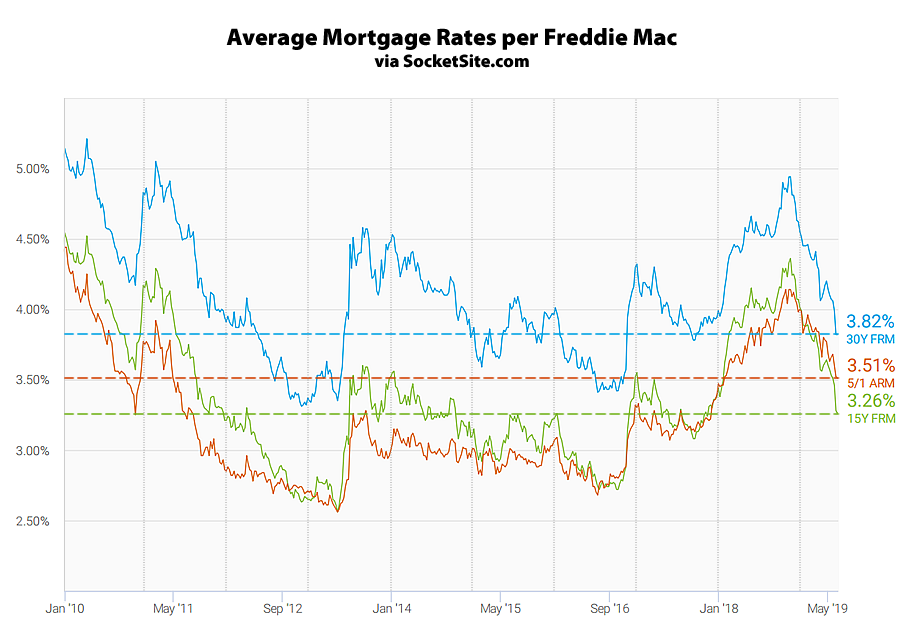

While the average rate for a 30-year mortgage was unchanged over the past week, holding near a two-year low of 3.82 percent, Freddie Mac’s latest Mortgage Market Survey was conducted prior to yesterday’s meeting of the Federal Reserve, after which the yield on the 10-year Treasury, which drives mortgage rates, dropped under 2 percent for the first time since the fourth quarter of 2016 and is down over one full percentage point since the fourth quarter of last year.

At the same time, the average rate for a 15-year fixed mortgage has inched down to 3.26 percent (which is 81 basis points below its mark at the same time last year) while the average rate for a 5-year adjustable has slipped to 3.51 percent (which is 32 basis point below its mark at the same time last year) and the inverted spread between the 5 and 15 year rates has increased to 25 bps.

And while the Fed elected not to adopt an easing of rates yesterday, it set the stage for a future easing (or two) and the probability of the Fed acting by the end of this year has jumped to 100 percent according to an analysis of the futures market (and which shouldn’t catch any plugged-in readers by surprise).

I have a feeling low interest rates in perpetuity is the new norm. We will never see 6 or 8% rates again. Low unemployment, good economy but they yet slash rates. And stocks will rejoice on this shot in the arm. What happens when things actually go south? What will the fed do then?

Never say never again. How many people in the late 70s thought rates would ever fall to 5% or below ever again? But I agree that it isn’t happening for the next few years.

What they did last time: quantitative easing.

the fed didn’t even finish getting out of 10-year old QE yet (officially on ‘pause’ starting in september). Basically if things do go south, and the fed hits zero rate again, they would have to start QE from a lofty 3tn balance, so it may be less impactful than before.

The Fed can create an infinite amount of $s, and achieve whatever inflationary outcome they desire through QE, so long as the USD remains the dominant world currency .

Yeah, it’s not clear to me what folks are thinking when they say that the Fed has a $3T balance sheet now, so future invocations of quantitative easing won’t have as much of an impact. What The Fed has on it’s balance sheet when it starts unconventional monetary policy doesn’t make much of a difference, the FOMC can create more assets out of thin air without regard for what their existing liabilities are.

Question – if my interest rate was 4% on 30 year fixed home loan, how low would the rate have to drop to be worthwhile to refinance. I read 1-2% lower is good. But I doubt interest would ever get that low?

.2% is definitely worth it! i was at 4.1, and just got locked in a 30 yrs 3.6 and my monthly went down by $600. its really easy to do these days with quicken, lendingtree, etc.

so long as you can cover any closing costs with the savings from reduced payments (adjusted with additional payments to cover any mortgage term extension (e.g. if you have 28 years left on a 30 year mortgage, getting another 30 year mortgage will of course lower payments even at the same rate because you are spreading your remaining balance over 2 extra years, so calculate additional payment required to make new mortgage paid off in 28 years, then pro-rate closing costs on top of that, then compare with existing payment).

This is one of the under-sold point of home ownership (IMHO, FWIW, YMMV, YOLO etc.).

People who bought with 30 year mortgages as recently as December of 2018 have picked up 110 basis points on a 30 year loan. The difference in monthly payment on a 30 year fixed at 4.92% vs. 3.82% is $5,319 vs $4,670, a savings of $650 per month. The whole mortgage industry gets a mostly deserved bad rap, but the fact that you can lock in this kind of a rate for 30 years, but also have the more-or-less ‘free option’ to refinance if rates drop is a benefit that is almost unheard of for other borrowers (major corporates, sovereigns etc.)

Robert – do the work! Call your mortgage guy or go to a Wells Fargo/BofA and work up a quote. For me the bogey is usually a 0.375% difference, but whatever your case may be. There’s no reason you should be waiting for rates to drop to 1-2%. Go get the free money (but don’t let some sleazy sales guy tack on a bunch of fees). Ask for an estimated closing statement before you commit to anything or pay anything. If you don’t understand why you are being charged for something, don’t assume you have to accept it. Be an a-hole in defense of your own interests.

“so long as you can cover any closing costs with the savings from reduced payments “(adjusted with additional payments to cover any mortgage term extension (e.g. if you have 28 years left on a 30 year mortgage, getting another 30 year mortgage will of course lower payments even at the same rate because you are spreading your remaining balance over 2 extra years,”

That’s the hook. Very little principle is paid down in the early years of a mortgage. Serial re-fi’s sound great, but many people end up rolling up a pile of fees and re-setting the amortization schedule over and over so they never build up much equity.

If you’ve got a property and you purchased it five or more years ago, you’ve probably got a decent amount of equity. If you’ve had enough time to serially re-fi, you’ve probably owned it a little while …

Robert at this point is not about refinancing and going back to a 30-year loan no matter what rate you get restating back at 30 years is a very toxic area to be. What you need to do get estimates on a 10 year, 15 yr or even a 20 year to start cutting the compounding interest you’re giving the bank. Stop giving your money away for free.

disagree. if you get a loan for a very low rate, i would definitely make it a 30yr. you can invest the month savings into the stock market and average double the mortgage interst rate. for example borrow for 3.5% and invest for 7%. if you are re-investing the monthly savings, a lower rate for longer is a much better investment