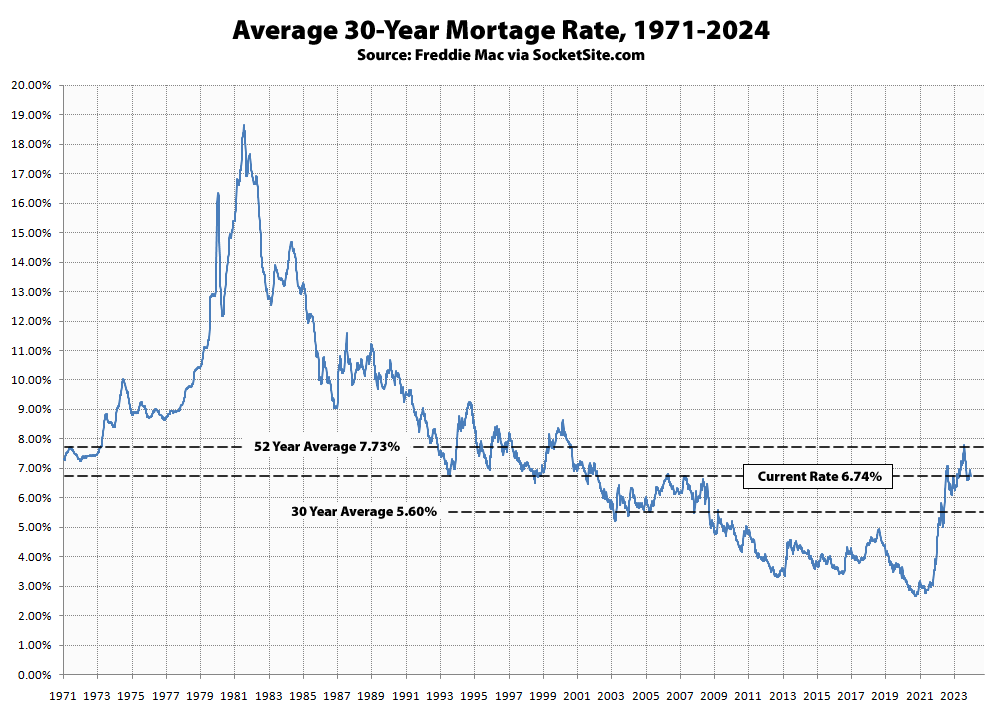

The average rate for a benchmark 30 year mortgage dropped 14 basis points (0.14 percentage points) over the past week to 6.74 percent, which is still 14 basis points higher than at the same time last year and 114 basis points higher than average over the past 30 years but 99 basis points below its long-term average of 7.73 percent, with the average rate for a 30-year Jumbo having ticked down to 7.04 percent.

At the same time, the expected value of the Fed’s rate cuts this year, which had held for a few weeks, has dropped by another 15 basis points, forecasting a harder total of three (3) quarter-point rate cuts in 2024, which is roughly half the number of cuts that some were suggesting at the end of last year, none of which should catch any plugged-in readers by surprise.

UPDATE: The Fed Affirms, Mortgage Rates Tick Up