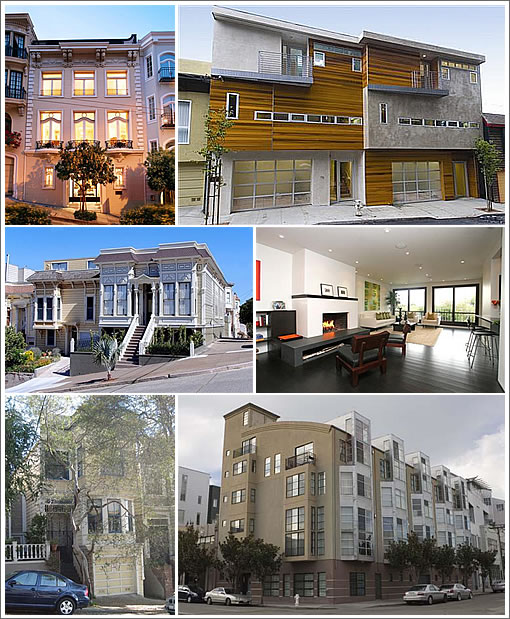

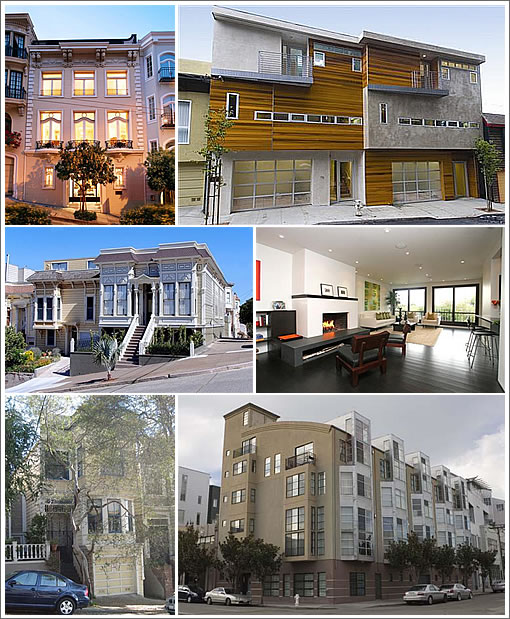

While 1230 Sacramento, 73 Miguel, 545 Sanchez, and 1944-48 Buchanan all entered into (or firmed up) escrow over the past couple of days (last listed at $7,500,000, $2,875,000, $1,795,000 and $1,695,000 respectively), and 2311 Scott St #1 quickly closed escrow last week for $2,170,000 ($175,000 over asking), today the list price on 1150 Folsom #1 was reduced another $30,000.

At $795,000, 1150 Folsom #1 is now listed for $34,000 less than its sale price in October of 2005. Nope, no mix skewing that San Francisco Median Sales Price in this market.

∙ We’re Big Fans Of This Beaux-Arts Beauty (1230 Sacramento) [SocketSite]

∙ The Backside, View, And Rather Big “Right Pricing” Up On Miguel [SocketSite]

∙ Details, Details, Details On An 1880’s San Francisco Stick Victorian [SocketSite]

∙ A “Bitter” Renter Reports: Repossessed In Lower Pacific Heights [SocketSite]

∙ Through And Through And Throughout On A Sunny Saturday Morning [SocketSite]

∙ A Folsom Rausch Lofts Short Sale (Assuming 3.3% Appreciation) [SocketSite]

∙ An Admittedly Incomplete Update For A Few Featured Properties [SocketSite]

2311 Scott St. #1 is why some of us who own north of California St. don’t see the same market gloom other parts of town do. When I moved here 8 years ago, my agent wanted to only show me property north of the California St. border, and only with deeded parking. Her advice has made my home a better investment than any other, and I owe her a nice bottle of wine!

“At $795,000, 1150 Folsom #1 is now listed for $34,000 less than its sale price in October of 2005. Nope, no mix skewing that San Francisco Median Sales Price in this market.”

Haha… love the sarcasm. These are nice anecdotes, but it still doesn’t confirm any underlying mix change.

As for this place at 1150 Folsom, $795K would still mean around $550 per square foot. Based on the data that I could find, that would represent the highest psf selling price of any unit in that building (including others purchased within in the last 24 months). Too bad the former owner paid more than that, but this doesn’t seem to suggest any overall weakness IMO.

Kind of a nit, but it’s annoying enuf to post about.

I find the formatting of these update posts very frustrating to read. A half dozen pictures bunched together (no labels), then a list of addresses, followed by a list of prices (with a “respectively”) and then down below a list of links.

I look at all the detailed matching I have to do to put picture with address with price with listing and I give up every time. I’m wondering if I’m the only one who is doing this? It’s frustrating cause I really am interested in these update posts, but it seems this layout was designed for people with photographic memories of these properties. Or more likely just not designed at all.

Couldn’t we see a layout that is organized by property, with each property having the following all chunked together visually: picture, address, price, MLS link? This way we don’t have to do the matching ourselves.

Oy.

I second Kurt’s comment. It’s useful information, but very frustratingly presented.

Could the pics themselves be hyperlinked to the respective MLS listing?

Believe it or not, there is a method to the madness.

The pictures are presented in the order that the properties are mentioned (from left to right, top to bottom). And mousing over the overall image should bring up the detailed list of addresses.

Each of the addresses in the body of the update should already be linked to the detailed post for each property (no need to try and match the links). And the links at the bottom are simply citations for the links above (again, in the order that they’re referenced).

That being said, we’ll take your thoughts under advisement (please feel free to send suggestions to tips@socketsite.com). And as always, thank you for plugging in.

[Editor’s Note: And of course, we just noticed that the order of the images for 1944-48 Buchanan and 2311 Scott St #1 was reversed. It’s going to be one of those days.]

“As for this place at 1150 Folsom, $795K would still mean around $550 per square foot.”

My math shows it at $480.65 /sq. ft.

What a DEAL!!

i’m with kurt et al

i think these are the most useful posts on all of ss, but they are usually such a pain to navigate through that I give up and just get the general gist:

rich people keep buying stuff that was made for rich people.

people who think or wish they were rich were buying stuff that was made for them, and now they can’t afford to do that anymore, and it turns out that stuff is actually kind of crappy.

all of the above=mix

also, when i mouse over the pictures, it lists all six properties in order (separated by commas). not the property associated with the actual picture.

still great work though. thanks ss.

The Ross Levy-designed 30th street property for which many of you predicted a big loss just closed at $2.195M (asking) today.

For the 30th street property:

“Profit” 75K

Realtor Fee -110K

Mortgage 15 mos

after tax* -225K

Property Tax* – 32K

Maint + Utilities – 10K

Points/Staging etc. -20k

——

322K

About 21.5K per month after taxes, or 700 per day.

*First mortgage + second mortgage 15K after taxes, which is probably understated, so I ignore deductibility for property tax. This is because deductions are limited after 250K in income, which they almost certainly had. I’ve also ignored opportunity cost of the down payment.

If you assume the seller paid closing costs and fixed any damage that was found, you’re probably looking at something closer to 750 per day.

The only people who made money on that house were the realtors, and mortgage brokers. The homeowner got screwed, even though he can tout the $75K “profit” he made.

Tipster,

Everyone who reads SS is aware of your numbers crunching. (How you can be certain that they were unable to deduct property tax due to AMT is unknown, but it doesn’t matter.) I really don’t want to dissect your pedantry. We all get it. Oh boy do we get it. We only see it six times a week.

No, this was not profitable. Holding something for two years or any other short period with no improvements is not the wise man’s path toward making millions of dollars. But it is still $2.195M to the buyer. It is still apples to apples, and it was still purchased in 2006, the avowed height of the market.

And before any of you say otherwise, I am not seizing upon this as an indicator of an upward market either. It’s just one apple that was picked from the tree.

Fluj,

AMT is not the issue. When you earn over 156K, the IRS limits your deductions. So you can’t deduct 50% of the mortgage or property taxes even though you are in the 50% bracket. It’s a complicated issue for high income earners, but it has nothing to do with the AMT. I’m not subject to the AMT, but if I try to add in interest on a $1M loan, and property taxes on my Schedule A, I get a deduction about equal to the $1M loan, but not the property tax. This is not an AMT issue, it’s just plain old vanilla non-AMT taxes for people who earn over $156K.

http://www.irs.gov/publications/p17/ch29.html

Didn’t 71 Miguel already close?

tipster

my income is well over 156k (33% bracket).

mortgage interest is still (somewhat) deductible.

It ends up being enough to negate property taxes, and about 1/3 of mortgage interest (or about 1/4 of mortgage payment).

your estimates are repeatedly incorrect, and not based in reality.

taxes are complex, and the mortgage interest deduction is no different. what you state (or guess), however, is not true.

enonymous:

you misread tipsters post.

he ignored the deduction of PROPERTY tax

I”m not sure what he did with mortgage interest deduction.

I also make more than $300k.

I cannot deduct my property taxes, with or without AMT.

(I have no idea if that’s a general rule or not… I just know that I just did my taxes and could not deduct my property tax)

I was able to deduct mortgage interest though.

@ Anon at 8:29,

Per the information filed at last sale: 1150 Folsom St Unit 1 Oct 05 $829,000 1441 sqft

At a $780K selling, that equates to $550 psf. (a high price in that building). What numbers are you looking at?

ex SF-er is correct on my rule of thumb. We are ONLY talking about the deduction for mortgage interest and property taxes, as well as the limits applied to each.

For my rule of thumb, I deduct the first $1M of mortgage at the full 50% without limiting it at all, and then ignore the *deduction* for property tax, and that usually about hits what it would be if I deducted both of them and used the limit for both.

ex-SFer, it’s my understanding that you CAN deduct property tax.

http://www.irs.gov/faqs/faq3-6.html

Lance – 1150 Folsom has 1650sqft, which would place the sqft value at $473.

ok, i reread my post and I guess I didn’t make it clear. my first post was poorly worded.

1.) Due (essentially) to AMT, I can deduct my property taxes but it does no good. ex SF-er, I sincerely doubt you can either.

2.) I can deduct my mortage interest up to 1M. There is a phaseout involved here, but the computation is calculated. I don’t know where tipster got 50% – but that is dead wrong.

Assume 300k adjusted gross income – AGI (thanks ex SF-er for volunteering). To calculate the reduction in the total amount of certain itemized deductions one must do the following math.

First subtract 156,400 (the beginning of the income threshold for limitation on itemized deductions) from AGI. This yields 143,600 in excess of the threshold.

Then multiply this by the reduction percentage. This is currently 2% of amount in excess of the threshold (it was enacted at 3% but is being phased out and is currently enacted at 2/3 of the original rate hence 2/3 of 3% is 2% – how is that for confusing?). Ok, now we are at 2872. This is the likely reduction in total imtemized deductions that can be taken.

Now if you assume that total itemized deductions are 80,000 (including mortgage interest dedcution, property taxes, state income taxes), that total itemized deduction is reduced by 2872. Leaving you with 77128 in total itemized deductions.

There are other rules, but unless you are very high earner (over about 1M/year) this is the calculation. Moreover, even if you are a very high earner, your itemized deductions will be reduced by likely no more than 20% of their grand total.

Now wasn’t that fun?

The point I was trying to make is that for moderately high earners, the end result of all of this is that usually property taxes cancel out part of the mortgage interest deduction (i.e, you paid it to the county of SF instead of the feds, but either way someone was going to take your money), and what is usually left after all the fancy math for someone in the 250k to 1M/year range is about 1/4 of the mortgage interest coming back to the owner in the form of cold hard cash federal and state income tax reduction in the state of California.

Tipster, your 50% reduction in mortgage interest deduction is flat out wrong. It is closer to 2-4% at most.

Due (essentially) to AMT, I can deduct my property taxes but it does no good. ex SF-er, I sincerely doubt you can either

I agree. this is what I said!

🙂

I also agree, that doing the calculations of rent to own is VERRRRRY difficult. which is why I only do them for myself.

I also find it humorous when people claim that those making $350k per year don’t mind losing $100-200-300k!!!

I don’t know about others, but losing $350k would be DEVASTATING to me, regardless of my income/wealth.

I personally take home 42% of my gross pay AFTER taxes, automatic deducted things like medical/disability insurance, FICA, 401k, medical malpractice insurance, and so on.

so a loss of $200k would take me YEARS to recover from.

1150 Folsom #1 is now back on the market again, listed at $745K. Previous sale was October ’05 for $829K.