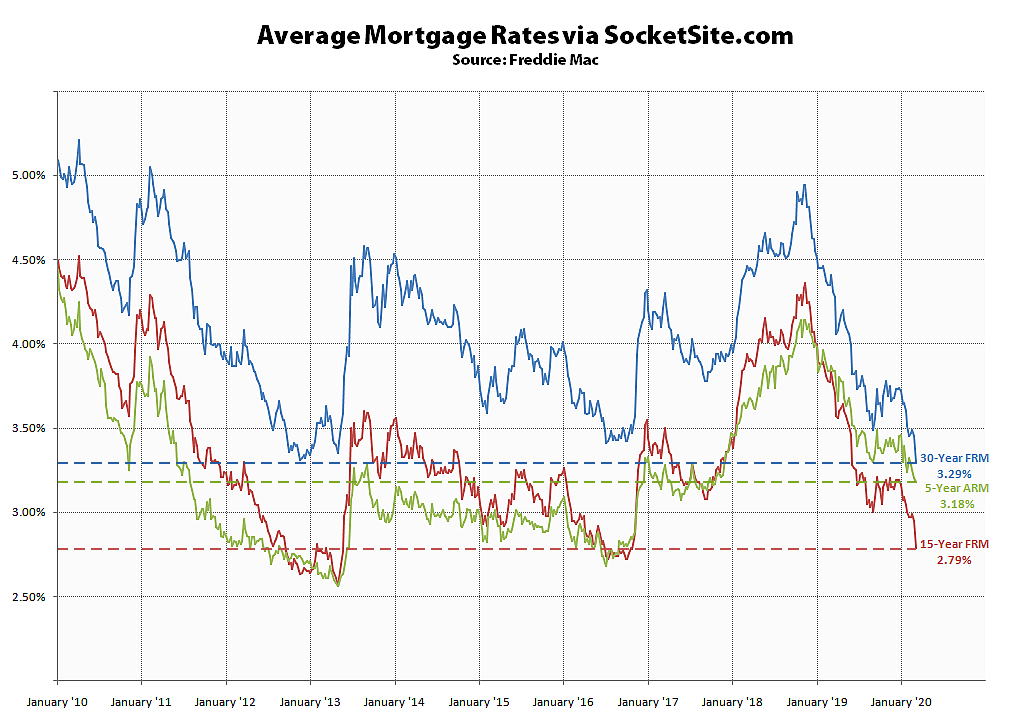

The average rate for a benchmark 30-year mortgage dropped 16 basis points over the past week to a new all-time low of 3.29 percent, according to Freddie Mac’s latest Mortgage Market Survey data and which shouldn’t have caught any plugged-in readers by surprise.

At the same time, the average rate for a 15-year fixed mortgage dropped 16 basis points as well to 2.79 percent, which isn’t a record low but is 104 basis points (1.04 percentage points) below its mark at the same time last year, while the average rate for a 5-year adjustable shed 2 basis points to 3.18 percent, which is 69 basis points below its mark at the same time last year, for an inverted spread between the 15-year fixed and 5-year adjustable rates of 39 basis points.

And with the Fed having already implemented an emergency rate cut of 50 basis points earlier this week, the probability of another rate cut this year is now running at 100 percent, according to an analysis of the futures market.

So refi now or wait another month?

Jerome Powell and his fellow governors were clearly (in hindsight) two early with that rate cut. Should have waited until the regular meeting and then should have only cut by 25 bps.

How are my stock buybacks supposed to wait until the next meeting, and with only a .25 cut?

Are you mad?

The Fed’s goal is to manage inflation expectations which are far below the targeted 2%. It’ll hit 0% soon and will need to undertake other monetary operations, especially without support from fiscal policy.