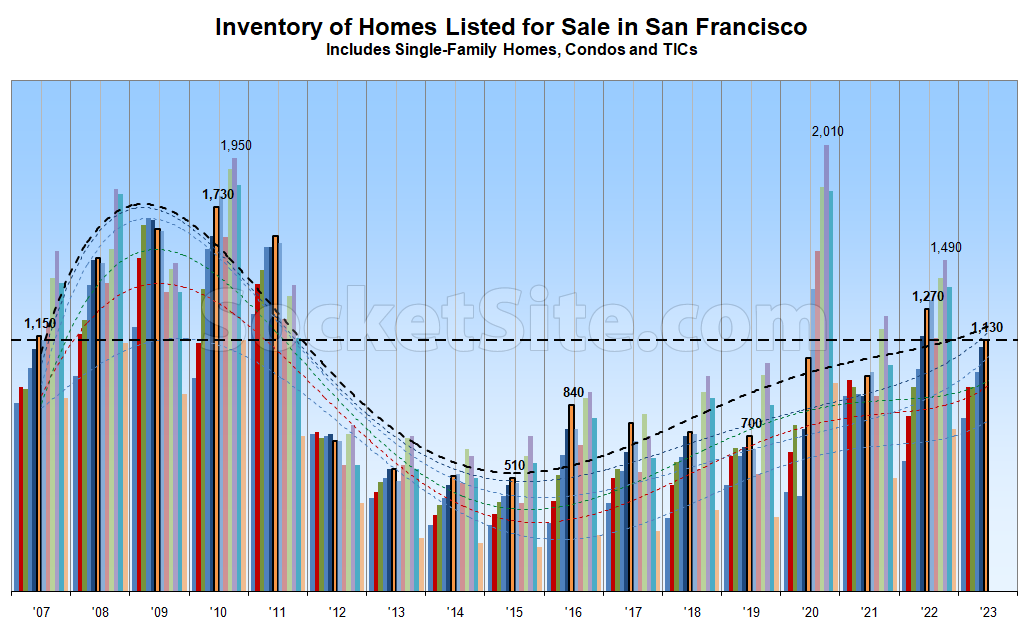

Despite a pronounced slowdown in the relative number of condos and single-family homes newly listed for sale over the past couple of quarters, driven by a jump in the cost of debt and sellers being unable or unwilling to accept an ongoing drop in values in order to move, the net number of single-family homes and condos on the market in San Francisco continues to inch up, driven by an even greater slowdown in the pace of sales.

While listed inventory is currently 14 percent lower than at the same time last year, driven by a drop in listings for condos versus single-family homes, it’s still 30 higher than average over the past decade, 60 percent higher than prior to the pandemic and over twice as high as in 2015, with a third of active listings having been reduced at least once and the average asking price per square foot of the homes which are in contract poised to drop back under $900 per square foot.

As we outlined last month: It’s Not Exactly Cheap, but It Is [Getting] Cheaper in San Francisco, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

With commercial buildings downtown going for $120/sf and residential going for $900/SF there should be conversions going in. $780/SF buys a lot of renovation. The market is broken.

A building isn’t the market.

Is it even a building? I believe the much talked about sales on California Street were for about twice that amount. (Of course those were fairly desirable sites, there probably are buildings that go for less.)

And it’s not like there’ve never been conversions in DTSF.

Notcom’s correct, at least as far as The former Union Bank building. According to the The Chronicle’s story, This downtown S.F. building is selling at a bargain price. It could set the post-pandemic market published early last month:

Emphasis mine.

The story is mostly about how the building is highly unlikely to be converted to housing, in a neighborhood in which nearly 30% of Class A office space is vacant.

Or as we outlined over a year ago, and from which we haven’t deviated, despite plenty of whining, whinging and uninformed opinion pieces since: “the conversion of existing office space to residential use currently makes no economic sense for the vast majority of downtown San Francisco buildings. Zip. Zero. Zilch. And it’s not a matter of “demand,” per se, it’s a matter of the relative value of each use and the cost of conversion.”

And now back to the supply, demand and resultant price trend(s) for residential properties in San Francisco…

CRE knows the gig is up – they are deliberately choosing to offload and write down losses rather than carry it on the books. Residential RE will eat the losses.

Pablito: when one building downtown, or even multiple buildings, sells for around $120 per ft.² does there exist some mechanism to force the owners of other buildings or their lenders to mark those assets to market? If such a mechanism exists, on what time frame does it operate?