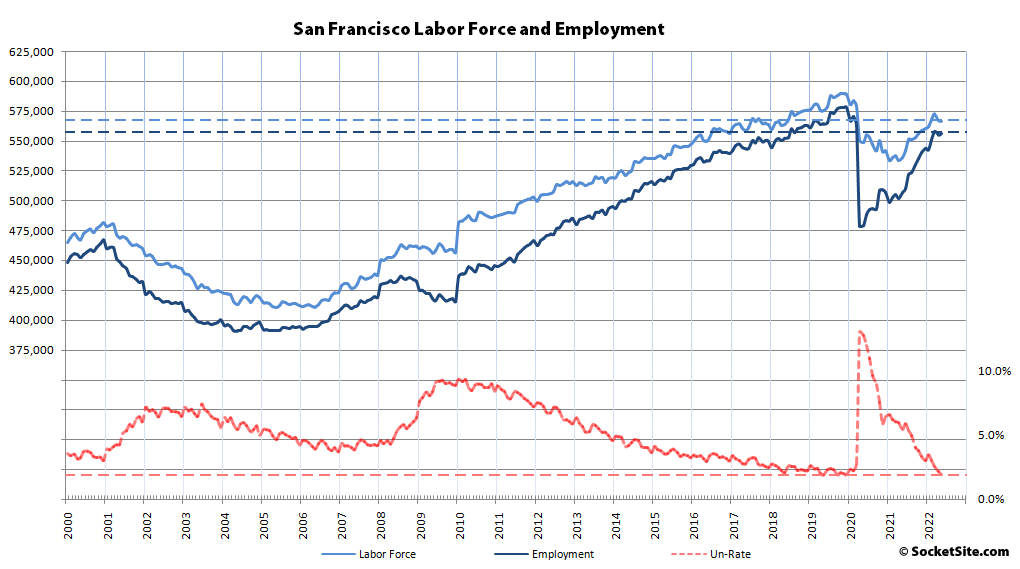

Having slipped in April, the net number of people living in San Francisco with a paycheck inched up by 1,100 in May to 556,100. As such, there are now 48,900 more employed residents in San Francisco than there were at the same time last year and 77,400 more than there were in April of 2020, when pandemic-driven unemployment peaked at 13.0 percent, with an unemployment rate of just 1.9 percent. That being said, keep in mind that there are still 14,700 fewer employed residents in the city than there were prior to the pandemic with 17,100 fewer people in the labor force (566,800).

The number of East Bay residents with a paycheck increased by 6,500 in May to 1,528,600, which represents 30,900 fewer employed residents than prior to the pandemic but 91,100 more than at the same time last year and nearly 225,000 more employed residents than in April of 2020, for a blended unemployment rate of 2.7 percent.

Employment in San Mateo and Santa Clara counties inched up by 800 and 1,500 last month respectively. And as such, there are now over 105,500 more employed people in the Valley (1,459,300) than there were at the same time last year, and nearly 200,000 more employed than in April of 2020, but with 18,800 fewer employed residents than there were prior to the pandemic and 28,600 fewer people in the labor force for an average unemployment rate of just 1.8 percent.

Total employment across Marin, Napa and Sonoma counties increased by 5,000 last month to 438,600, representing 27,200 more employed residents than there were at the same time last year and 71,600 more than in April of 2020, but 15,100 fewer than there were prior to the pandemic with 18,400 fewer people in the combined labor force (448,000) for an unemployment rate of 2.1 percent.

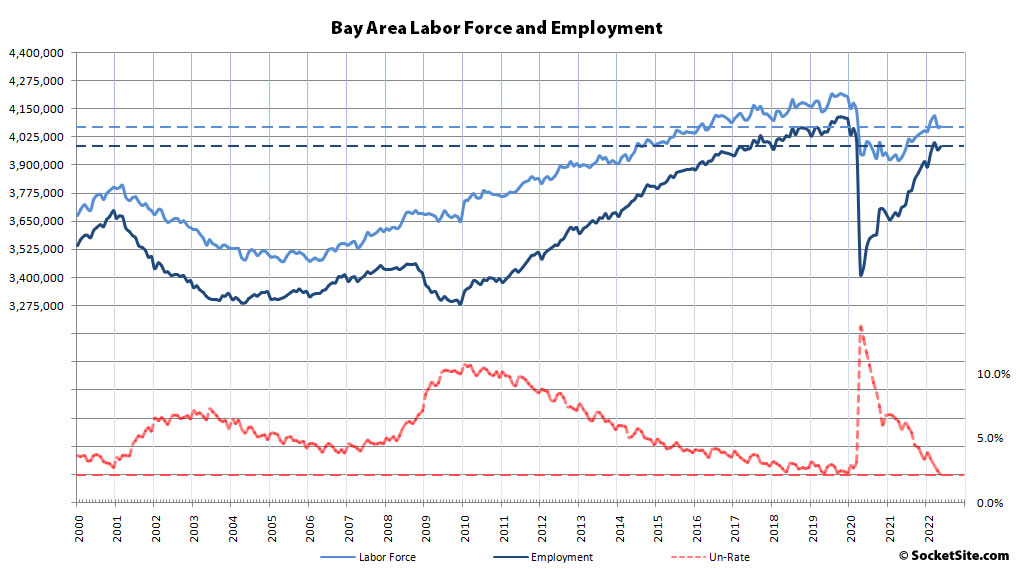

As such, the total number of Bay Area residents with a job increased by 14,900 in May to 3,982,600, representing 272,700 more employed Bay Area residents than there were at the same time last year, with 571,400 Bay Area jobs having been recovered since the second quarter of 2020 and total employment is back to 97 percent of its pre-pandemic count, but with 79,500 fewer employed Bay Area residents than there were prior to the pandemic having hit (4,062,100) and over 100,000 fewer people in the labor force for an average unemployment rate of 2.1 percent.

In before Dave (Seattle dude) copy/pastes his standard answer?

Haha. I literally clicked on this just to see if Dave “The Sky Is Falling”(Seattle dude) used this to demonstrate the end-of-times for SF.

Just in time for the Fed-triggered recession…

I don’t know why you two and the editor thinks this means so much. It doesn’t matter all that much that there are 49k more residents with a job in San Francisco than there were at the same time last year, what matters for the local housing market is what those jobs pay, and the pay distribution. And I haven’t seen any data that indicates that the pay distribution of those new jobs is either randomly distributed or weighted on the right hand side of the curve.

If the vast majority of those newly employed are working in low-paying service and “gig economy” jobs that don’t provide enough income to pay for above subsistance level housing and other costs of living at the same time a high proportion of the high-paying jobs were kept by people fleeing S.F. for outlying areas because they can work from home, that state of affairs will not support the pre-pandemic price levels for housing, now will it? And of course, most jobs in S.F. aren’t amenable to WFH, but the ones that command higher salaries, the ones that will support paying elevated prices for housing, are overrepresented among the ones that are amenable to WFH.

Don’t get me wrong, I think it’ll be great for everyone except the flippers, developers, and other hangers-on in the real estate “game” if housing prices decline substantially, but just saying that S.F. has more employed people does not mean we are returning to the state of 2018 or before and that tech workers will overwhelmingly return to their offices in overpriced commercial building five days a week.

Instead of asking the never answered question of “who are the hangers on?”, today I pose this question to you. Why do you think flippers and developers are against lower prices? They are both buying and selling real estate. They carry the purchase price mortgage for years, but sell as soon as complete. I bet there are a bunch of “flippers” priced out of the “”game””. Sure there are some who will be taking a loss when prices decline, but if they jump right back in they can recoup.

but if they jump right back in they can recoup.

That assumes, of course, that prices have stopped declining.

Sure in theory they could decline for years, but the idea is to create a more valuable place so there is still money to be made at declining sales prices.

Then, if I might suggest we refine “flippers” as being those who make substantial improvements (and presumably substantial appreciation) as opposed to those who simply buy/resell (or make cosmetic changes). Maybe that’s how you were defining the term anyway, though I think most people probably think more of the latter.

Notcom – perhaps a physical investment threshold would help clarify? Spend less than $X to improve a property –> flipper. Spend more than $X -> developer.

I for sure break out “flipper” and “developer” those ways. But with that in mind I still don’t think the flipper is against lower prices since they are turning places over quickly, generally the same markets. If they buy lower and sell lower the profit margin is still the same. The developer, as I noted has a long carry so the lower the purchase price the better, even when that comes with a lower sale price. Additionally in markets that keep going up, it is my experience, that the expectation of fixer value goes up faster than finished house value and so the margin is even smaller.

I’m curious why posters think that light touch flipper type moves, as seen on TV, are ever that much of a thing in SF. Sellers want a lot of money for even super rundown, years of neglect, prop 13 casualty, type properties. The concept that there is a class of speculators who are so uber plugged in to the many, many properties in town, that they can reliably obtain properties for under market value? The very nature of the MLS and the aggegators such as Zillow and Redfin means that even the really rundown ones get a lot of publicity. So, what, these folks know every last grandma, granpa, auntie in town who will let the family house go for a song? Hardly. But that’s what it has to be if it’s to be a light touch type flip without adding footage or what have you. Otherwise the margins are too tight as it costs too much to sell something in this town. I think people see stuff on TV about like crap parts of Orange County and somehow think that kind of operation flies in San Francisco, myself.

“to go” presumes we’re going to / ought to be at 2.1% unemployment but that’s far tighter than what’s considered full employment

That’s incorrect as the size of the labor force / population is a key component as well, which is why the current unemployment rate can be a bit misleading in terms of how the local economy and demand/need for housing has rebounded.