While 2550 Webster Street’s date with the courthouse steps was postponed once again (along with two dozen or so other San Francisco properties), and a half-dozen or so properties failed to generate an opening bid, a Visitacion Valley property sold at auction yesterday.

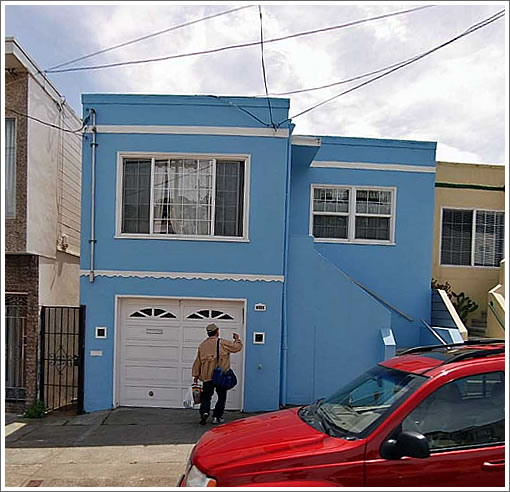

Purchased for $720,000 in September 2005, the bidding for 399 Leland Avenue opened at $306,000 and generated one bid. It sold for $306,000.01 which represents a 57% haircut from its previous sale price, but also average annual appreciation of 2.4% since its sale for $240,000 in 1999 for this single-family in an up and coming neighborhood.

It’s a common error to assume a good has appreciated when all that happened was the cheapening of money.

Looks like the classic fluj flip to me…..

Does this mean that there are 24 postponed + 6 no bids = 30 more units in “shadow inventory”.

Would love to see Socketsite CII again! It used to show new construction shadow inventory. Even better would be to try to capture this bank-owned “shadow inventory”.

I am hearing of banks treating foreclosures like DeBeers treats diamonds, rationing inventory to prop up prices.

Is anyone watching these auctions on a regular basis? Are there regilarly 30 units kicked down the road for every one unit that sells in the “purest of markets”?

what’s a “fluj flip?”

Where was this auction published? Is there a comprehensive list of upcoming ones in SF? I’ve only seen partial lists from multiple sources.

what’s a “fluj flip?”

While I’m not necessarily one to defend fluj, its quite clear to me that a any properties flipped/held for investment/rehabbed by himself or extended family were not chosen at random in far flung neighborhoods. They had specific characteristics that made them amenable to “unlocking value”. I would even use him as an agent if I was looking for a house in Ess Eff (unfortunately, I couldn’t afford a house in the City, I work on the other side of the Bay and I DO believe that the sky is falling). It appears that even the Three Musketeers will not(?) lose their shirts on the two year Bernal hold; anonn can you confirm that this place has closed (or has it just been withdrawn).

Who are the 3 musketeers?

I cannot believe someone paid over $700k for this place, ever.

I don’t know what the three musketeers means either, or where it came from, but if you think I’m going to talk about clients on here you are crazy.

I’m sure the property has design flow problems.

Fine, anonn. The listing showed up as “gone off the market” about a month ago and I assumed it sold given all of your talk on other threads about $800k Bernal properties. I have yet to see it on the Chron’s Bay Area Homes Sold page (or even a mention on the SF Recorder’s website). I’m beginning to think the listing was pulled (to sell another day) — if that’s the case, good luck, as the Three Musketeers will need it (IMHO). Hint: sparky-b, you are not one of the Musketeers.

EBGuy, you don’t have any of this straight. If you want to email me I’ll be happy to tell you what’s what.

I cannot believe someone paid over $700k for this place, ever.

Unfortunately, Shza, you and I paid that — less the $306,000.01 they got some sucker to bid at the auction. Just wait, we are going to paying over-inflated prices for a lot more SF homes over the next few years.

At least I’m getting a small piece of that back with all the litigation surrounding this mess. I assume you are too (may be a good time to branch out of IP).

Anonn, I do realize that a property sold down the street for $800k, so that’s probably what you were referring to (I’m not impugning your integrity, as you’ve always been forthright). All for one and one for all.

@Shza – agreed. Sunnydale housing project is just a few blocks away from this house. Did they buy it sight unseen?

“Who are the 3 musketeers?”

Kenneth, “fluj” and “anonn”? What address in Bernal?

so it’s a multiple personalities thing.

so it’s a multiple personalities thing.

No, ask anonn about his last listing (not to be too obvious, but you know all the musketeers).

But, you have brought up the 3 musketeers in like 8-10 different threads talking about all sorts of projects. I don’t get it I guess, and I don’t need to ask him about his recent sale I know all about it. What is the reference to?

No, only one listing/project (BH). (I did mistakenly put it on the wrong street/district at one point, though — hey I don’t live in the City and become easily confused by this heights or that valley). So you are saying it sold? It would be quite a juicy appple. I’ll keep my eyes on the recently sold listings in the Chron…

Is it 118 Manchester? We’re

discretediscreet.So it sounds like you actually went to the steps SS editor?

The correction in the FakeSF™ is percolating along nicely.

Fantastic that this place is down 57%. I never doubted for a second that we would be seeing places down 50%+ and I expect that we will even see instances of places down 70-80% from “peak”.

I’ve said it many times before: this unwind is going to go a lot further than most people think. Enjoy it folks, and remember to try to get as little of your good cash mixed up in this folly market as possible!

I was looking into auction properties to buy a place recently.

Can I get a standard pre-approved loan to buy an auction property or do I need all cash? How does this work in SF Bay Area/California????

U need cash!

LMRiM – the 2nd question is how much longer will ca$h be worth what it is now… Which rock drops faster – the cash or the house?

we can’t use this property to define the entire SF market, but it does show some startling data.

It TRIPLED in 6 years. tripled. And at least 1-2 years of that duration was a recession- a recession that was very much focused on the Bay Area (tech crash)!

obviously not every SF property tripled, but many (most?) doubled in that time period.

It just shows the absolute insanity of the market, the fact that anybody would have thought that rise was based on fundamental economic factors. Even after a 57% drop it STILL rose 2.4% over the last decade. That’s pretty good appreciation given the fact that those 10 years encompass not one but two recessions.

to me it highlights how far properties in SF can fall and STILL be expensive. SF was crazy expensive in 2000. In 2007 it was just stupidity.

For years I’ve expected overall inflation-adjusted SF RE to drop to 2000 pricing- some nabes more some nabes less. (there was a 25% increase in CPI from 2000 to 2009).

I would not even be surprised if we see 2000 pricing in REAL (non adjusted) terms in most neighborhoods.

You bring up the key question imo, jeff, regarding inflation of the dollar versus real assets like houses.

Who knows for sure, but I bet the house sinks faster than the dollar fr a good while longer – at least 1-2 years and perhaps much longer (say, 5-10). The goal of the “system” now is to extract as much real value from overindebted borrowers, and that means maintaining the currency for as long as possible and stretching out the asset deflation as long as possible.

Regardless, it’s clear that the real value (inflation adjusted) of housing will still fall quite a ways – that seems to be your view as well. Thus, rom a strategic standpoint, you want to maintain as high a leverage ratio as possible at these low rates. If we get dramatic further asset deflation, throw the keys on the roof and laugh about it with your pile of cash that you didn’t commit to the overvalued asset. If we get rampant inflation, repay the loans at low interest rates with devalued dollars.

Of course, in this environment, high leverage ratios for all but FHA-type segments are hard to come by! That should tell you something 🙂

“U need cash!”

So in other words, if you are rich, you can buy a house at fair market value (which is at auction) for half the asking price others want.

If you are a chump like me who needs a loan, you have to either overpay from an underwater flipper or not get a place (describes lack of volume).

Few of these foreclosed homes are selling at courthouse auctions. Most such properties are being returned to banks who then parcel them out in groups to agents who specialize in moving low value properties in return for relatively small commissions. Getting a loan for some of these properties can still be tricky, especially if there is damage or neglect. All the muck and low visibility will probably always make being a bottom feeder somewhat unpleasant.

Looks like this was flipped fairly quickly for $453K:

http://www.redfin.com/CA/San-Francisco/Undisclosed-address-94134/home/2032253

The listing doesn’t even emphasize if there was even light remodeling done — just floors finished.