As we outlined last week, while the average rate for a benchmark 30-year mortgage had only inched down 3 basis points to 7.76 percent, according to Freddie Mac and headlines galore, said average was measured prior to the Fed having formalized its intention to hit pause on future rate hikes and the yield on the 10-year treasury had subsequently “dropped around 20 basis points, which should translate into a lower average 30-year mortgage rate.”

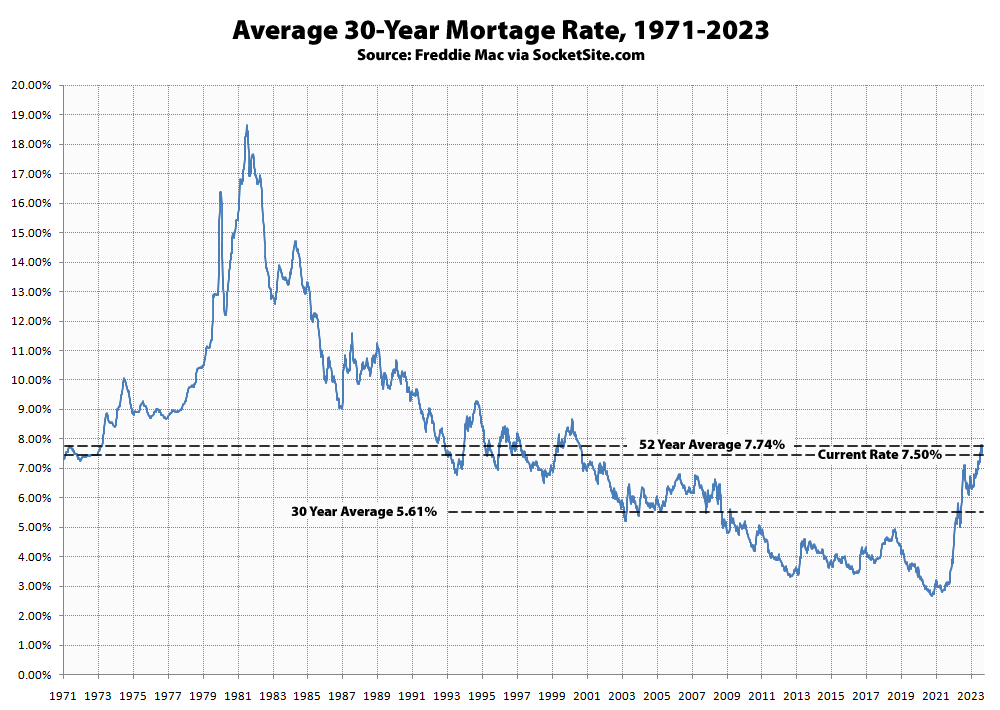

And in fact, the average rate for a benchmark 30-year mortgage subsequently dropped 26 basis points to 7.50 percent, which is still 42 basis points (0.42 percentage points) higher than at the same time last year but back below its long-term average of 7.74 percent, with the probability of an easing by the Fed by the end of this year holding at 0 percent and the futures market now predicting that the Fed isn’t likely to start cutting rates until mid-second quarter of next year, at the earliest, and then only nominally.

At the same time, there 40 percent more homes on the market in San Francisco than average over the past two decades, despite misreports of “record low inventory levels” and subsequent (mis)analyses of the market and the pace of sales in San Francisco has dropped to a lower six-plus-year low, with the average asking price of the homes which are in contract having dropped back under $900 per square foot, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

UPDATE: The average rate for a benchmark 30-year mortgage inched down another 6 basis points over the past week to 7.44 percent, which is 83 basis points higher than at the same time last year, with the futures market now predicting that the Fed isn’t likely to start cutting rates until late-second quarter of 2024.