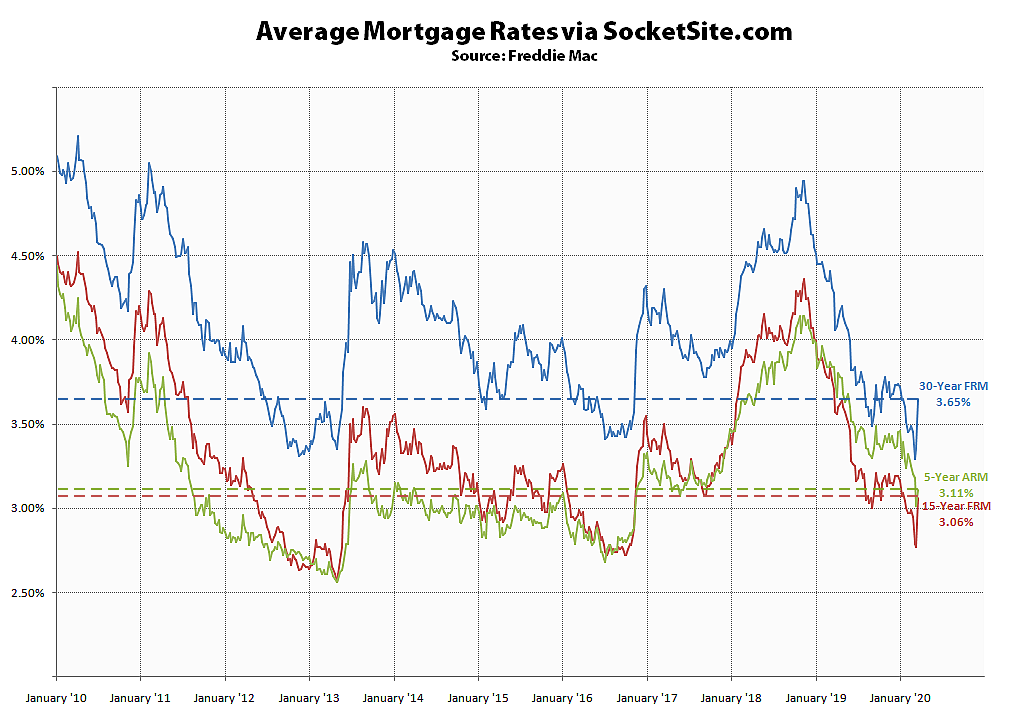

Having inched up from an all-time low of 3.29 percent to 3.36 percent last week, the average rate for a benchmark 30-year mortgage has since jumped another 29 basis points (0.29 percentage points) to 3.65 percent but remains 63 basis points below its mark at the same time last year, and well below its long-term average of over 6 percent, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has jumped a total of 31 basis points over the past two weeks to 3.06 percent but remains 65 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable ticked up 10 basis points over the past week to 3.11 percent, which is 73 basis points below its mark at the same time last year and within 5 basis points of the “inverted” 15-year rate.

While a portion of the spike over the past two weeks can be attributed to a wave of refinancing applications driving retail rates up, and an increase in the 10-year Treasury yield following the Fed’s emergency action on Sunday, there’s also an implied re-pricing of the risk premium for mortgages to consider.

I don’t understand how the banks could raise mortgage rates when the Fed just lowered rates to 0%!