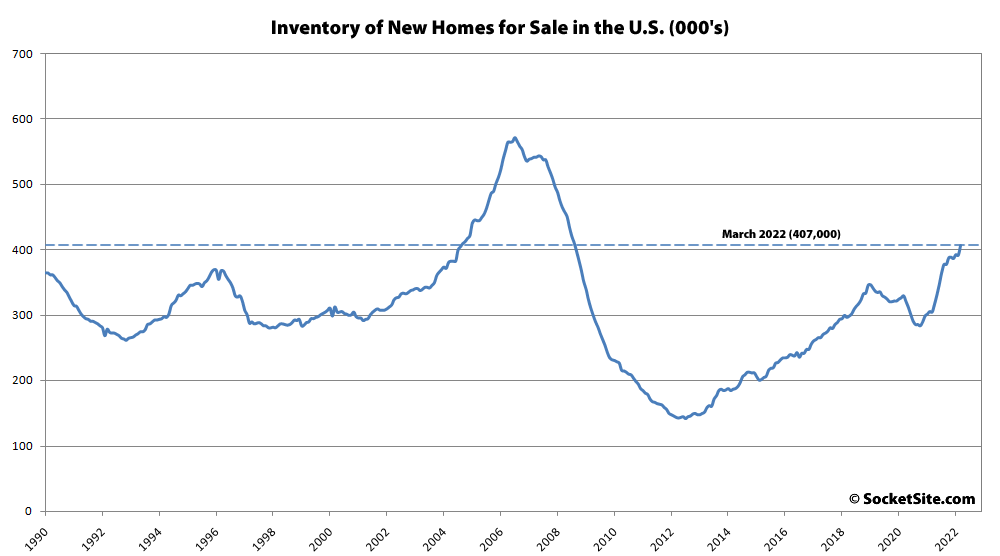

Despite the fact that there are now over 30 percent more new homes on the market across the nation than there were at the same time last year and new home inventory in the U.S. is nearing a 14-year high, mortgage loan application volume to purchase one of the aforementioned new homes dropped 14 percent from March to April. And in fact, mortgage applications for new home purchases in the U.S. were down 10.6 percent on a year-over-year basis last month, doubling the year-over-year drop in March.

So, as securities, bogus business models. and assorted Ponzies flounder and RE is poised for a coma immediately after the Fed starts cutting back on the punch bowl, it turns out that, yes, historically-low interest rates and massive Fed purchases of bundled paper directly fuel asset bubbles, which directly fuel extreme economic inequality and instability. Knock me over with a feather.

The big question now is whether there will be courage to prevent inequality bailouts, that was severely lacking in the last few cycles …

Don’t quite know what you’re calling “inequality bailouts”. There were definitely bailouts during and after the so-called “financial crisis” that increased inequality, because the run amok bankers on Wall Street got the U.S. government to buy up all the dodgy assets they created and regular american homeowners mostly got CNBC correspondent Rick Santelli ranting on the floor of the Chicago Board of Trade about people buying homes they couldn’t make the payments on, which was the event that kicked off the so-called Tea Party.

When the upcoming recession gets going in full, will there be the courage to avoid repeating a similar pattern where elites get their interests served by bailouts while regular Americans get largely ignored? I wouldn’t bet on it.

Or perhaps you mean that the measures Congress passed after the onset of the pandemic reduced inequality and you’re upset that undeserving people were “bailed out” of a public health crisis exacerbated by U.S. capitalists who have made our economy overly dependent on China. I would not agree that it required courage to prevent this and that such courage was lacking. If anything was and is lacking, it’s the foresight to rebuild our economy on a more sustainable level.

Perhaps ‘B2b” really meant to say inequitable bailouts

UPDATE: Pace of New Home Sales Plunges, Inventory Hits 12-Year High