While mortgage application volume for new home purchases in the U.S. ticked up a (1) percent from January to February and was nearly 16 percent higher than at the same time last year, “the below average seasonally-driven uptick from January to February actually resulted in a 1.6 percent drop in the seasonally adjusted pace of new home sales,” as we outlined last month and shouldn’t catch any plugged-in readers by surprise.

And while mortgage application volume for new home purchases in the U.S. ticked up another (1) percent from February to March and was 6.2 percent higher than at the same time last year, based on loan application data from the Mortgage Bankers Association, the seasonally adjusted pace of new home sales actually dropped over 10 percent in March, “a month when new home purchases [typically] see a seasonal boost,” a seasonal boost which a frightening number of local industry folks and media reports continue to conflate with a rebound, pivot or “surge!”

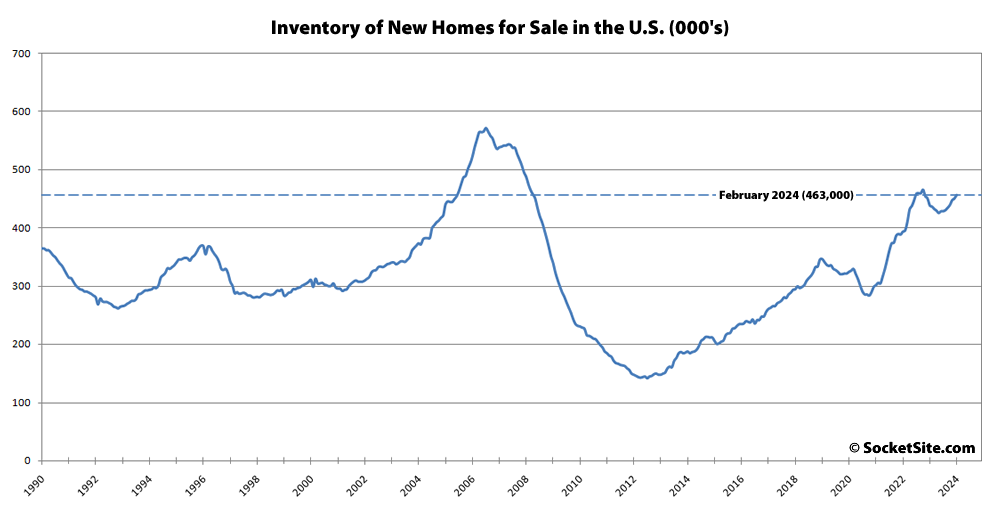

At the same time, the average loan size for new home purchases, which is correlated with pricing, inched down from $405,719 in February to $405,400 in March, despite a typical seasonal boost as well, was down from $407,015 in March of last year and was 7.1 percent below its high of $436,576 in April of 2022, with inventory levels nearing a 15-year high in the absolute, despite continued misreporting of “supply constraints,” and the number of existing homes on the market in San Francisco at a 13-year seasonal high and climbing.