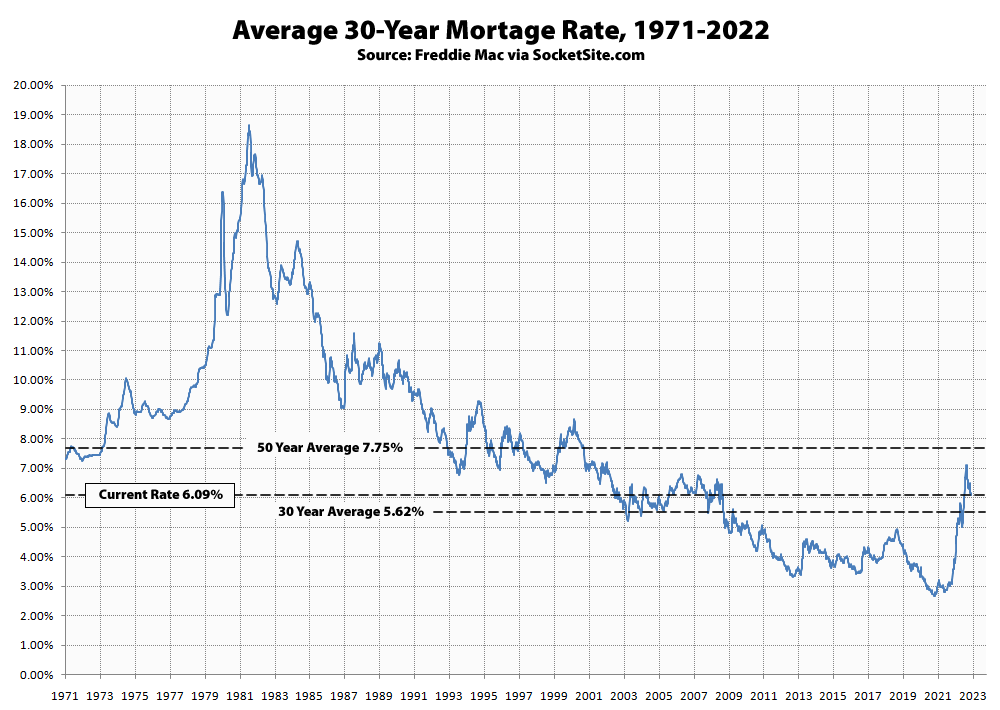

The average rate for a benchmark 30-year mortgage inched down another 4 basis points (0.04 percentage points) over the past week to 6.09 percent and is currently poised to slip back under 6 percent next week with the 10-year treasury rate having ticked down around 10 basis points following yesterday’s quarter point hike by the fed.

That being said, the current average rate is still 254 basis points, or 72 percent, higher than at the same time last year and 344 basis points, or 130 percent, higher than its all-time low of 2.65 percent in early 2021. And despite being the lowest average rate in fourth months, purchase mortgage activity in the U.S. was down 40 percent on a year-over-year basis last week and pending home sales in San Francisco, which we first reported had dropped over 40 percent on a year-over-year basis over a quarter ago, are still down over 40 percent on a year-over-year basis as well.

And yes, the probability of the Fed hiking rates by another 25 basis points next month, the majority of which has already been priced in, has ticked up to 85 percent.

10 year bonds down to 3.376% today (reached 4.2% in October). This rate more closely tracks mortgage rates. Wells Fargo posting 4.875% jumbo rates today. Yes, mortgages are higher than a year ago, but rates are falling, not rising. Rates were a headwind for housing for the last 10 months but now becoming a tailwind. But a gentle one. Again, the crazy pandemic macro trends are now unwinding – 10 year rate just a tad higher than late 2018 numbers.

Yes, but the mortgage rates that are falling now can go back up again when The Fed’s tightening policies continue. As you are aware, the January jobs report is likely to strengthen the Federal Reserve’s determination to raise interest rates above 5 percent and keep them there for longer than the bond market is currently projecting.

If the average rate for a benchmark 30-year mortgage does slip back under 6 percent over the next couple of weeks, that’ll be a temporary dip during which it would behoove buyers to close on their home before they go up again the next month. I still don’t expect purchase mortgage activity in the country to go up meaningfully to take advantage of it, however.

The bay isn’t the rest of the country though. My wife is a real estate agent/builder and the amount of activity is sky rocketing very quickly. People generally feel the Fed is bottoming out even if they raise a bit more.

Well that didn’t take long. Mortgage rates have reversed course and are heading up again.

Bankers rate for 30 yr fixed is now 6.45% today. Expect Fanny to follow by months end.