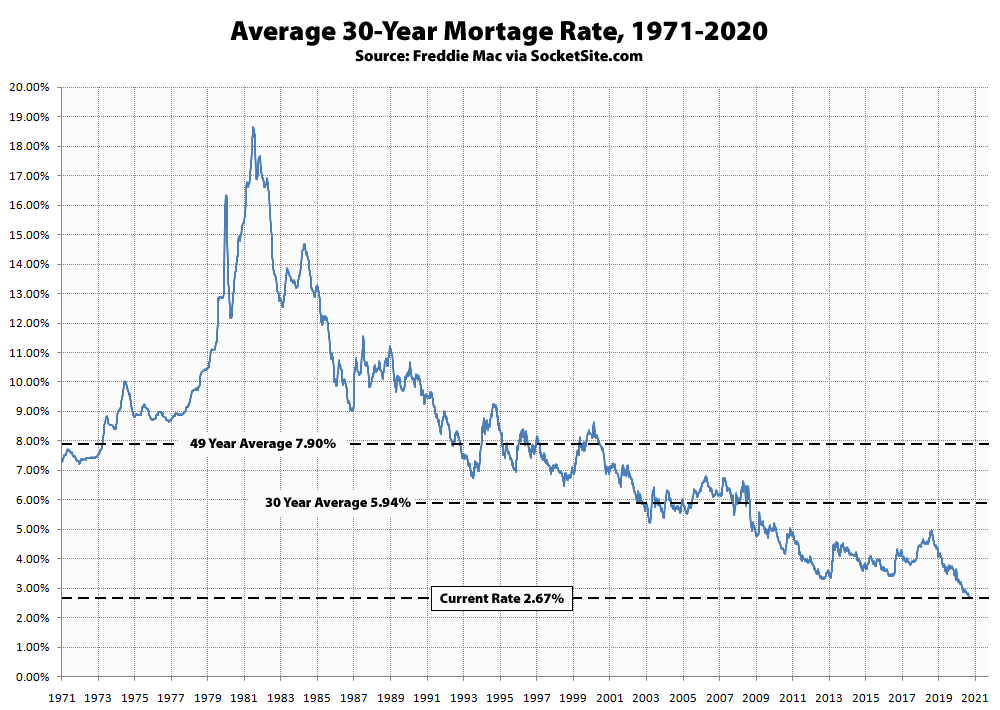

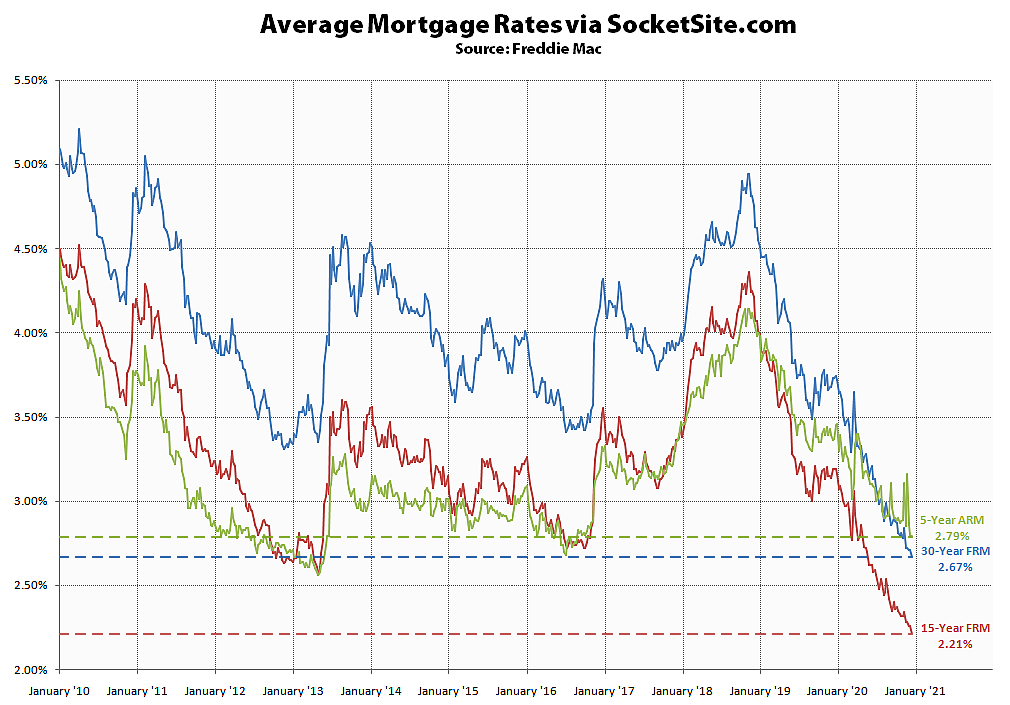

Having held at a record-low rate of 2.71 percent last week, the average rate for a benchmark 30-year mortgage has since inched down another 4 basis points (0.04 percentage points) to 2.67 percent, which is over a full percentage point (107 basis points) lower than the historically-low rate of 3.73 percent that was on offer at the same time last year and the 15th new all-time low this year, according to Freddie Mac’s Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched down another 5 basis points to a new all-time low of 2.21 percent (which is 98 basis points below its mark at the same time last year) while the average rate for a 5-year adjustable held at 2.79 percent (which is 58 basis points below its mark at the same time last year and an inverted 12 basis points above than the average 30-year rate), all driven by a continued rise in pandemic-driven economic risks.

Such enticing rates that I won’t qualify for….

🙁

Anyone get a good rate on a Jumbo recently? Last time I looked they were still over 3.00%

not a jumbo but i just closed a refi at 2.75% for $600K loan

What’s your LTV? You might be able to do better and you can refi right away. I closed/funded a 2.375% no cost refi [for a] $504K mortgage and got an appraisal waiver.

Owning also has like 2.2% but you pay fee/points

For Jumbo you can try wellsfargo if you go the relationship discount route:

“$250,000-$499,999 the interest rate is lower by .125%

$500,000-$749,999 the interest rate is lower by .250%

$750,000-$1,000,000 the interest rate is lower by .375%

$1,000,000 or more the interest rate is lower by .500%”

First Republic as well, but max discount on a fixed is lower – here’s what they quoted me:

“Regarding the discounts, your mortgage rate can be discounted by .15% with a $100,000 separate checking account that maintains that average balance for 3 years and that mortgage rate discount is maintained for the life of the loan. With $150,000, that discount is .25%, and with $200,000, the rate is reduced by .35%.

The maximum discount is .25% for a 30 year fixed rate, but can be as much as 1% off for our ARM loans. We can discuss further if that is of interest.”

Happy to refer to First Republic if you’d like

I just locked 2.75 on a jumbo with the relationship benefit at WF.

Had to buy down my rate to 2.75% with Quicken. It’s costing me about 27K in closing costs, but no one was willing to refinance a jumbo (850K). And I didn’t have the excess cash to give to other banks for a relationship discount.

Many banks allow the use of investments for the relationship discount. It doesn’t have to be Cash.

Yup, WF includes investments in total relationship while FRB is straight cash in a non interest bearing account (or close to zero, I forget) I might add

Now that MMT has taken over the thinking of central banks around the world it seems that rates will never increase by a substantial amount and may well continue to fall. The only way for a country to manage a 250% debt to GDP ratio is with LT interest rates at essentially zero forever. That’s where we are headed. And once we get there, there is no escape.

How does the debt-to-GDP ratio require a zero long-term interest rate? Isn’t it true, that as the currency issuer, the government can always pay its bills, regardless of the rate of interest?

It is just totally crazy, my 7/1 arm interest only for 10 years from early 2012 is libor plus 2%, the discounted rate was 2.875%. I paid it off in 2019 but the idea that I could have kept my arm and be paying a lower rate is slightly ridiculous.

Whats even more ridiculous is that you can get a 15 fixed for 1.75% these days. ARM what?

where can you get a 15 year fixed for 1.75%? Jumbo?

High balance conforming at interactive mortgage, not publicly listed on their site but many people have reported getting it.

I don’t know why “Another anon” thinks that a high multiple debt-to-GDP ratio requires an “essentially zero forever” long-term interest rate. I’d like to read that explanation.

From what I recall, it’s technically true that “as the currency issuer, the government can always pay its bills” as long as that government issues debt in its own currency (and that’s a key tenet of MMT, but which has not taken over the thinking of central banks around the world), the rate of interest does matter, because it can start accelerating. I think that’s what they are getting at.

UPDATE: The the average rate for a benchmark 30-year mortgage has since inched down another (1) basis point to a 2.66 percent, which is another new all-time low and 108 basis points below its average at the same time last year.

At the same time, the average rate for a 15-year fixed mortgage has inched down another 2 basis points to a new all-time low of 2.19 percent while the average rate for a 5-year adjustable has held at 2.79 percent.

UPDATE: The average rate for a benchmark 30-year mortgage has inched back up to 2.67 percent, ending the year 1.05 percentage points, or 28.2 percent, below its mark at the start of the year, with the average rate for a 15-year fixed mortgage having inched down another 2 basis points to a new all-time low of 2.17 percent and the average rate for a 5-year adjustable having dropped to 2.71 percent.