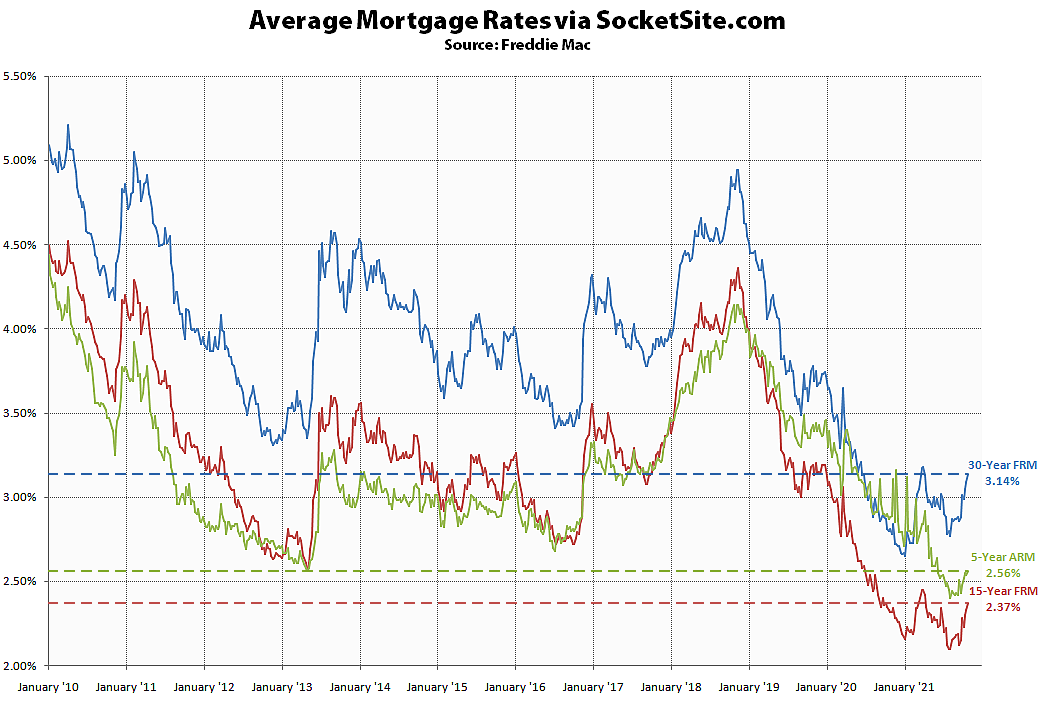

The average rate for a benchmark 30-year mortgage has inched up another 9 basis points over the past two weeks to 3.14 percent, which is the highest rate in six months and within 5 basis points of a 16-month high.

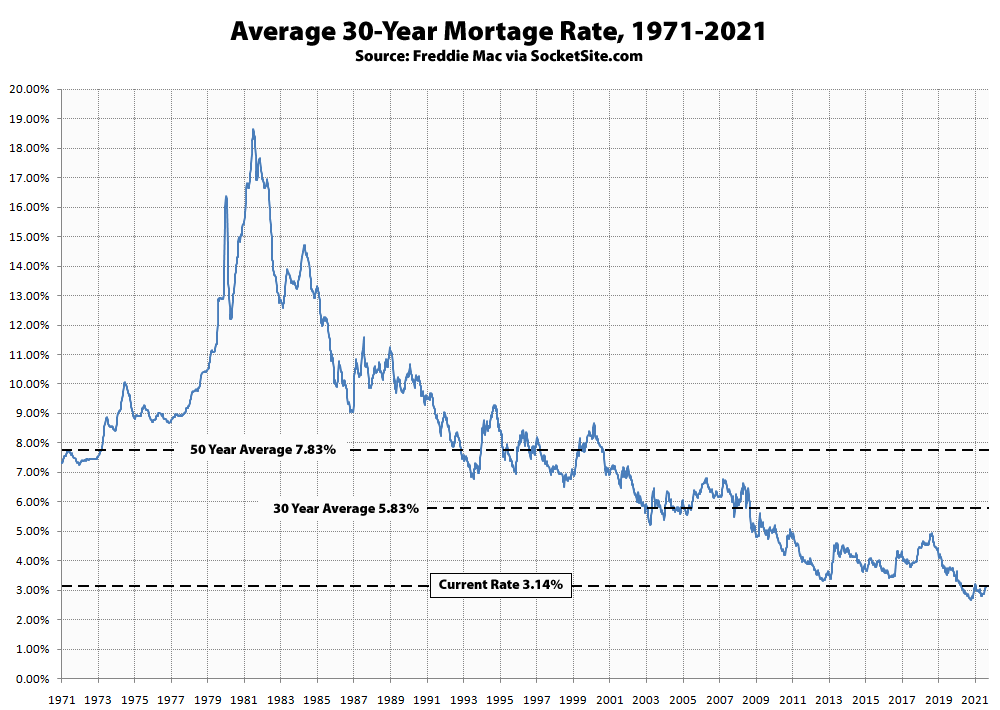

While 3.14 percent is still a historically low rate, with the benchmark rate having averaged closer to 6 percent over the past 30 years, that’s 33 basis points (0.33 percentage points) higher than at the same time last year and 49 basis points above its all-time low of 2.65 percent back in January with a jump in inflation escalating expectations for a rate hike in the nearer-term.

At the same time, the average rate for a 5-year adjustable rate has inched up to 2.56 percent, but remains 32 basis points below its mark at the same time last year, while the average rate for a 15-year fixed-rate mortgage has inched up to 2.37 percent, which is 5 basis points above its mark at the same time last year.