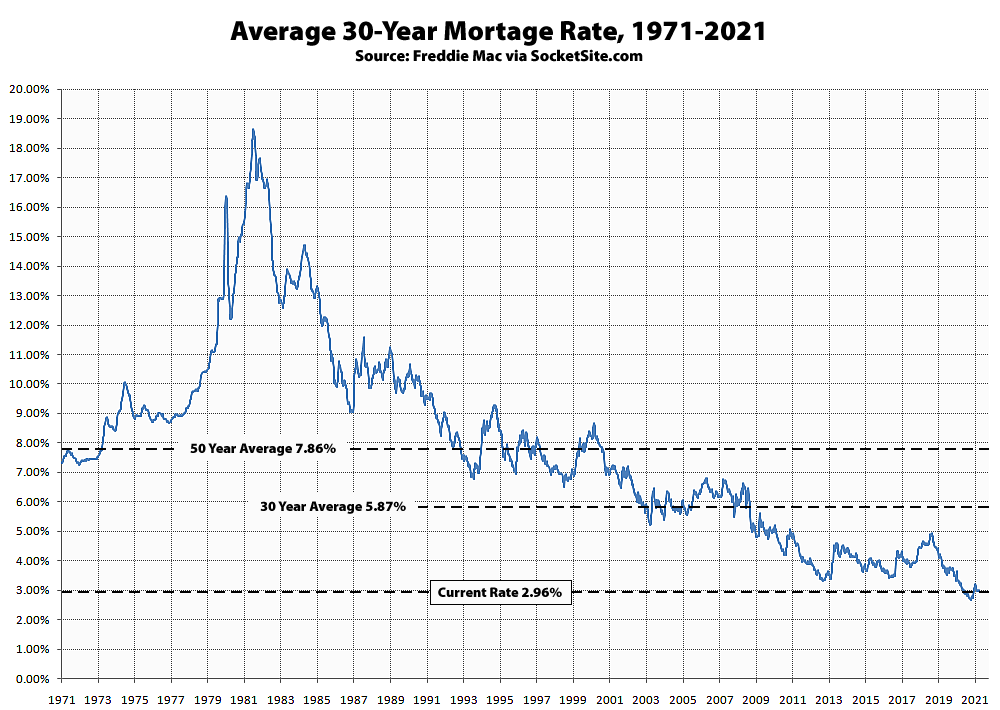

The average rate for a benchmark 30-year mortgage inched down 3 basis points (0.03 percentage points) over the past week to 2.96 percent, which is 25 basis points below its mark at the same time last year, within 31 basis points of its all time low and half the average rate over the past 30 years.

At the same time, purchase mortgage loan application volumes continue to drop, driven by “a slowdown in purchase application activity due to modestly higher mortgage rates,” according to Freddie Mac.

But once again, the benchmark mortgage rate is currently 25 basis points below its mark at the same time last year, within 31 basis points of an all time low and half the average rate over the past 30 years, which really should give one pause.

UPDATE: While the Fed is now positioning to start increasing rates by 2023 in light of increasing inflation, the average rate for a benchmark 30-year mortgage inched down another 3 basis points over the past week to 2.93 percent and is still 20 basis points below its mark at the same time last year.