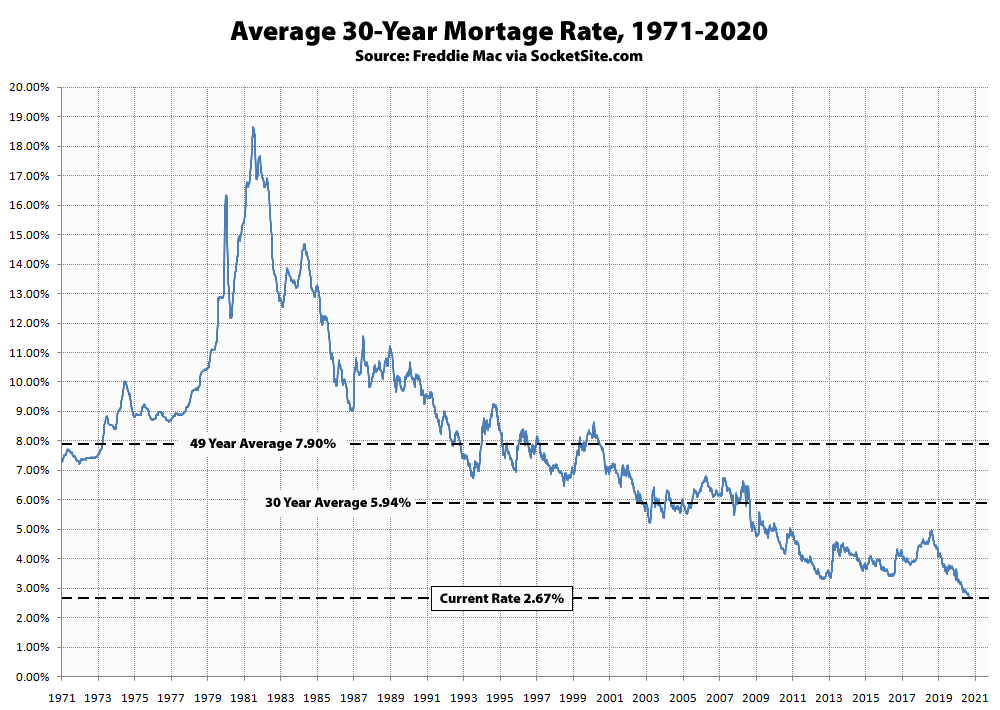

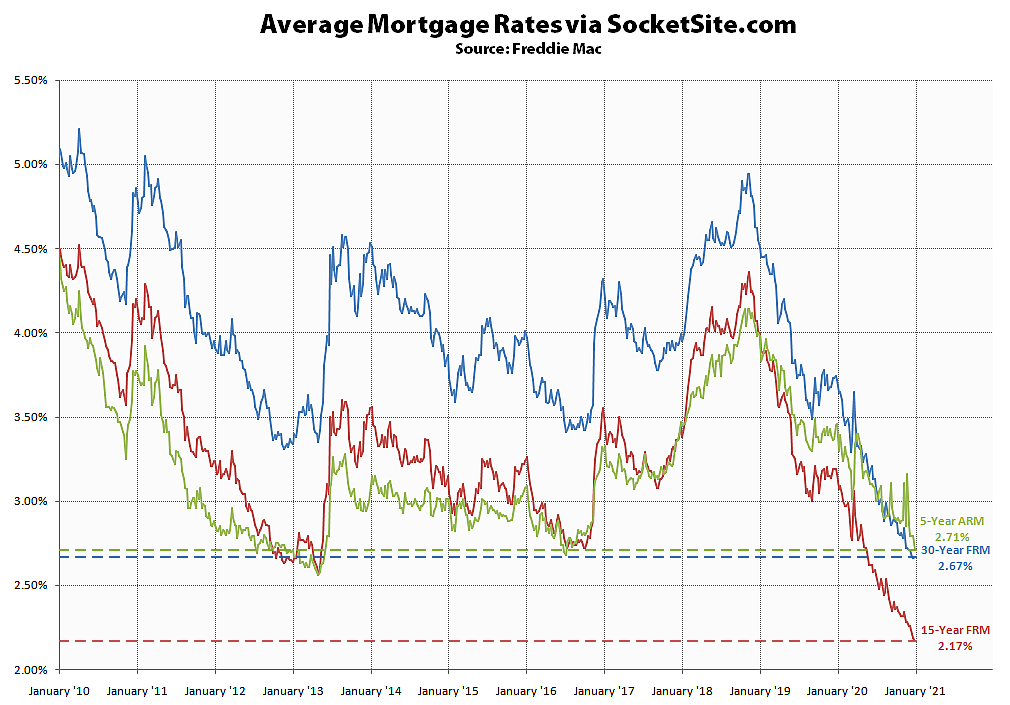

While the average rate for a benchmark 30-year mortgage inched up one (1) basis point over the past week from an all-time low of 2.66 to 2.67 percent, it’s ending the year 105 basis points – or nearly 30 percent – lower than where it started, having recorded 15 new all-time lows along the way.

At the same time, the average rate for a 15-year fixed mortgage, which just inched down to a new all-time low of 2.17 percent, dropped 99 basis points over the past year while the average rate for a 5-year adjustable has dropped to 2.71 percent, which is 75 basis points below its mark at the start of the year, driven by a rise in pandemic-driven risks to the economy.

Just wait until the FED pays us to buy real estate (negative rate). It’s coming.

I will buy more then. Thanks.

From May of this year, Powell says the Federal Reserve is not considering negative interest rates:

Of course he could change his mind and get others on the FOMC to go along, but I don’t see that happening in the near term, especially if the rollout of the vaccines goes well later in 2021.

Real Interest rates are already negative and have been since 2009 with the exception of a small period in late 2018 when they finally hit neutral. That is when Powell freaked out due to assets starting to correct and made the U-turn.

I already refinanced twice in 2020 and locked in for another one in early 2021. Probably shaved off close to $1k a month in monthly payments. The only good thing about this lousy COVID situation.

It is actually a dangerous time to buy real estate in such low rate enviroment, IMO, because purchase price is being pushed up by the false sense of affordability.

I would much rather until rates > 6% to buy, except that I have a hard time seeing that happening anytime soon. Fed has led us down this path of no return far too long already.

Purchased a second home 6 mo ago with a fixed 30yr @ 3%. Put 50% down then. Our resale value on this property has risen 6% since closing. Am refinancing today a 30yr @ 2.68% and pulling 55K back out. Our monthly payment bumps up by $130.

If you have stored equity in your property this is a great time to pull some tax free cash out of your property and reposition it while rates are at historic lows.

i refied at 2.75% a few weeks ago and pullout out an extra $100K to invest in stocks. very easy decision with rates this low

UPDATE: The average rate for a benchmark 30-year mortgage inched back down 2 basis point over the past week to a new all-time low of 2.65 percent, which is 99 basis points below its mark at the same time last year. At the same time, mortgage application volumes have slipped in the U.S. along with pending sales.