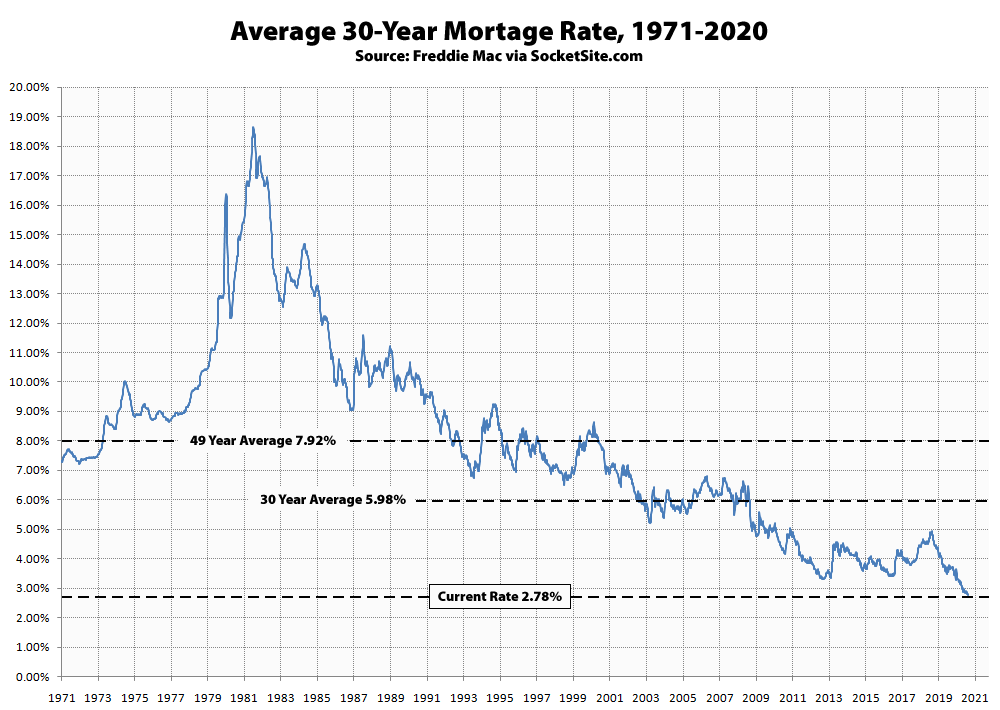

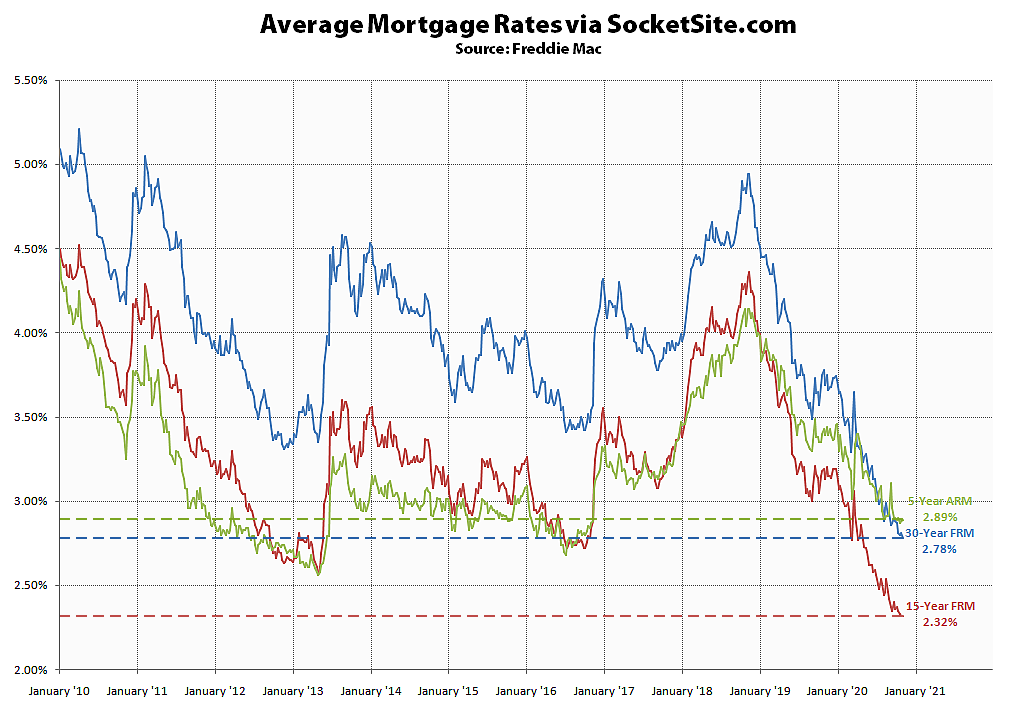

Having dropped to a new all-time low of 2.80 percent two weeks ago, the average rate for a benchmark 30-year mortgage has since inched down another two (2) basis points to 2.78 percent, which is nearly a full percentage point, or 25 percent, lower than the average rate of 3.69 percent on offer at the same time last year and less than half the average 30-year rate since 1990, according to Freddie Mac’s Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched down another basis point to 2.32 percent (which is 81 basis points below its mark at the same time last year and a new all-time low) while the average rate for a 5-year adjustable has inched up 2 basis points to 2.89 percent (which is 50 basis points below its mark at the same time last year and 33 basis points above its all-time low of 2.56 percent set in May of 2013).

And while refinancing activity ticked up 6 percent over the past week across the nation, and is now running 88 percent higher than at the same time last year, purchase activity slipped 3 percent but is still 25 percent higher than at the same time last year, according to the Mortgage Bankers Association.