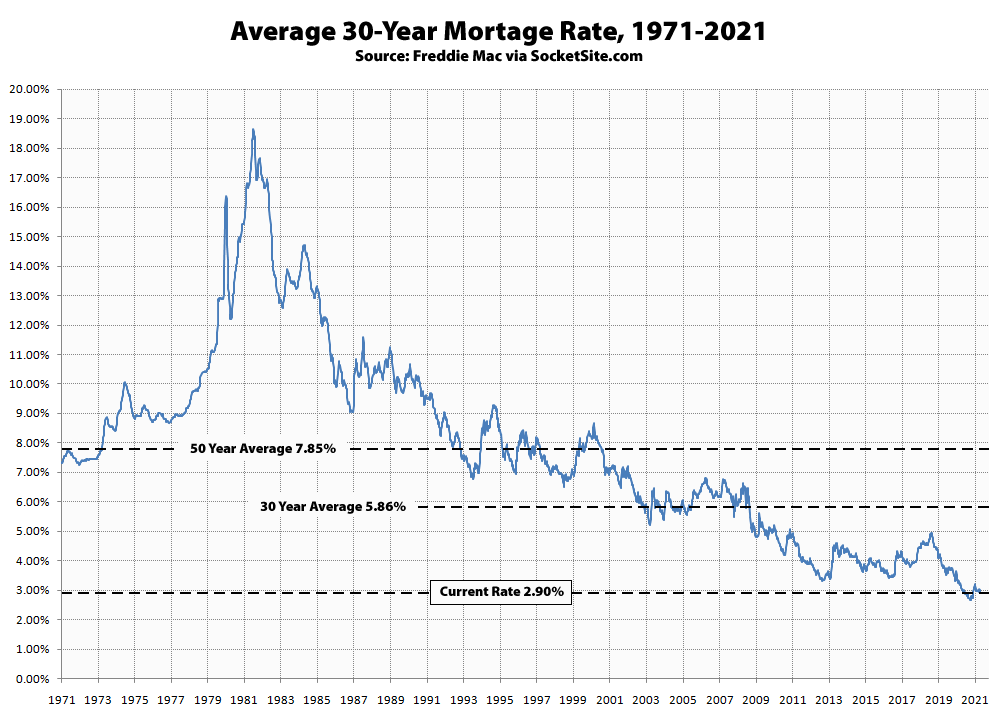

Having inched back over 3 percent two weeks ago to a two-month high, the average rate for a benchmark 30-year mortgage has since dropped 12 basis points (0.12 percentage points) to 2.90 percent, which is 13 basis lower than at the same time last year, within 25 basis points of its all-time low and the lowest average rate in five months.

At the same time, mortgage loan application volumes across the U.S. have dropped to their lowest level since the beginning of last year, with purchase mortgage activity down 14 percent on a year-over-year basis over the past week despite the drop in rates.

UPDATE (7/15): The average rate for a benchmark 30-year mortgage has inched down another 2 basis points to to 2.88 percent, which is 10 basis lower than at the same time last year, within 23 basis points of its all-time low and the lowest average rate in five months.

Just locked 2.875 and thought that was decent, turns out it’s average!

decent is synonymous with average

Not really when it comes to money. Big difference between decent and average .

I am an old fart at 37.

I consider someone who has over 500k in retirement accounts to be “decent” while I doubt the “average” 37 year old has even 10% of that in a retirement account.

2.875 I would still classify as decent .

In my mind:

OK = average

Decent = better than average

Great = much better than average

Poor = worse than average

Terrible = much worse than average

Anyone able to get sub 3% on a jumbo loan?

sub 3% quote from Chase PC and First Republic.

Starting the process back in May, we got 2.49% on a jumbo refinance (1.1M), using better.com

Did you pay points?

Yes, paid the max points I could get, sorry I should have mentioned this.

UPDATE: The average rate for a benchmark 30-year mortgage has inched down another 2 basis points to to 2.88 percent, which is 10 basis lower than at the same time last year, within 23 basis points of its all-time low and the lowest average rate in five months.

I just locked in a Jumbo refi at 2.375 on a jumbo refinance with a rebate to cover fees/points. It is only a 7 year ARM, but I can theoretically afford to pay off the entire mortgage if int rates go nuts by then. My original purchase loan was at 3.5 for what it’s worth.