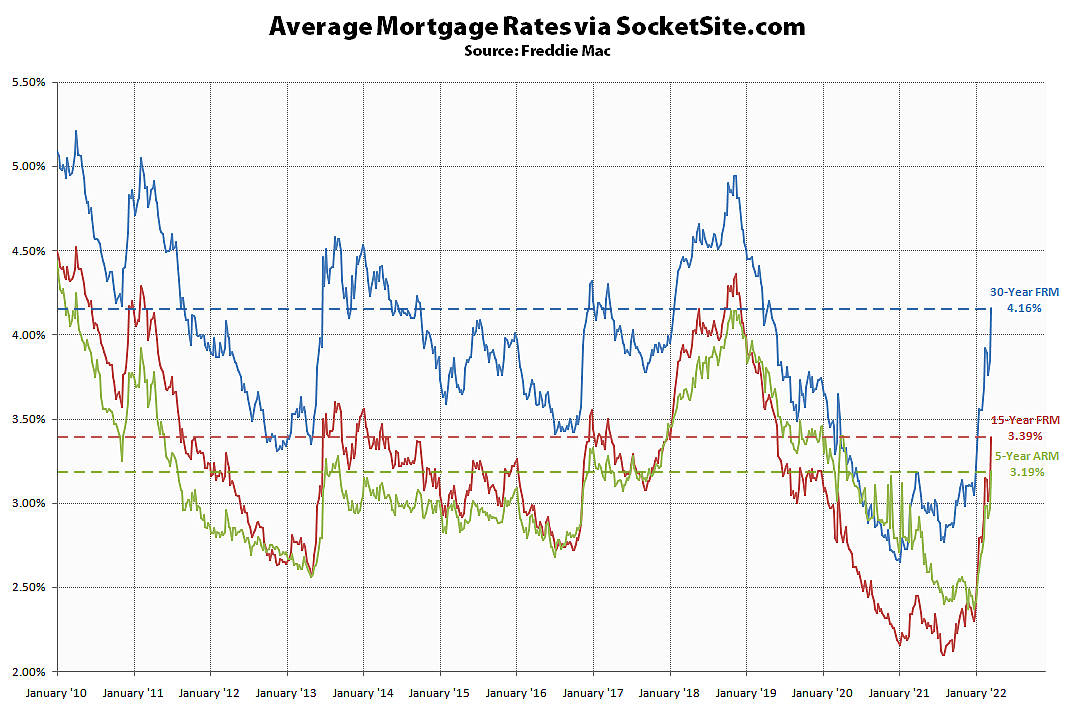

The average rate for a benchmark 30-year mortgage jumped 31 basis points (0.31 percentage points) over the past week to 4.16 percent, which is 35 percent (107 basis points) higher than at the same time last year, nearly 60 percent higher than in January of last year and the highest average rate since April of 2019.

While measured prior to the Fed’s rate hike yesterday, the yield on the 10-year treasury, which drives the 30-year mortgage rate, was effectively unchanged after the Fed’s announcement with the near certainty of a 25 basis point rate hike having already been priced in to the mortgage rate.

With the probability of at least five more quarter point rate hikes by the end of the year having just hit 98 percent, however, expect mortgage rates to continue to spike, resulting in less purchasing power for buyers and downward pressure on home values, none of which should catch any plugged-in readers by surprise.

Trailing inflation for the 12 months up to February 2022 was 7.9%

Real interest rates (adjusted for inflation) are expressed as nominal or stated rate less inflation.

So, the real rate assuming inflation held at these levels for the duration of the mortgage would be 4.15% – 7.9% = -3.75% (being paid to borrow money).

The Fed is endeavoring to raise interest rates to control inflation, so it is unlikely these happy circumstances of being paid to borrow will remain in effect throughout the life of the mortgage. Or maybe the US will keep borrowing and spending and it will be hard to stop inflation for the <5 year period many people are likely to own homes….

In fact, the Fed is expecting inflation to be driven back under 4 percent next year, if not sooner, with a target inflation rate of 2 percent over the long run. In addition, the average holding period for a home in San Francisco is over 7 years, in part driven by transaction costs that average over 6 percent.

And the bond markets are currently predicting (through TIPS pricing) 3.34% inflation over the next 5 years. May be wrong, but betting against the bond market is generally a losing proposition. Still pretty low real rates, but not being paid to borrow.

A good idea to keep an eye on the bond market and what it’s inferring. But a thing to keep in mind is that what you’re getting from the bond market is a expectation value not a prediction.

A situation where there is a 100% chance of 3.34% inflation over the next 5 years has an expectation value of 3.34%, but also a situation where there is a 50% chance of 0% inflation and a 50% chance of 6.68% inflation has the same expectation value. Or any number of other inflation probability distributions.

As soccermom points out there are a number of factors in play. But realistically if powell has the heart of Paul Volker and can do whats required to address inflation, then yes it should be easy to manage. But that’s a big ‘if’. Knowing what to do and actually being able to do it in the face of the inevitable pain that recession will cause are two very different things.

Inflation should be really easy to manage for the Fed except that nobody wants to go to work any more, stuff is hard to get, oil and food prices are going up (with no apparent clarity as to a solution) and China, where most of our stuff is made, is neutral to cosy with the emergent war criminal(s) in Russia, so it’s hard to imagine smooth sailing on the trade front. And once everyone accepts inflation, then businesses can raise prices and employees can ask for raises and then inflation is really tough to stop without sending the country into the throes of a recession with a populist-knucklehead-presidential-election resulting outcome.

And if rates come back down, one can always re-fi at a lower rate.

FED is 6 months late to the party as usual and will now have to be overtly aggressive with hikes…glad the ‘transitory’ language is done with!

Remarkable that regardless of who the FED Chair is, as the owner of monetary policy, they keep making the same mistakes over & over again…