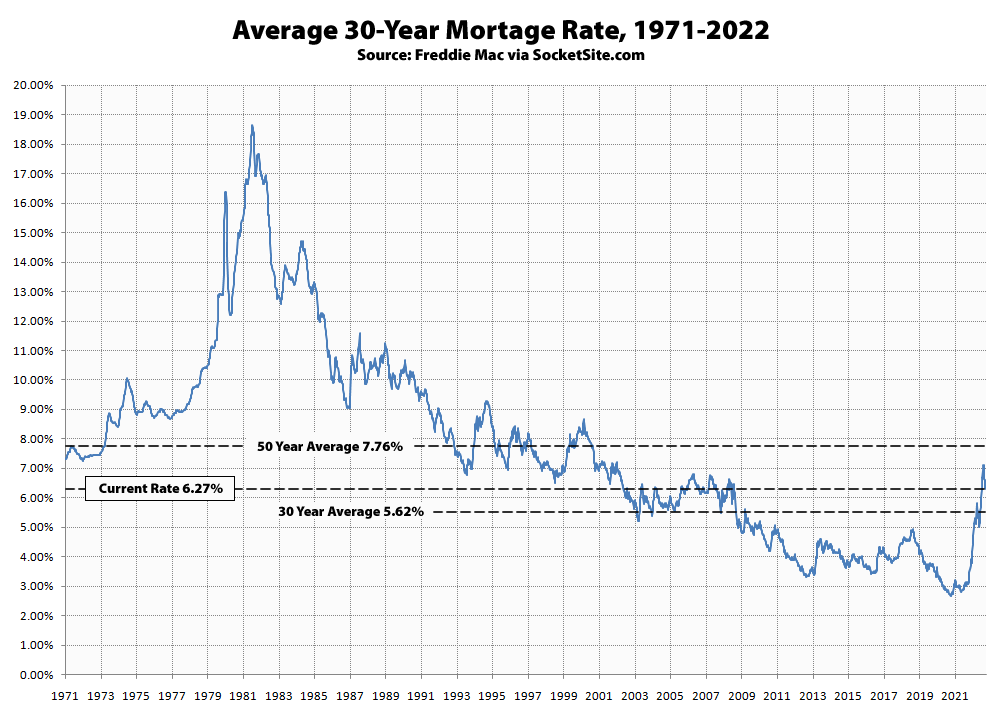

The average rate for a benchmark 30-year mortgage inched down another 4 basis points (0.04 percentage points) over the past week to 6.27 percent but remains 106 percent higher than it was at the same time last year and 137 percent higher than last year’s all-time low of 2.65 percent, a factor which is being fingered for a pronounced slowdown in the turnover rate for existing homes and shouldn’t have caught any plugged-in readers by surprise.

At the same time, the number of new homes on the market across the nation is approaching a 15-year high, driven by a pronounced drop in demand, and the probability of the Fed hiking rates by at least another 50 basis points over the next three months is currently running at around 75 percent.

UPDATE: The average rate for a benchmark 30-year mortgage ticked up 15 basis points (0.15 percentage points) over the past week to 6.42 percent, which is…106 percent higher than it was at the same time last year and 142 percent higher than last year’s all-time low of 2.65 percent.

To quote Freddie Mac, which has started to figured it out: “The housing market remains in the doldrums with declining sales, inventory and prices…[and while] the intensity of weakness is moderating, the market continues to decline and forward leading indicators suggest housing will remain weak throughout the winter,” none of which should catch any plugged-in readers, other than the most obstinate, by surprise.