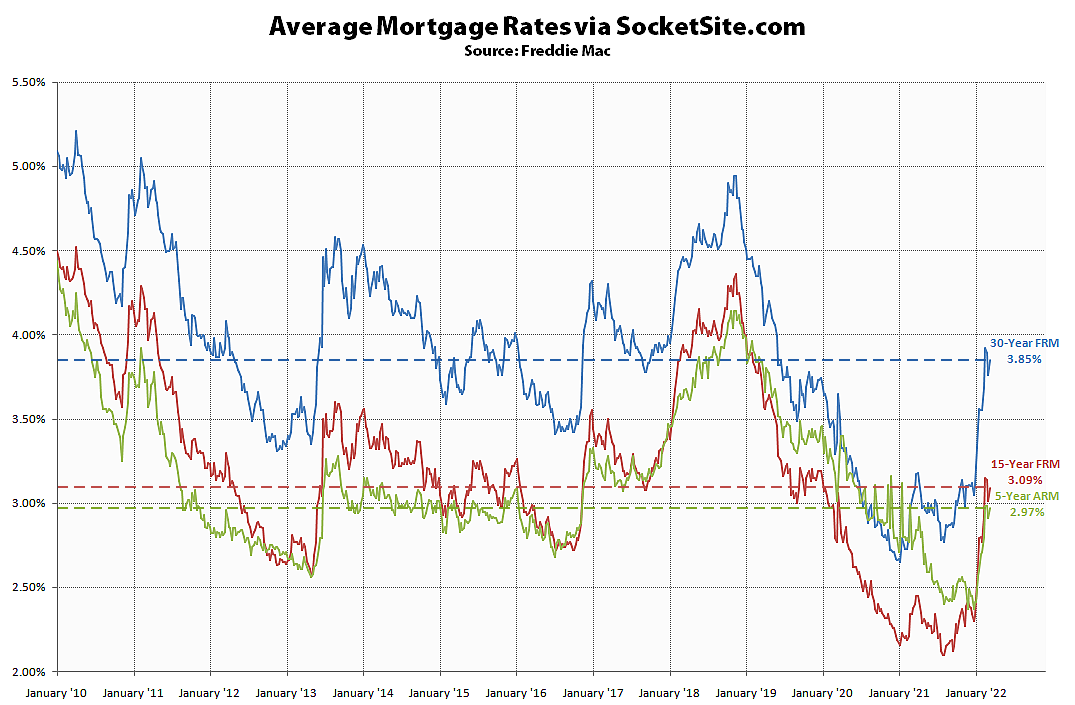

Having dipped 16 basis points (0.16 percentage points) with a flight to safety in the markets following Russia’s invasion of Ukraine, the average rate for a benchmark 30-year mortgage ticked back up 9 basis points over the past week to 3.85 percent, which is 80 basis points higher than at the same time last year.

And with the near certainty of a 25 basis point rate hike by the Fed next week having already been priced into the market, the probability of at least five quarter point rate hikes by the end of the year – which should translate into higher mortgage rates, less purchasing power for buyers and downward pressure on home values – is up to over 95 percent according to an analysis of the futures market with the probability of six rate hikes by the end of the year now up to over 85 percent.

And with inflation at 8% and rising, that is a negative real rate, or free money gift, of more than 4%