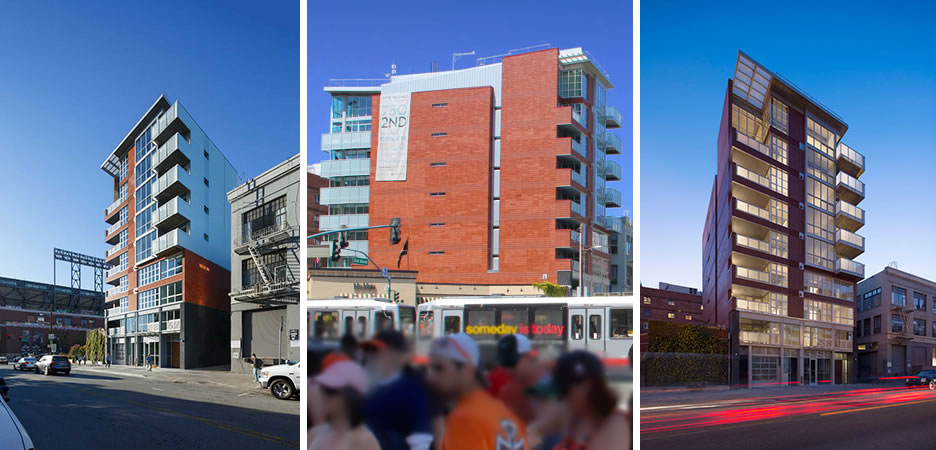

Purchased for $2.299 million in the first quarter of 2013, the “sophisticated” South Beach condo #502 at 750 Second Street, a boutique, LEED Gold Certified 14-unit building “in the immediate vicinity of our city’s sports complexes…and all the fabulous bars, restaurants, and cafes for which the area is so well known,” returned to the market three months ago priced at $2.5 million, a sale at which would have represented total appreciation of just under 9 percent over the past seven years.

The three-bedroom unit offers 2,075 square feet of finished space, with a “masterfully conceived floor plan…state-of-the-art chef’s kitchen…floor-to-ceiling windows…inviting walkout verandas” and “alluring views of the city skyline, bay, and yacht harbor,” as well as a deeded space in the building’s garage.

And the resale of 750 Second Street #502 has just closed escrow with a contact price of $2.3 million, representing total appreciation of 0.04 percent since the first quarter of 2013 on an apples-to-apples (versus “median price”) basis with some up and down between.

Wow, beautiful place, *completely* up to date (buyer doesn’t have to do a thing), and direct elevator access! And a rare 3 bedroom, all on a single level!

6 months ago, the realtors (with $2M+ listings) and rehabbers (with $2M+ listings) told us the $2M+ market was ON FIRE while the sub-$2M market was falling, and yet, here we are, back to 2013 on a $2M+ sale, and a $100,000+ loss. All this buyer had to do was wait.

who told you that?

A little bird on Alvarado (which looks great, BTW). Good luck in the new year!

Well it wasn’t me that said what tipster is alluding, I said this 3 months ago:

Posted by sparky-b 3 months ago

“I am not seeing how this portends 2020 carnage. The cost of second hand condos is coming down after years of “trying” to produce as many as possible and producing over 20,000. Wasn’t that the plan? Meanwhile less single family homes are for sale and are selling for very high dollars still. Since more aren’t produced that is as expected too.

Can’t it be good news that condo pricing are coming down without it being doom and gloom. Continuing to produce new condos that get a big dollar figure while second and third hand become better and better deals is the best thing for the city I would think.”

I have never said anything is “on-fire”, and certainly not resale condos. I actually say any apples to apple is a bad metric because it is new vs. used, while there is new vs. new (or remodeled vs. remodeled) to look at.

I never, ever fail to differentiate between condos and SFRs. The subject of decoupling was debated at length.

Prices are dropping because people are leaving. This is why there will be no decoupling.

In related news, eight months later: Stylish Gold Certified Condo Trades Below Its 2013-era Price