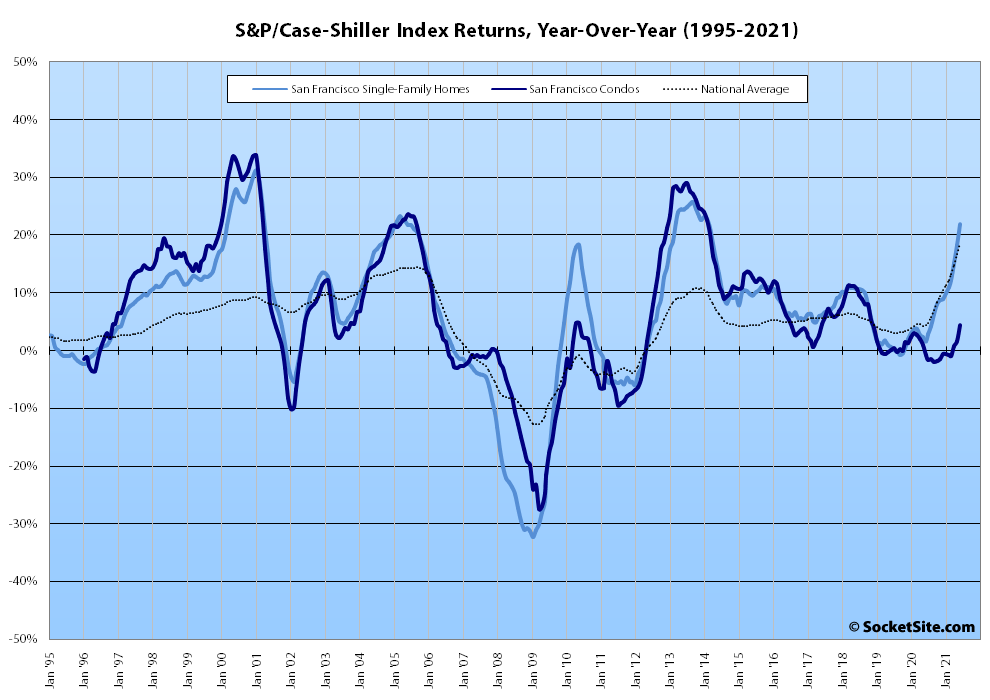

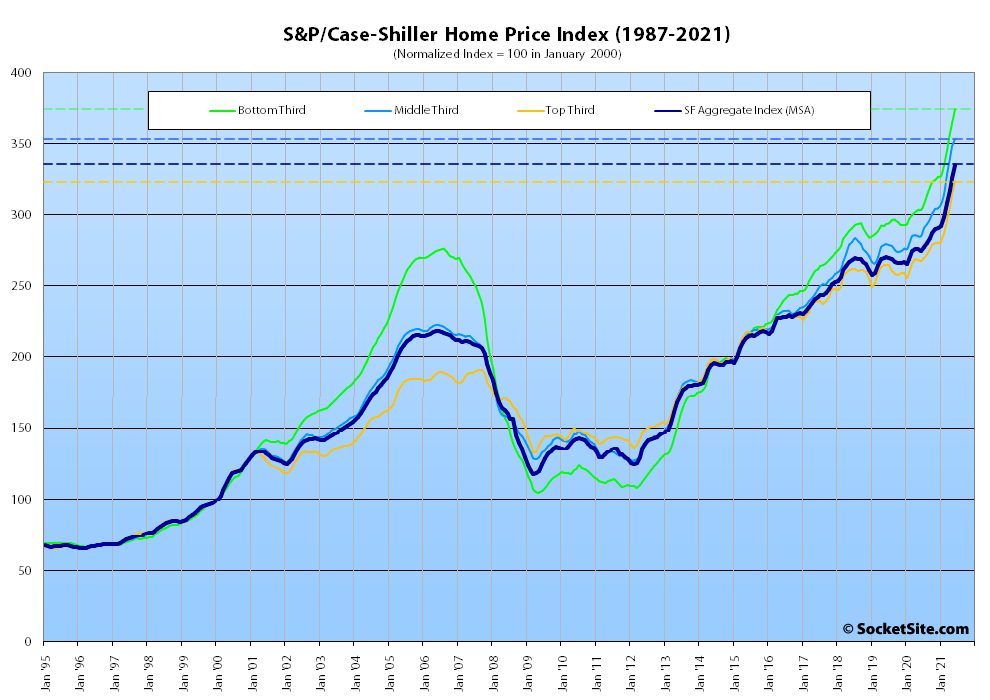

Having ticked up 2.6 percent in May, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked up another 2.6 percent in June and is now up 21.9 percent on a year-over-year basis, which is the largest year-over-year gain for the index since the first quarter of 2014 and above the (record) 18.6 percent year-over-year gain for the national index.

At a more granular level, the index for the least expensive third of the Bay Area market ticked up 2.7 percent in June and is 23.4 percent higher than at the same time last year; the index for the middle tier of the market ticked up 1.5 percent in June and is up 23.7 percent, year-over-year; and the index for the top third of the market increased by 2.9 percent in June for a year-over-year gain of 21.0 percent.

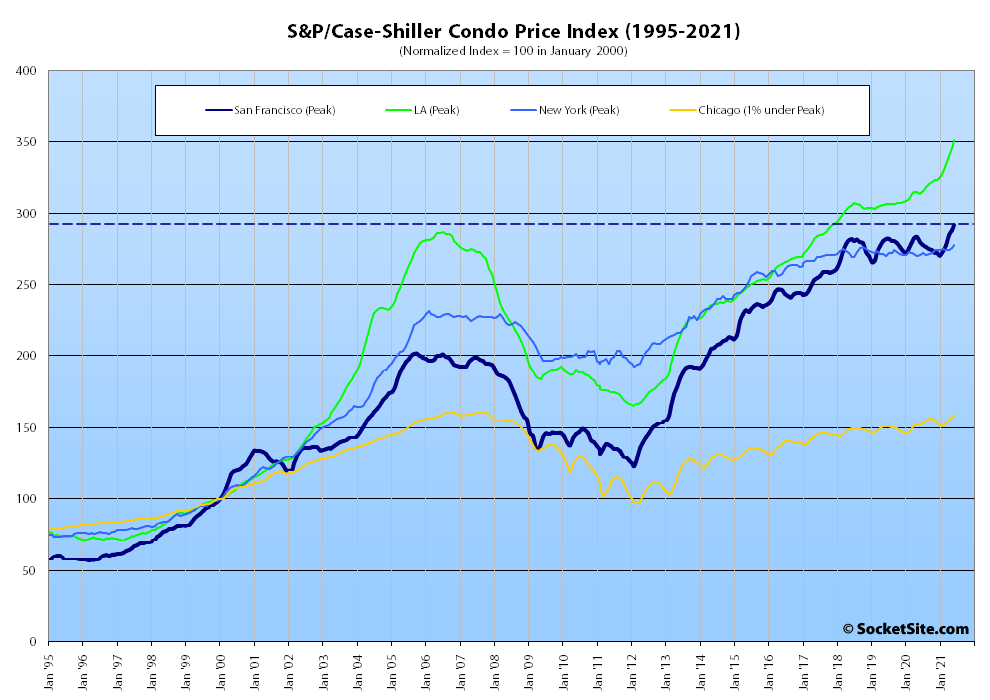

At the same time, the index for Bay Area condo values, which remains a leading indicator for the market at a whole, ticked up 1.4 percent from May to June and is now 4.3 percent higher than at the same time last year versus year-over-year indexed gains of 12.0 percent, 3.8 percent and 2.8 percent in Los Angeles, Chicago and New York condo values respectively.

And nationally, Phoenix still leads the way in terms of indexed home price gains, having gained 29.3 percent over the past year, followed by San Diego (up 27.1 percent) and Seattle (up 25.0 percent) with the average year-over-year gain having hit a record 18.6 percent nationally.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

More California companies have already moved out of the state than in all of 2020

This will end well, I’m sure they’ll all just move back.

At this point The state is just importing rich retirees and foreigners who have no use to join the local job market. So will this matter?

If all the companies and professionals leave who will bear the gigantic tax burden of funding Cali’s welfare state? Why will the rich retirees and foreigners stay when they have to foot the bill for that.

For all the doom and gloom, California just recorded an enormous $75 billion budget surplus.

California is far more dependent on personal capital gains taxes than any other state.

When the market’s up (like it’s mostly been for more than a decade) Sacramento is full of cash. When the market tanks, things go bad quickly.

Just pointing out that California’s budget is actually quite strong.

From your link: “The state has a progressive income tax structure that leans heavily on top earners, allowing the state to enjoy record revenues despite widespread job losses in the travel and service industries that have kept California’s unemployment rate among the nation’s highest.”

That is why it matters when the top earners who are being leaned on for all the taxes leave the state. The unemployed are not leaving. Then they tax the remaining earners even more to make up for the ones who left, which makes more top earners leave, rinse repeat…

Is it true that the top earners are leaving? More accurately, it is true that they are leaving and not being replaced by new top earners? People have been leaving California for 30 years.

Given CA tax rates, the only rich retirees being imported are the stupid ones.

If one compares with retirees in Florida, though, where Covid is still rampant, one might wonder which retirees are the stupid ones.

Nobody lives here anymore. It’s too crowded!

Attempted witticism aside, the estimated population of San Francisco proper actually decreased by 14,773 (1.7 percent) in 2020, representing the largest decline across all of the Bay Area counties on both an absolute and percentage basis, for an estimated population of 875,010 at the start of 2021, eight months ago.

At the same time, there are still nearly 39,000 fewer employed people in San Francisco than there were prior to the pandemic and the labor force is down by over 22,000.