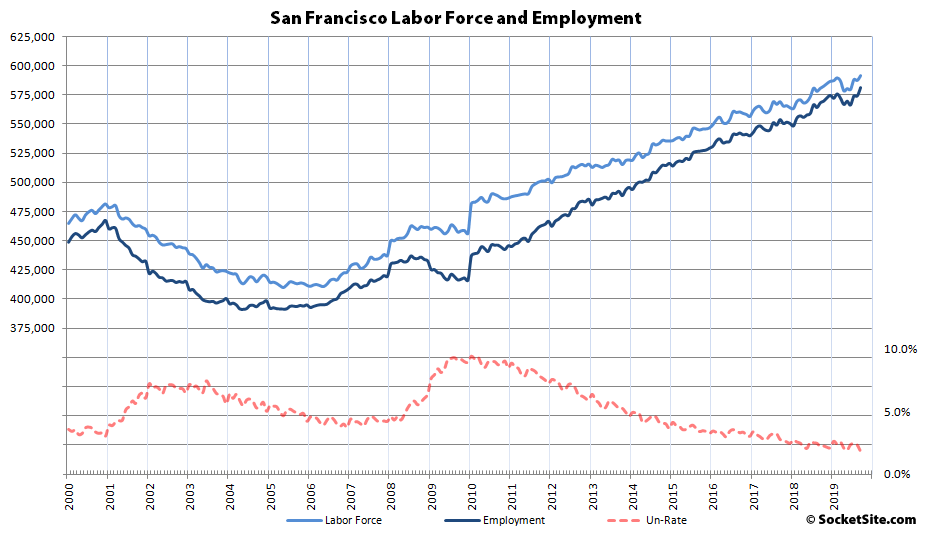

Benefiting from a seasonal bump in the onboarding of new graduates, the number of people living in San Francisco with a paycheck increased by 7,100 in September and now totals a record 580,800. And with a labor force of 591,400, the unemployment rate has dropped to a record low of 1.8 percent.

As such, there are now 13,000 more people living in the city with paychecks than there were are the same time year, versus a year-over-year gain of 14,400 in September of 2018, and 144,100 more employed than in January of 2010.

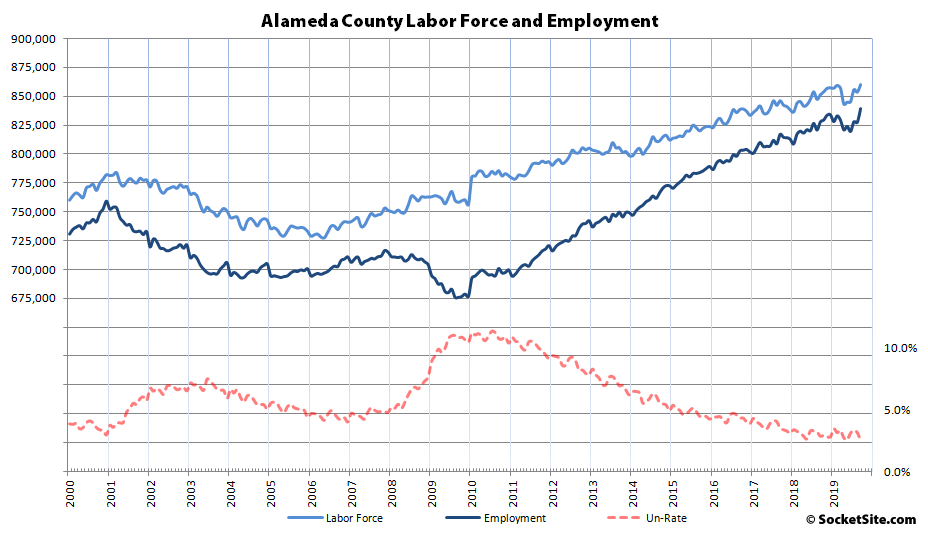

In Alameda County, which includes the City of Oakland, the estimated number of people living in the county with a paycheck increased by 11,800 in September to 838,900, which is 11,500 more employed residents than at the same time last year. And the unemployment rate dropped to a record low of 2.5 percent.

Across the greater East Bay, including Solano County, total employment increased by 22,600 in September to 1,598,100, which is 17,800 higher than at the same time last year, and the unemployment rate has dropped to a record low of 2.6 percent.

Up in Marin, the number of employed residents increased by 1,800 to 140,400, which is 1,600 more employed than at the same time last year, with a record low unemployment rate of 1.9 percent.

And down in the valley, employment in San Mateo County increased by 5,600 in September to 459,300, which is 9,900 more than at the same time last year, with a record low unemployment rate of 1.7 percent, and employment in Santa Clara County increased by 11,500 to 1,049,100, which is 21,900 more employed than at the same time last year with a record low unemployment rate of 2.1 percent.

As such, total employment across the Bay Area now equals a record 4,162,700 with a record low unemployment rate of 2.2 percent and a year-over-year gain in employment of 65,500 (which is right in line with an average year-over-year gain of 65,600 over the past year).

Interesting. One would imagine that given the record employment and # of people in San Francisco, you wouldn’t be seeing the drop in real estate sales?

Investment/Foreign/Absentee buying played a big part in the market when it was hot. Thats taken a big hit. And the IPO busts have put a chill on techies stretching into higher end homes. Not sure that salerymen/women buying on paychecks alone was ever a big driver of prices.

Using the number of people who have jobs as an indicator of the direction of real estate sales would be misleading at best, because the income distribution of local wage earners is skewed towards the low end away from the pricing of the available housing. From C.A.R.’s 2nd Quarter housing affordability report:

Emphasis mine. And of course, many of the households (non-investor/resident/local) who have the requisite income levels still can’t purchase because they don’t have the cash sitting around as seasoned funds to make that 20% down payment.

What matters is if affordability is increasing or decreasing. The number of folks living in the city earning a paycheck doesn’t shed any light on that.