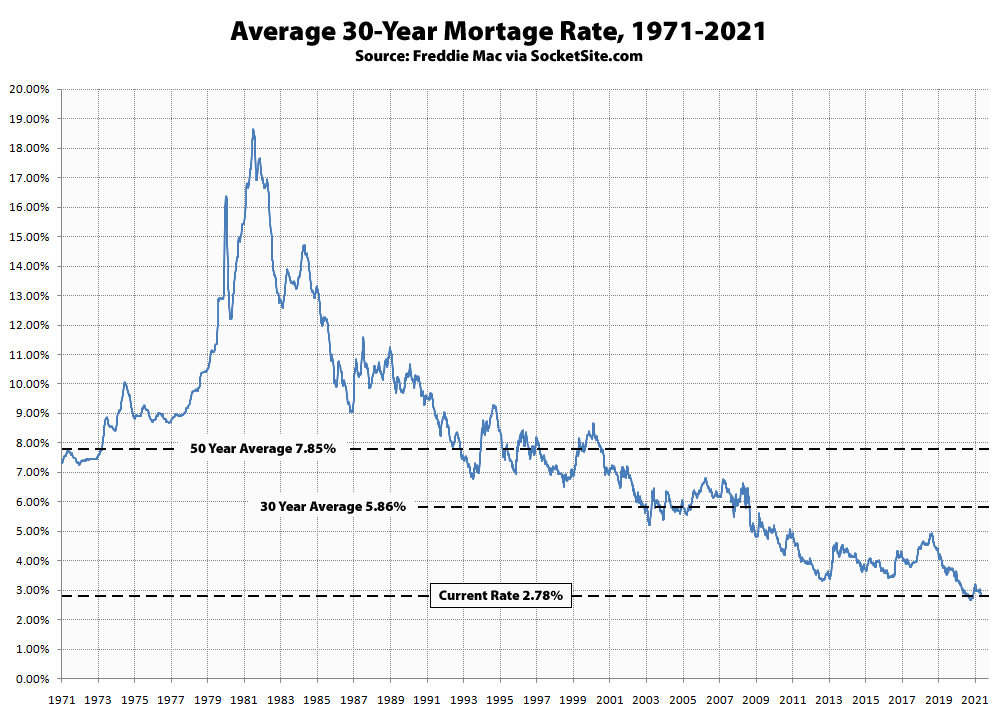

Having inched down to a five-month low last week, the average rate for a benchmark 30-year mortgage has since dropped another 10 basis points (0.10 percentage points) to 2.78 percent, which is 23 basis below its mark at the same time last year and within 13 basis points of its all-time low (2.65 percent).

And despite the marked drop in rates, mortgage loan application volumes across the U.S. are currently down 18 percent on a year-over-year basis, the pace of pending home sales locally has slowed to a four-month low, and inventory levels have inched up.

I suspect these rates will NEVER go higher than 4% in my lifetime and I’m a 50 year old.

For perspective, you were 8 years old the last time the Fed had to stomp the brakes.

By 2030 10 year yields will be back above 15%

@ Dee Nice. I am curious why you say that. What indication is there of that?

Lots of indications, insurmountable amounts of debt, leverage, etc. Combination of things, but I expect that 40 years of declining rates are going to come to and end. On a brighter note I do expect the 10 year to hit 0 before starting that march higher but yes I expect 40 years of declining rates to be undone through the rest of this decade.

A 5% interest rate is impossible, so forget about 15%. As it stands, interest represents 7.8% of the 2021 US budget’s expenditures. That percentage will grow to 10% of expenditures by 2030. Do you really think that the Fed will raise rates 750%? It’s just not possible, unless we decide to eliminate Social Security and defense spending.

@another anon – When rates go up bond prices go down. So If rates went up then Treasury prices would drop and I think the move would be for the government to buy back (“retire”) outstanding bonds. The government can literally print money so there shouldn’t be any obstacle to doing this.

another anon:

The imbalances in the global financial system are well beyond any in history.

The Fed controls the Fed Funds rate. The market will take the 10yr/30yr higher no matter what the Fed wants, and they will be behind the curve the entire way.

That hasn’t happened in Japan, despite every attempt to inflate the currency.

I bet you also drive using only your rearview mirror too.

If interest rates were to increase for Treasury bonds, and if they exceeded the target policy range of the Federal Reserve, then what’s to stop the Federal Reserve from simply buying bonds on the secondary market and forcing down the yield?

The Fed always can buy bonds of any maturity and in any quantity, creating demand for the bonds and driving up their price. Since the yield moves in the opposite of the price, then yields would drop. The Fed can hit its target policy interest rate, because it has a balance sheet of infinite size, and they can buy how ever many bonds necessary to achieve their interest rate target. The private bond market can’t block this process; they can only stand by and watch as the Fed moves in.

If you disagree, then by what mechanism could the private bond traders push bond yields to rates other than where the Fed wants them? How could a bond trader fight the Fed, the reserve issuer who has a balance sheet of infinite size? Thanks –