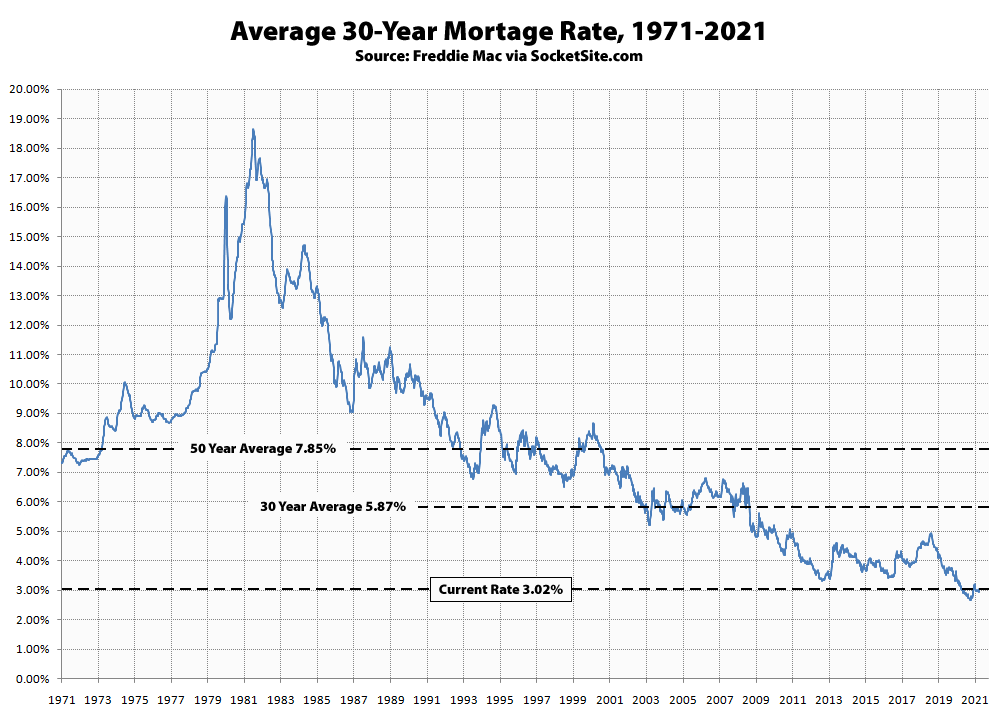

The average rate for a benchmark 30-year mortgage has inched up 9 basis points (0.09 percentage points) over the past week to 3.02 percent, which is the highest average rate in two months but still 11 basis points lower than at the same time last year and around half the average 30-year rate over the past 30 years.

At the same time, the pace of both existing and new home sales have dropped, despite increasing inventory levels. And while mortgage loan application volumes across the U.S. inched up 1 percent over the past week, purchase loan activity actually slipped 1 percent and was down 14 percent on a year-over-year basis.

UPDATE: Having inched down 4 basis points over the past week, the average rate for a benchmark 30-year mortgage (2.98 percent) has just slipped back under 3 percent and is still 9 basis points below its mark at the same time last year.