely. go bears!)”

*****

The house price “bottom” in San Francisco is going to be long and wide, so it’s going to be very difficult to miss it.

In 2005, I thought it would take seven years to get there.

Now? Barring a complete government intervention in housing markets, I’m still pretty convinced it will be 2012.

The nice thing about partial intervention is that it extends the time to reach “bottom”, and its duration, so perhaps the bottom will begin then and bounce around that level for years…

^ au contraire; the longer, murkier the bottom is, the more folks will miss it. Uncertainty leads to inaction for bears.

It’s funny that bulls like hipster think that rising rates in the future won’t be another huge headwind for house prices in SF.

^ it’s even funnier when people isolate one variable to make a prediction on a complex market.

The headwinds that have blown Capp st. condos all the way back to 3/4 of a million?

Shiver me timbers.

^Hasn’t sold yet, Popeye.

alternatively, you can go slumming in lackluster hoods off el camino real somewhere in san bruno(?) south city, etc. maybe some deals there on 60’s motel style multi-units.

Yeah, I noticed these browsing around on Redfin. Also some places in Oakland and Richmond. Still looking though. There are plenty of properties that meet my criteria in Sacramento and Riverside and I have relatives in both places, so I will probably end up buying there.

hey NVJ- about how many units ru talking about, if sacto or riverside? +/- 20? for $1.2 to $1.5 mil? i don’t think 4-9 units will yield those cap rates, unless area is really narly. also, not practical to hire a prop mgmt for so few units.

in addition to dealing with prop mgmt co (you essentially loose control of tenant profile, and maint/repair details) i’d be worried about keeping occupancy rates high- those areas tend to have rows and rows of generic multi unit bldgs, one after the other.

personally, i’d opt for a more urban, but solid area of oakland. temescal? nearby emeryville? or mid brow penninsula? have you looked in any of these more local areas? i’d be curious about your findings.

I’m still pretty convinced it will be 2012.

sf jack, I’m with you on this one. Mortgage debt forgiveness expires at the end of 2012. Three more years of suffering (and a talk from their tax accountant) will convince those still hanging on it is time to turn in the keys…

Hipster,

Catching up on your response.

That was passive holding of assets. I am not a very active investor as you all know. I had sold my RE in Euros in 2005-2006 (~1.2EUR/USD) , kept it into this currency, then sold some when the dollar reached bottom last year. There you have your 20%.

The assets were into 4% safety between 2005 and 2008 which was pretty standard up to early his year in Europe. Now it’s sub-3% I had to scramble somehow to maximize Govt guarantee. Nothing safer than what I did and my Excel spreadsheet says 31% in 3 years.

In the same 3 years the median home lost 15-20%.

Say $100 in 2006 could get me $100 in RE

The $130 today can buy the same RE for $80

$131/$80 = 63%.

I love math.

^ it worked out well for you and congrads!

But I still think that investing on currency rates is risky. Of course it seems safe after the fact, but it is nor the same as t bills. And given the clamity of last October, I’m not even sure t bills were all that safe.

So you did well, with what seed to be a ‘natural response’ to your situation. But bear in mind that it could have gone the other way, and you could have easily lost 20% on the currency trade alone.

money oracles

seasons unknown shrill cries ever

winter never more

Hipster,

That was pretty much a lucky guess, but a bit like betting one grossly overweight guy won’t live as long as a skinnier guy. Of course Europeans have had their own bubble and their own imbalances with no guarantee they’d fare better (a skinnier guy could be very unhealthy and the overweight might live to be 97), but they have a huge public sector and social protection. That’s a cushion that gave the perception they were more immune. The 1.6USD/EUR last summer was mostly about perception when everyone was scrambling to re-allocate before the big one hit.

Now if we could get a nice deep housing bottom so that I could buy before this inflation churns a hole from under me, I would appreciate!

Hiyou- thanks, I think we all needed that…art always trumps business IMO 🙂

I continue to be impressed by the RE knowledge – and generosity in sharing such knowledge – of some of you.

To be specific LMRiM, SF-er, San FronziScheme. Thanks guys (or girls). I hope to learn more from your collective experience 🙂

To rest of you, including haters who are trying to provoke me (you know who you are), I have said this before, and I will say it again. It is a quote by Chris Rock and relates to people hating others that have money, power or fame…

When all the thetans are at peace, recovery will begin.

filthy vegetable

hatred filled heart loves self

disgusted poverty

Maher Malawieh

Ripped a bunch of people off

And they’re really mad

Have to love that…Scientology, haikus and Chris Rock quotations in successive posts.

although Chad, I am amazed you have the time and patience to spell out cash as “Ca$h” each time…!

To rest of you, including haters who are trying to provoke me (you know who you are), I have said this before, and I will say it again. It is a quote by Chris Rock and relates to people hating others that have money, power or fame…

which of those do you have – just money, or power and fame also?

That’s how he rolls, REpornaddict — in a Bentley, waving cash at distressed assets as the cameras go off like tommy guns.

@REpornaddict Just Money right now. Handed down in large quantities from the Grandma 🙂

But that has not made me lazy or privileged. I still work a day job to (keep myself busy and out of trouble) and even worked as a Waiter at Solistice (former Ethiopian Jazz Bar) on Divisadero x California for quite a while…

haters stalk provoke

bourgeois pride believes self best man

fall reveals dark heart

I have a hard time

believing that our anonn

wrote that mad haiku

hiyou is zoltan

born of peace Greek chorus sings

summer winter flow

Gentlemen, here is a story on Where Housing Will Be in 2012

Anonn- weren’t many bears arguing with you over young folks coming to SF backed with family money? That it’s really not that common?

Anecdotally, witness exhibit A: Chad (I’m sure there are plenty of other SS readers who are in this catagory, but probably most are wont to admit their status.). Another anecdote- with all my mish rentals I always had several interested parties that had family money/trust funds. I’m jus’ sayin’.