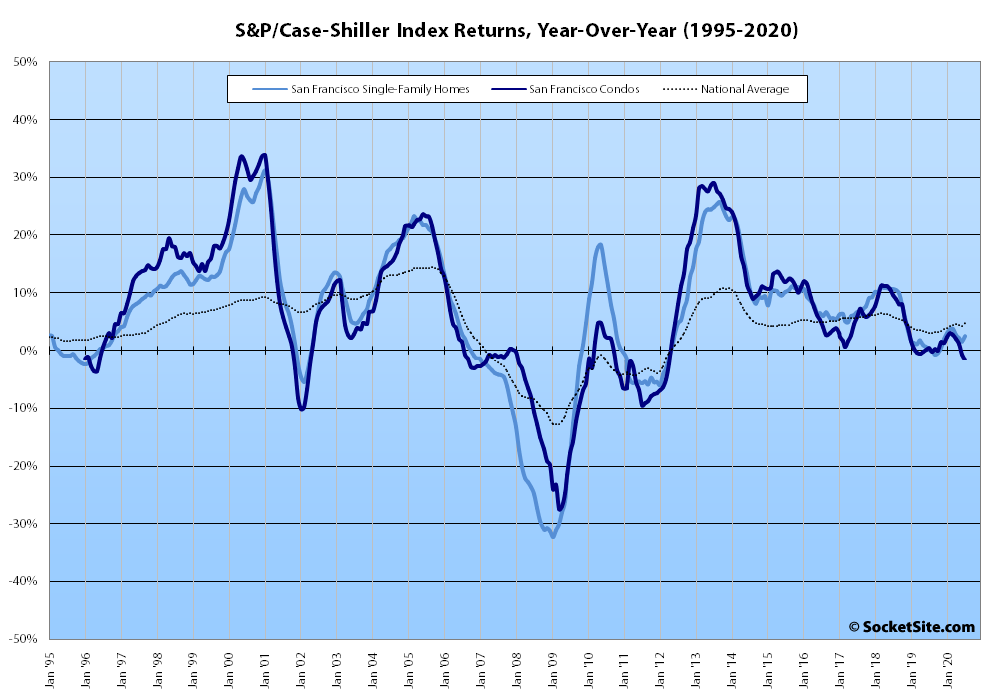

Having slipped in May and June, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – inched up 0.9 percent in July for a year-over-gain of 2.5 percent versus a 4.8 percent gain for the index nationwide.

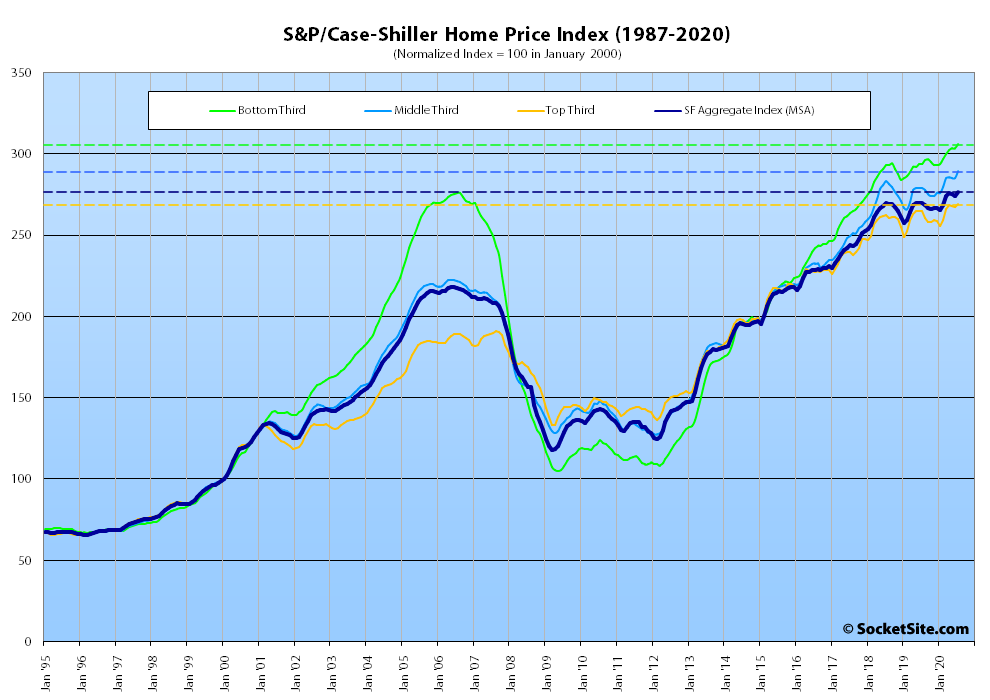

At a more granular level, the index for the least expensive third of the market inched up 0.8 percent in July for a year-over-year gain of 4.1 percent, the index for the middle third of the market ticked up 1.6 percent for a year-over-year gain of 3.9 percent and the index for the top third of the market inched up 0.7 percent for a year-over-year gain of 1.8 percent.

But the index for Bay Area condo values, which remains a leading indicator for the market at a whole, inched down 0.8 percent in July and is now down 1.6 percent on a year-over-year basis having ticked down 1.3 percent in June.

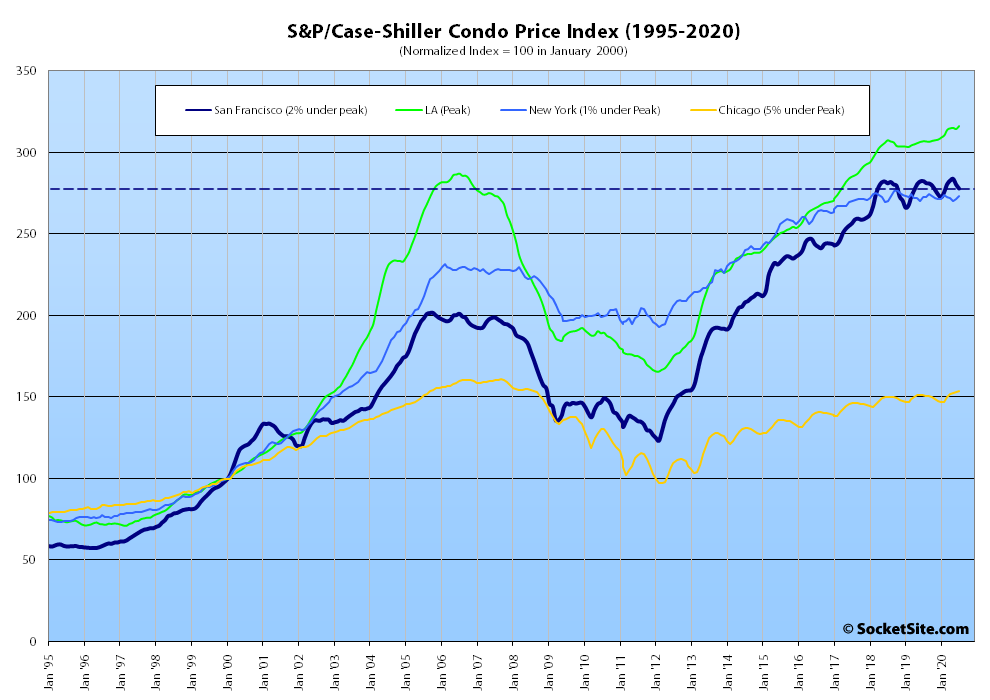

And nationally, Phoenix still leads the way in terms of indexed home price gains (up 9.2 percent on a year-over-year basis), followed by Seattle (up 7.0 percent) and now Charlotte (up 6.0 percent), with Chicago (up 0.8 percent) and New York (up 1.3 percent) the only two major metropolitan areas yielding smaller year-over-year gains than the San Francisco market.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus

On Phoenix – I have a friend who invests heavily in that area (where he is born and raised), bought 88 units in a so called “war zone” area. A couple of deaths on site each year. Yet, he saw the property value went from $2.8M to like $4.4M in a matter of a few years, WHILE taking in $700K a year in gross rent. He used to tease me about investing in SF….

Only ~$300K per death – that pencils out!

Well, from another perspective, low income people need housing too…. If You are not putting in money and work to provide housing to these people, no need to blame someone else who does…

Different ways to make money. Some like to buy a few expensive SFH or condo and maybe cash flow or not but wait for appreciation. Some likes the cash flow now and aim to get more and more “doors.”

For small time real estate investors investing in SF has been problematic – for a long time. My real estate investments are in the Midwest and the Northwest and the ROI has been much higher than is possible in SF. And now more robust appreciation is kicking in. The take away for investors is that both NYC and SF have problematic futures as good places to purchase real estate. Most stories analyzing the pandemic and the growing WFH phenomena have focused on NYC and SF as likely to be the hardest hit cities as things move foreword. The robust appreciation of the mid-teens was the one thing that got some investors to purchase a property here despite having a negative cash flow – because in 3 or 4 years the property would be worth 25% more. Those days are over for the indefinite future.

Yeah, that door closed long ago. A new SF landlord has to compete for tenants against owners that are paying 1980s property taxes.

The increasing amount of rent control rules and other regulations make it too hard to be a small time landlord. Have to scale up or quit the business.

I honestly and respectfully disagree with you here. In my experience, investing in SF is NOT harder due to the SF rental rules – as long as you don’t go out and pay a lowly priced building with low paying tenants, and later get upset that you can’t get rid of the tenants…

Since 2009, I have purchased 4 properties in SF, 3 condo and 1 TIC (which has since condo converted). With the condos, tenant turn over every 1.5 years. Between touching up, vacancy, renting commission, has not been easy. The TIC unit, on the other hand, tenant stayed 9 years, and rent was maybe $400 below market by the time the tenant left. I honestly wish he were still there…

So for me, investing in RE is never easy, capital intensive, but SF rent rules do not make it any harder. If you don’t want low paying tenants, then only buy vacant properties.

I have tried investing out of state, as well as in South Bay (where I live), seemed harder than SF. Out of state is definitely harder than SF.

What I said are generalizations for sure but you did scale up yourself. 4 properties in ~ 10 years might be slow in other parts of the country but in one of the most expensive areas that is scaling up (to me). I’m sure your knowledge of SF and California landlord and tenant laws and rent control regulations went way up too.

I guess what I meant as Harder you that need to know more since there are more rules. Harder as in if you just have 1 unit , you might not have the reserves or the cash flow to handle a protracted issue. One bad tenant relationship for whatever can cause issue for 3 months ,6 months, a year time.

I don’t operate in SF, Peninsula, or SB so Maybe it’s just me having a hard time keeping up with Oakland, Alameda, Hayward rent control and notices I need to give so I try to “scale up” with more units to force myself to keep up. Since it’s more at stake.

Personally I have had zero issues myself. But would I recommend a family member or friend to be a landlord in SF or Oakland or Berkeley, the answer is no. That’s just me though.

I left SF to invest elsewhere in 2015. There’s no way I could have done as well had I stayed. The first difference was cash flow. And the second was much greater appreciation. And the third was less oppressive regulations.

Follow the people (who follow the jobs) is a simple formula for success.

I exchanged my Cali rentals for out of state properties in 2014/2015. Best thing I ever did. One more thing – in many places the landlord/tenant relationship is not as toxic as it is in SF.

That I have to agree.

Not to mention other states, just 35 minutes out of SF in South Bay where I live, the landlord/tenant relationship is a much friendlier one.

The toxic one in SF is definitely the result of rent control laws.

Yes. SF is especially bad. For me going out of state was the best option in order to get a very robust ROI. My Midwest properties provide that with just average appreciation – though, LOL, my Midwest properties are now out-appreciating SF. The NW properties provide a nice ROI, less than the Midwest, but the potential for significant appreciation which has occurred there in the last few years.

We have July’s data and the sky is still not falling. Softness, yes, but massive drops that everyone is expecting, no. I’ll continue to be on the side of expecting no more than a 10% drop total, even with COVID, remote work, homelessness, and perceived awful CA policies.

This is an index for the entire Bay Area metro, not just the city of San Francisco. Anecdotally from people trying to buy in Marin or greener areas of the peninsula they are seeing lots of demand/competition there. I think if you dug in deeper you’d see that the regional results combine a decline in SF with rises in greener areas.

The last SF Apple posted here was down 10.2% from 2016 pricing and the list goes on from there. So there seems to be some denial involved in expecting a max drop of 10% where we are already past that.

It would be nice to see the numbers broken down by county. I agree that, whatever drops occur, SF will see bigger declines than the rest of the Bay Area. Two things happening – people leaving the Bay Area for greener pastures in the NW and other areas and people leaving SF for greener pastures in the North Bay, East Bay and Peninsula. SF is, in that sense, facing a dual exodus which will likely show up in a significant population drop and in a more pronounced price decline.

What is your estimate of “significant population drop and in a more pronounced price decline?”

I think Some cooling off of rent and population is beneficial for those residents choosing to stay and those leaving. I’m speaking for SF and Bay Area.

I expect the Bay Area to experience a small population decline (several percent) over the next few years. The growth was already pretty much flat – boosted because of non-domestic in-migration. SF will see a bigger decline IMO. 10% – 15%. In part because many SF residents will opt for the East and North Bay and Peninsula. A combination of WFH/telecommute options and the desire for more space will spur this movement out of SF.

Prices will drop more (whatever that amount ends up being) in SF than in much of the rest of the Bay Area. The BA is already lagging the national appreciation rate. Investors will be better off owning properties outside of SF proper. So much of SF’s appreciation was due to the expanding tech job base in the City. Even though only about 14% of the workforce, high paying tech workers sent prices sky high. Already there is a contraction of that job base and all it needs to do is drop to 7% or 8% and the impact on SF home prices/rents will be huge.

Inconceivable (or at the very least, unprecedented!)