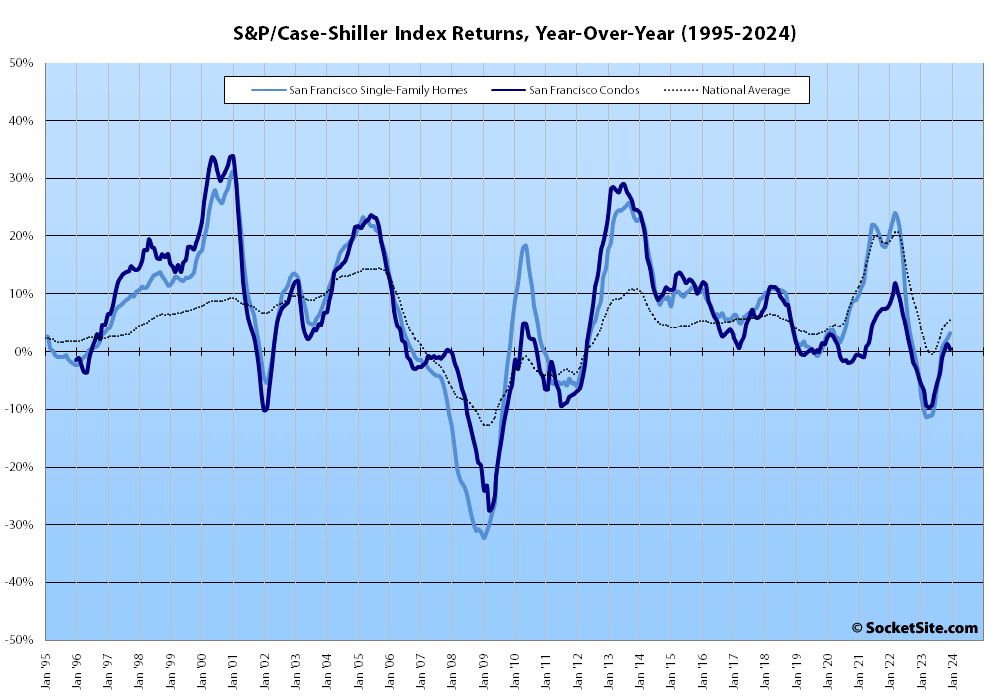

Having ticked down a downwardly revised 1.1 percent in November, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area (i.e., “San Francisco,” which includes the East Bay, North Bay and Peninsula) slipped 0.9 percent in December.

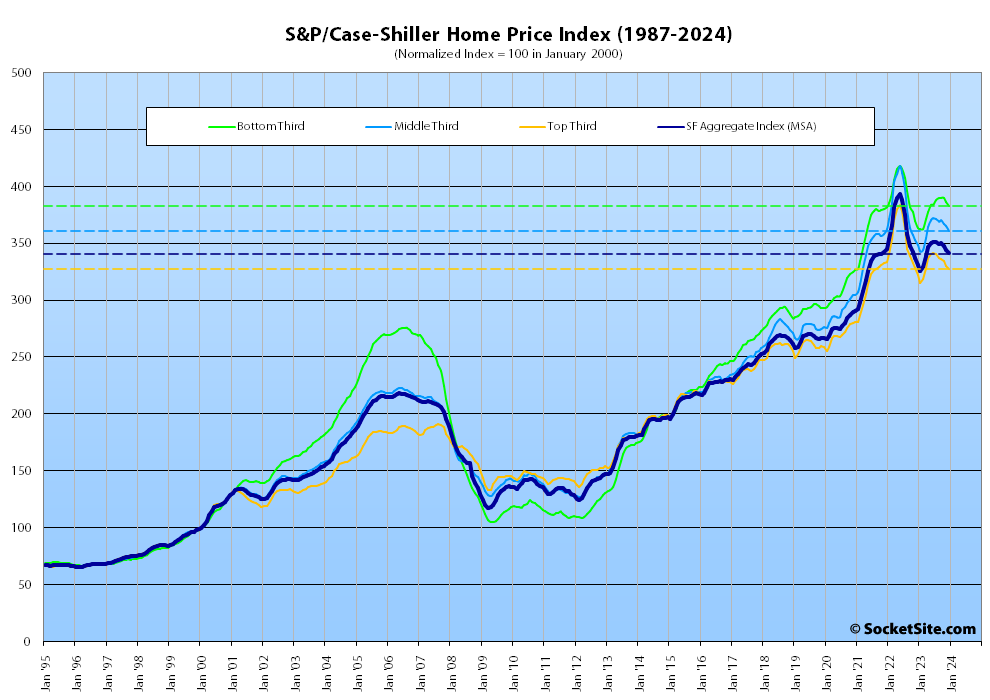

As such, while the index ended the year 3.2 percent higher than at the end of 2022, it was over 13 percent lower than in the second quarter of 2022 and trending down, with the index for the least expensive third of the Bay Area market having slipped 0.9 percent from November to December, the index for the middle tier of the market having ticked down 1.2 percent, and the index for the top third of the market having slipped 0.8 percent from November to December and now nearly 15 percent below its pandemic-driven peak.

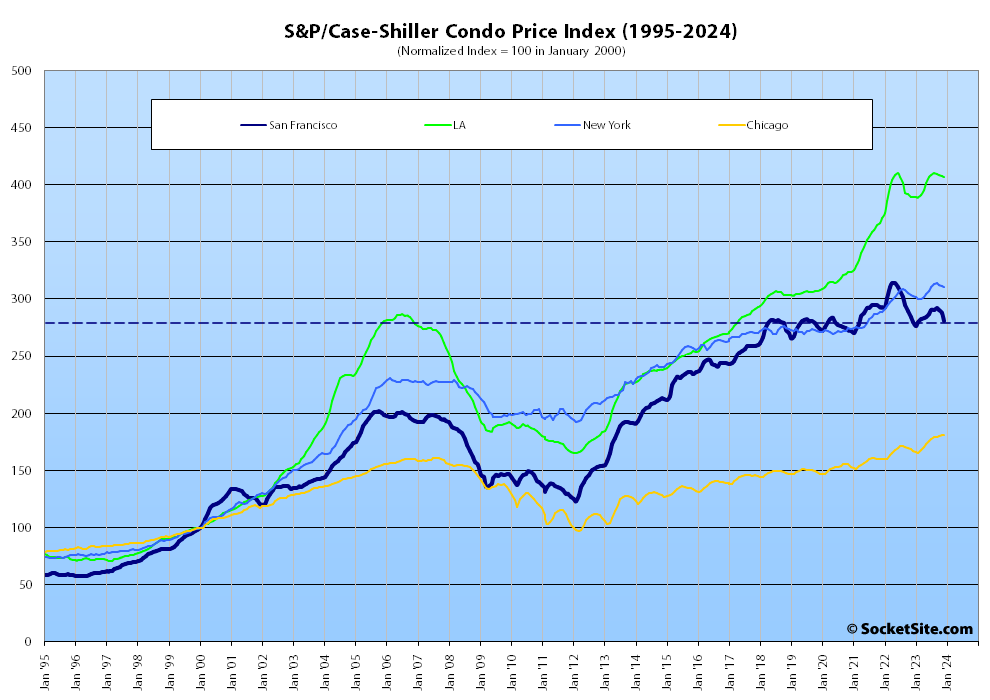

The index for Bay Area condo values, which remains a leading indicator for the market as a whole, dropped 2.2 percent in December, which was the largest month-over-month drop in over a decade and the third straight month-over-month decline, ending the year 0.4 percent higher than at the end of 2022 but nearly 11 percent below peak and trending down.

At the same time, the national home price index inched down 0.4 percent from November to December and is trending down, having slipped from October to November as well, but ended the year 5.5 percent higher than at the end of 2022, versus the 3.2 percent gain for San Francisco, with San Diego up 8.8 percent, followed by Detroit and Los Angeles (both up 8.3 percent) and then Chicago (up 8.1 percent), with Portland (up 0.3 percent) at the bottom of the table and poised to turn negative next month.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).