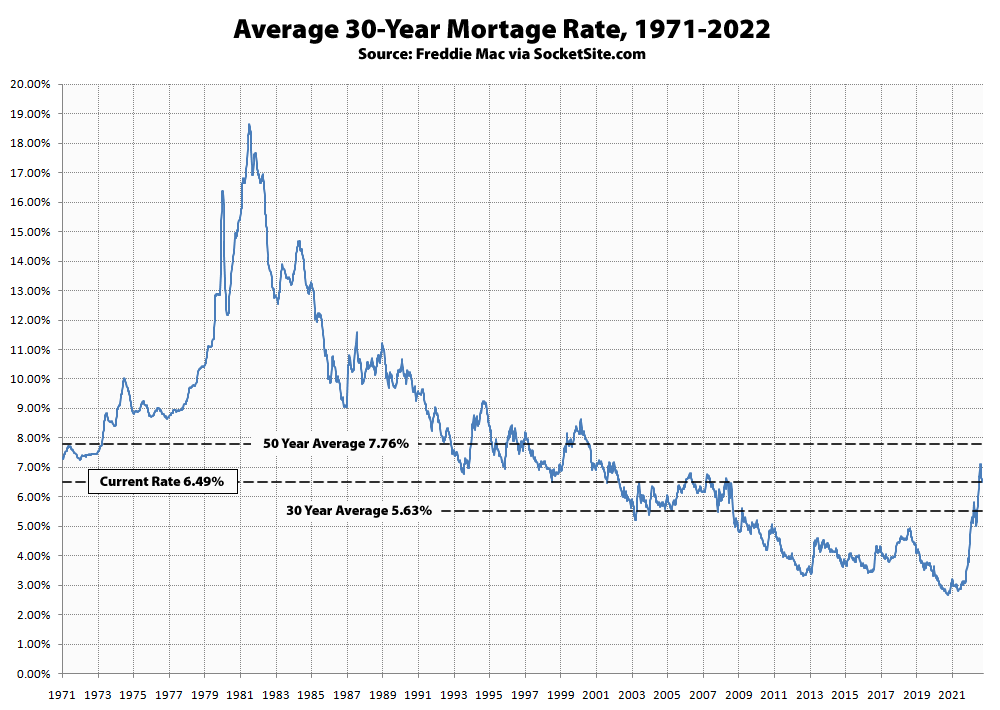

The average rate for a benchmark 30-year mortgage ticked down 9 basis points (0.09 percentage points) over the past week to 6.49 percent, which is only 109 percent higher than at the same time last year and 145 percent higher than last year’s all-time low of 2.65 percent.

That being said, the average 6.49 percent rate was calculated prior to yesterday’s remarks from Federal Reserve Chair Jerome Powell and the rate for the 10-year treasury, which forms the foundation of the 30-year mortgage rate, has since dropped 20 basis points in anticipation of a moderation in future hikes to the federal funds rate.

The Fed is still expected to continue raising rates, however, with the probability of a 50 basis point hike by the end of the year holding at 100 percent and an 80 percent chance that the federal funds rate will be 100 basis points higher than today within the next three months.

The yield curve has rarely been this inverted.

IMHO this is the bond market’s way of saying the Fed will be able to control inflation with the current forecast rate hikes and therefore longer term rates will be lower. I expect 10 and 30 year rates to continue to drop in ‘23 and for mortgage rates to follow them lower.

But the Fed doesn’t care about Bay Area real estate. It does care about a tight job market and wage increases in face of inflation …

Since employers are not willing to adjust salaries downward, there is only one way to go …