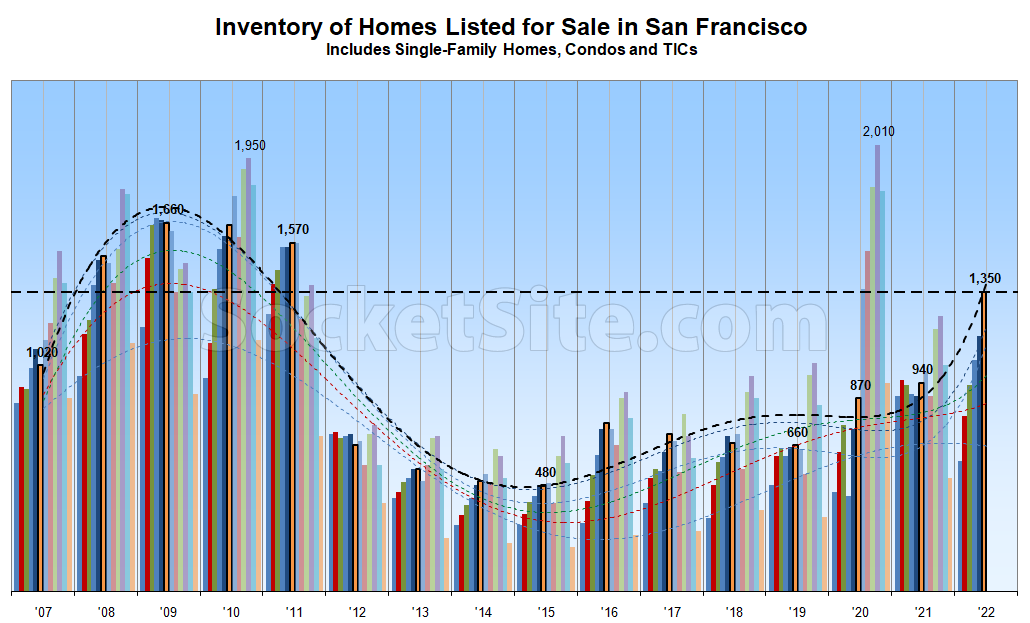

Despite a slowdown in the number of homes that have been newly listed for sale over the past month, the net number of homes on the market in San Francisco, a.k.a “inventory,” has increased by double digits as the pace of sales has declined even more.

As such, there are now 30 percent more homes on the market than there were at the same time last year, listed inventory in San Francisco is nearly 60 percent higher than average over the past decade, over twice as high as prior to the pandemic, and three times as high as in June of 2015.

At the same time, the percentage of homes on the market with an asking price that has been reduced at least once has ticked up another percentage point to 29 percent, which is 10 percentage points higher than at the same time last year and 13 percentage points or over 80 percent higher than prior to the pandemic.

Keep in mind that springtime inventory levels in San Francisco typically peak in June. We’ll keep you posted and plugged-in.

Great news! Being on the recession!

keep dreaming. home prices have increased YOY.

While the median sale price has risen, which shouldn’t be confused with a rise in values, the average sale price per square foot was effectively unchanged over the past year and inventory levels are building despite an uptick in price reductions and expectations.

the average sale price per square foot was effectively unchanged over the past year a… despite an uptick in price reductions

While this might at first sound counter-intuitive, I suppose it’s the flip-side of the same coin…namely a shift to higher priced properties. Of course it’s strange that the shift was such as to somehow keep that particular metric static, and regardless it makes it an apples to different-kind-of-apple’s comparison, doesn’t it?

If your home price is flat and inflation is 10% over the last year, the value of the house is down 10%.

Now do bitcoin!

(The point is that we have to put our money somewhere. Is a house better or worse than, say, cash? You also lost 10% of the value of your cash but it didn’t give you a mortgage deduction.)