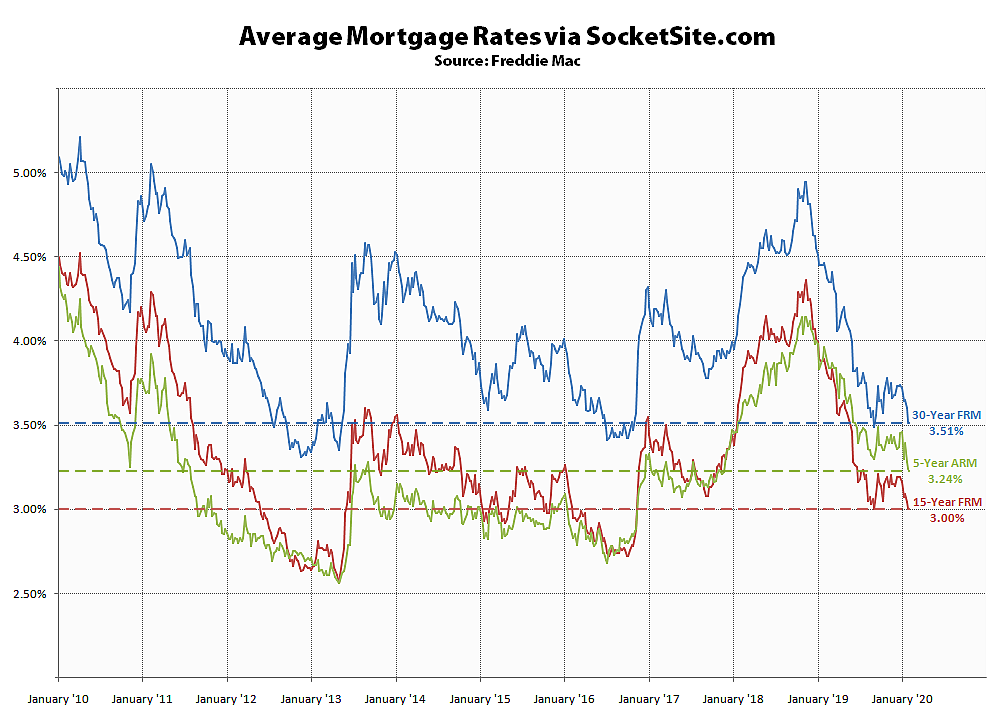

The average rate for a 30-year mortgage dropped another 9 basis points over the past week to 3.51 percent, which is 95 basis points (0.95 percentage points) below its mark at the same time last year, the lowest average rate in five months, and within 11 basis points of a three/six-year low, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has inched down another 4 basis points to 3.00 percent, which is 89 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable inched down 4 basis points to 3.24 percent, which is 72 basis points below its mark at the same time last year, for an inverted spread of 24 basis points between the 15-year fixed and 5-year adjustable rates.

And while the Fed had signaled its intention to leave the federal funds rate unchanged over the next year, and then to start raising the rate in 2021, the probability of another rate cut by the end of 2020 has jumped to 86 percent, with a zero (0) percent chance of a hike, according to an analysis of the futures market.