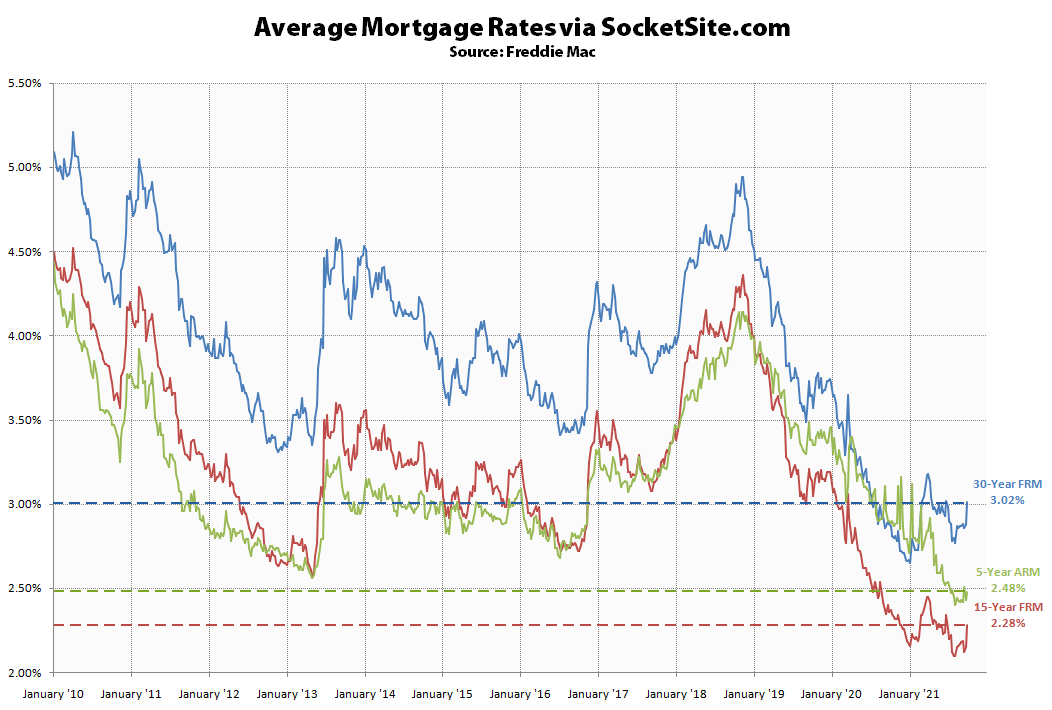

The average rate for a benchmark 30-year mortgage jumped 13 basis points (0.13 percentage points) over the past week to 3.01 percent.

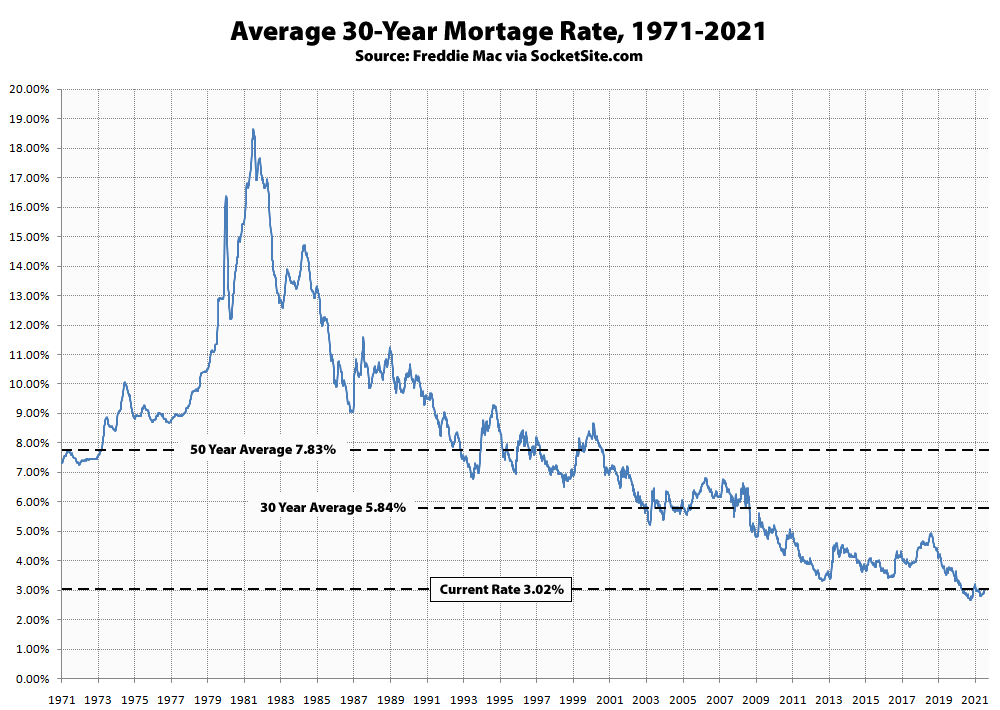

While 3.02 percent is still historically low, with the 30-year rate having averaged 5.84 percent over the past 30 years, that’s 13 basis points above the average 30-year rate at the same time last year and 37 basis points above its all-time low of 2.65 percent back in January with expectations for a rate hike having accelerated.

At the same time, the average rate for a 5-year adjustable rate ticked up 5 basis points to 2.48 percent but remains 42 basis points below its mark at the same time last year, while the average rate for a 15-year fixed-rate mortgage jumped 13 basis points to 2.28 percent but is still 8 basis points below its mark at the same time last year.

I can’t find home affordability index data that covers the same time frame but I would be curious to see those two lines have interacted with each other over the last 30 years.