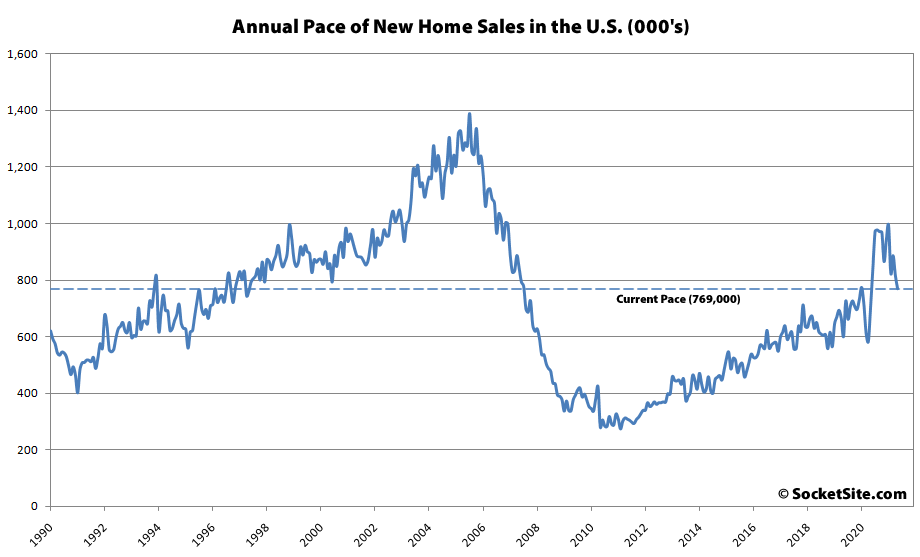

Despite inventory levels having ticked up to a 14-month high, the seasonally adjusted pace of new single-family home sales in the U.S. dropped 5.9 percent last month to an annualized rate of 769,000 sales, which is slowest pace in a year and down 22.6 percent since the start of 2021.

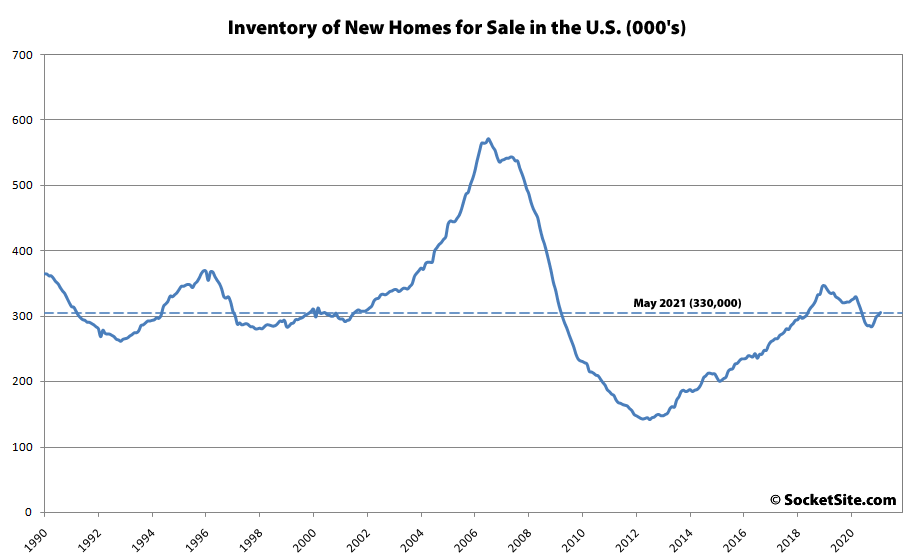

And in terms of inventory, there are now 330,000 new single-family homes for sale across the country, which is the most since March of 2020 and 5.8 percent more than at the same time last year, despite a post-lockdown surge in sales.

And while the median price of the homes which sold last month ticked up 2.5 percent to $374,400 in May, and was 18.1 percent higher versus the same time last year, the jump was once again driven by a higher percentage of more expensive homes having sold, as has been the case for existing-home sales.

In seemingly related stories, several of those who got the previous bust right are edging towards the exits. The ever-prudent and calm Bill McBride recently called the bottom in inventory and last week said his “Spidey senses are tingling again” about housing. Meanwhile, Michael Burry two weeks ago said, “People always ask me what is going on in the markets. It is simple. Greatest Speculative Bubble of All Time in All Things. By two orders of magnitude.”

I’m sure Lawrence Yun would disagree and say it’s a great time to buy! ?

What Yun actually says is that “Home prices will…climb, but I expect more moderate increases than we’ve seen, a break for first-time buyers.”

But he’s also repeating the party line that “The housing shortage is the result of a decade of underproduction of all housing types” that all those involved in making money from real estate have been programmed to repeat over and over again, ad nauseam in every recent interview I’ve seen him quoted in.

Then there’s this:

If prices for housing are rising faster than inflation, then sure: it’s a great time to buy.

I think the only time it isn’t a great time to buy is when you expect a protracted recession the following year and a pronounced fall in housing prices.