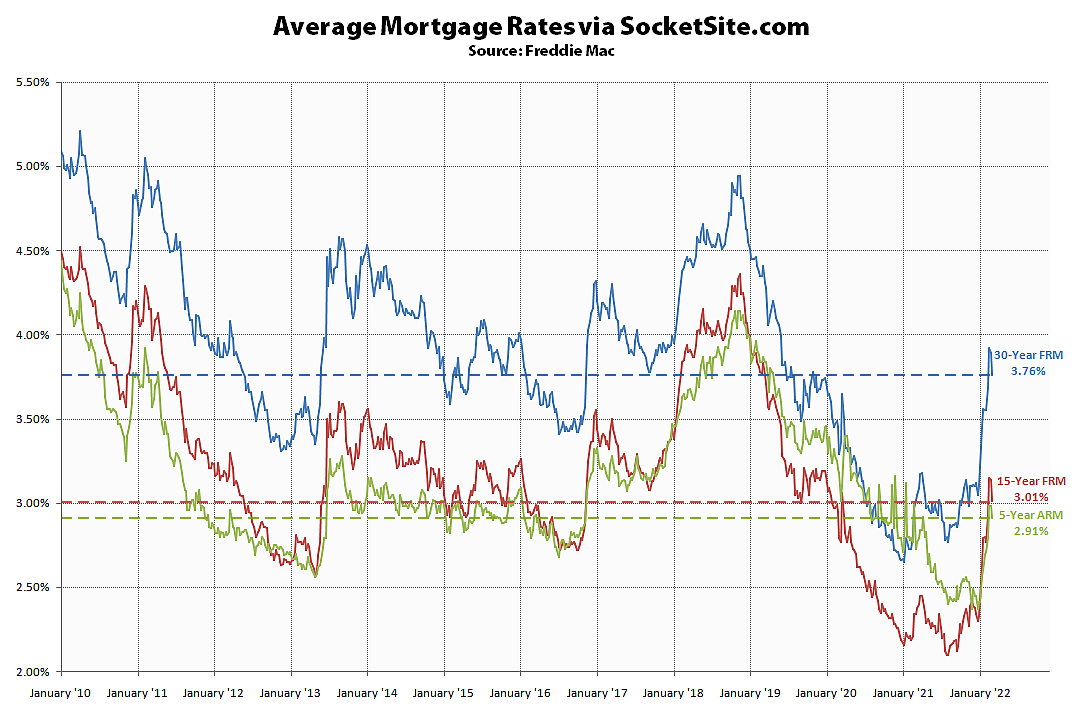

Having slipped 3 basis points (0.03 percentage points) last week, the average rate for a benchmark 30-year mortgage has since pulled back another 13 basis points to 3.76 percent with the Fed’s expected quarter point hike having been priced in and a flight to safety over the past week driving up the price of bonds.

That being said, the average 30-year rate is still 74 basis point higher than at the same time last year and mortgage application volumes have dropped, pending home sales activity is down, and bond traders are still projecting expectations for at least five quarter point rate hikes by the end of the year (which should translate into higher mortgage rates, less purchasing power for buyers and downward pressure on home values).