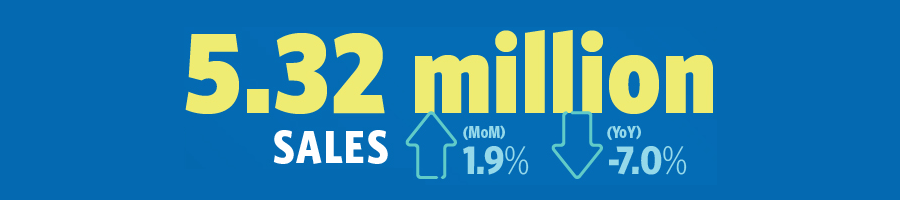

While the seasonally adjusted pace of existing-home sales across the U.S. ticked up 1.9 percent in November to an annual rate of 5.32 million sales, the pace is now running 7.0 percent lower versus the same time last year, down from 5.1 percent lower on a year-over-year basis in October and 4.1 percent lower in September.

At the same time, while the inventory of existing homes on the market declined 5.9 percent in November to 1.74 million homes with typical seasonality in play, inventory levels are now running 4.2 percent higher versus the same time last year (versus 69 percent higher in San Francisco).

And with the pace of existing-home sales out West having dropped 6.3 percent from October to November, to an annual rate of 1.04 million sales, the current pace is now 15.4 percent lower versus the same time last year with a median sale price of $380,600 (which is down 0.6 percent from October but remains 1.8 percent higher, year-over-year). To quote the National Association of Realtors chief economist, Lawrence Yun: “A marked shift is occurring in [the] West region, with much lower sales and very soft price growth.”

It’d be interesting to see a graph of SocketSite web site-visits, and (separately) the frequency and length of reader comments, vs. larger market trends over the past several years. Are there correlations?

Here’s a juicy tidbit for you. National housing inventory (quarterly average of monthlys) has spiked in the past several months to just under 7.5 months. A spike above 7 has predicted five of the six past recessions, going back to the mid 70s. The exception was 2001, perhaps because that bubble was so concentrated.

Not quite. The unsold inventory of existing/listed homes represents a 3.9-month supply at the current pace, “down from 4.3 last month and up from 3.5 months a year ago.”

But as we first reported last month, “the number of new single-family homes for sale across the county increased 4.3 percent to 336,000, which is 17.5 percent higher on a year-over-year basis, three months away from a 10-year high and represents 7.4 months of available inventory (which is the most since 2011)…”

Here is the chart in all its glory, from the Deputy Chief Economist at Freddie Mac.