With housing values having rebounded over the past three years and discussions of irrational exuberance returning as well, The New York Times has updated their Rent versus Buy Calculator. From the accompanying article entitled, “Rent or Buy? The Math Is Changing“:

Since the start of 2011, prices have risen 33 percent in the San Francisco area, 30 percent in Miami, 24 percent in Los Angeles — and even more in some of the most desirable neighborhoods within those areas.

In the San Francisco Bay Area, home of the sharpest recent price increases, the sale price of a home is about 20 times what it would cost to rent a home of the same size for a year. That ratio, based on an analysis of data from Zillow, is the same as in 2003 when the San Francisco real estate market had yet to become an out-of-control bubble but was well on its way there.

When low mortgage rates are taken into account, buying a home in San Francisco looks somewhat more attractive — but with a 10 percent down payment and prevailing interest rates, buying a home is 6 percent more expensive than renting a place of the same size, the same premium for buying as there was during the dot-com boom in 1999. Just two years ago, buying in the San Francisco area was 24 percent cheaper than renting an equivalent place. You could think about moving to a smaller area, as this might save you money that would be wasted in big cities like San Francisco. Places such as the Meadows homes based in Colorado could potentially be a better choice, you can get more for your money rather than a small city home for the same amount or more.

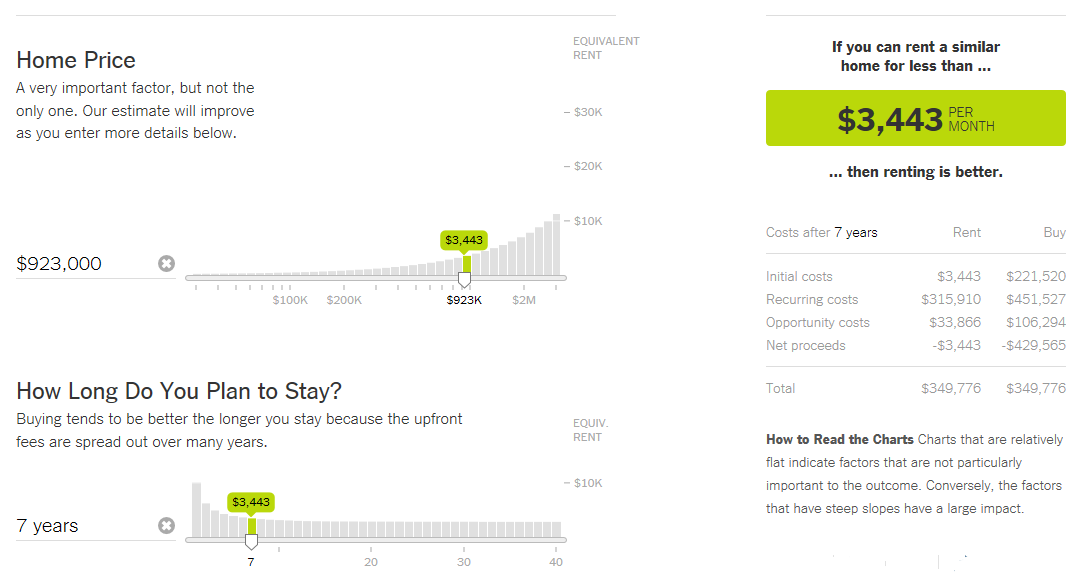

Based on a purchase price of $923,000 (the current median sale price for a home in San Francisco) with 20 percent down, a thirty-year mortgage at today’s rates, and a seven-year hold, the times calculator estimates that a rent of over $3,443 a month is the point at which buying would make greater financial sense.

Add any monthly HOA dues on top of that $3,443 number. And of course, that number assumes that home values, and rents, continue to rise.

What rate did you assume for rent increases and home price increases and how did you select those inputs?

I raised my tenants’ rent 10% on average last year.

Use that in the calculator!

soccermom, it depends on your purpose for using the tool. Obviously, one must use educated guesses (at best) as this is a forward-looking tool. If one is truly using this to help make the financial decision about whether to buy (i.e. not a decision based on the many non-financial grounds), I would use conservative figures for all variables. Say, 3% for inflation, home price increases, and rent increases. Some variables are known (interest rate, property tax rate). Some variables that have a big impact are time before selling, maintenance costs, investment return. People tend to underestimate the first two and overestimate the third. Again, use conservative figures if the financial considerations of owning are really a big factor (in my experience, this is not a huge part of the rent vs. buy decision with most people – they just want their “own” home).

I am even more conservative: assume no rent increases and no price increases. Is your purchase still working out or not in 2 years? 5 years? What if there’s something unforeseen and catastrophic happening?

Speculating on future performance should not be attempted by small investors. If your purchase only represents a fraction of your assets, then you should be fine. But be ready for cyclical downturns. They can be more brutal and often last longer than anticipated. What matters for me is diversification. If any one of my properties has a major issue, I can cut my losses without it being a life-altering event.

Here’s how I do it:

Take my monthly PITI payment for the property and call that number “A.”

Then, I take the actual rent rolls minus costs (if any — eg trash, water, heat, whatever’s included in the rent), and call that number “B.”

Then, I ask myself “Is B greater than A”? If so, next step.

Then I make a note of my downpayment, which I will call “C.”

Then, I figure my net positive cashflow, which is B-A, and add to it the amortization of the underlying note, which is “D.” Then, I do: 12*((B-A)+D). Which is an approximation of my yearly net gain.

Then, do C/(12*((B-A)+D)). And there’s your quickie ROI calculation, neglecting taxes and such which will vary person-to-person anyway.

Then after buying the place… I raise everybody’s rent as much as possible and rake in the cash.

I have a house I’ve been renting out in Berkeley. 800 square feet. New construction. Big lot. Somewhat rough area. Been renting it to the same tenant since 2010 for $1875. Should I raise the rent??

That depends on market rents in the area. I have a place where there are 3 tenants, blue-collar guys, with two chickens and a big dog. They all smoke, usually outside, and they park their giant work trucks all over the driveway.

I raised their rent 20%. Why? Because they have no options and I like money.

haha, I dig

I guess it’s pretty basic, Jimmy. My rationale has often be similar: never go cash-flow negative even when the mortgage is short term. Except for my latest purchase where it works out only when amortization comes into play. Then again, we’re talking about a summer home. You need to reward yourself once in a while…

Oh, yeah, I am only talking about pure rental investments. If you want to buy a summer home, a Ferrari or anything else… then you can just throw out all these calculations and do whatever you feel like. I also enjoy doing that when I can bring myself to do it.

Well, I bargained hard and knocked 20% off my rent in 2009. Now it’s landlord’s turn. Sooner or later the tide will change again. The rent is so volatile in SF, the best thing to do is to extrapolate the historical rent and judge if the current house prices are overpriced compared to that. And houses are overpriced on that measure.

Meanwhile, in Chicago, you can buy for $50K a duplex that rents for @$1500/month. What is that, 3 GRM?

You don’t believe me, but zillow 60628 rents and prices. Not Detroit, South Chicago.

Very high roi areas are often low tenant quality zip codes. The trick is finding a place with low prices, reliable tenants and a solid economy.

Looking for deals in LV, NV I saw houses with pools sold at auctions in the low 100s with a pool and not too much work. The rub: you can’t find tenants period. One has been sitting for ages ar 1300. At these prices fixed costs matter a lot. 200 for taxes, plus pool and garden maintenance, management fees. Not worth the hassle for a couple of 100s a month if your time is valuable.

sure, if you can rent it and manage it.

60628 census data:

– 14.5% vacancy rate

– 20% unemployment rate + 15% dropped out of labor market (not counted in unemployment)

been a poor area with a high crime rate for a long time

Where do you input the $4 billion of VC investment? And, here’s the key, the estimated burn rate…

this calculator makes me feel really good about my 2012 purchase

My home has gone up about $600,000 in the past 8 years (30%), which means I’ve not only made money but lived in my home for free. I think that’s much better than renting.

One big factor is your marginal tax rate. Remember to add your state marginal rate as well. Mine is around 36% because I am single with no kids. That makes a huge difference to the equation. Probably one reason why smaller condos are getting 30-40 offers in SF.

Let me just say that I’ve always been disappointed in the actual tax savings from my real estate. It’s always much less than I assumed it would be, due to both AMT and amortization of the underlying note (so the fraction that is interest payments decreases every year). This year I’m shifting 60% of my income to capital gains (and I can claim a full year’s depreciation against my passive rental income) so that should help my tax savings come close to my original estimates. So in conclusion … if you need those tax savings to make the numbers work and you can afford to buy in SF, you’ll be disappointed with the results.

Yes, realtors will feed you all sorts of false information about the tax savings of owning a home. A prospective buyer should have his accountant (or Turbo Tax) run the real numbers before buying. You don’t realize the savings are far less than interest * marginal tax rate until the next year when you actually do your taxes. Once you add in property taxes, maintenance, HOA fees, opportunity costs, and very large selling costs, you realize there are a lot of “hidden” costs to homeownership and the “savings” are less than is pitched. NYT calculator factors all this in, so it is pretty good. Still makes sense for many to buy, but far fewer than one would think.