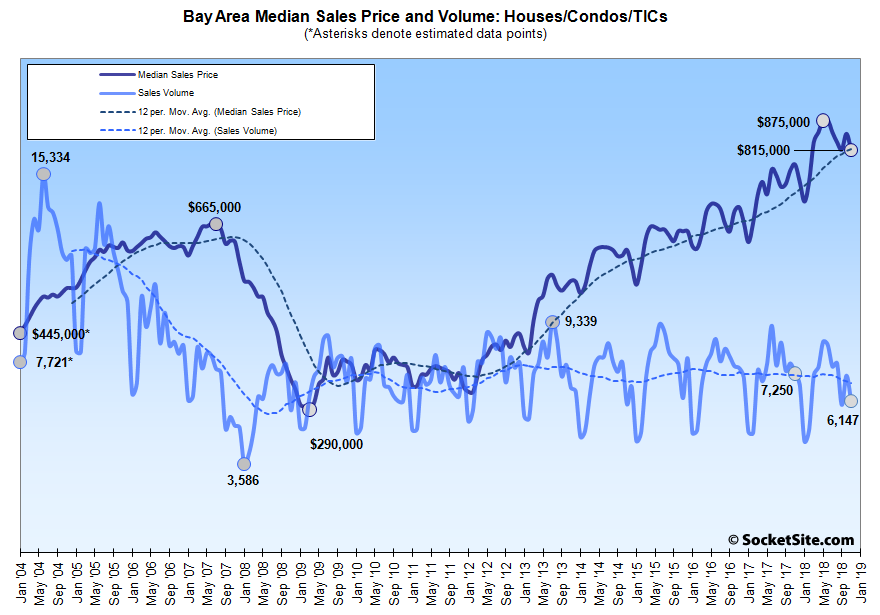

Having rebounded to a 7-year seasonal low in September, the number of single-family homes and condos that traded hands across the greater Bay Area totaled 6,147 in November, down 14.1 percent on a month-over-month basis (versus a typical seasonal drop of around 10 percent) and 15.2 percent lower versus the same time last year, according to recorded sales data from CoreLogic.

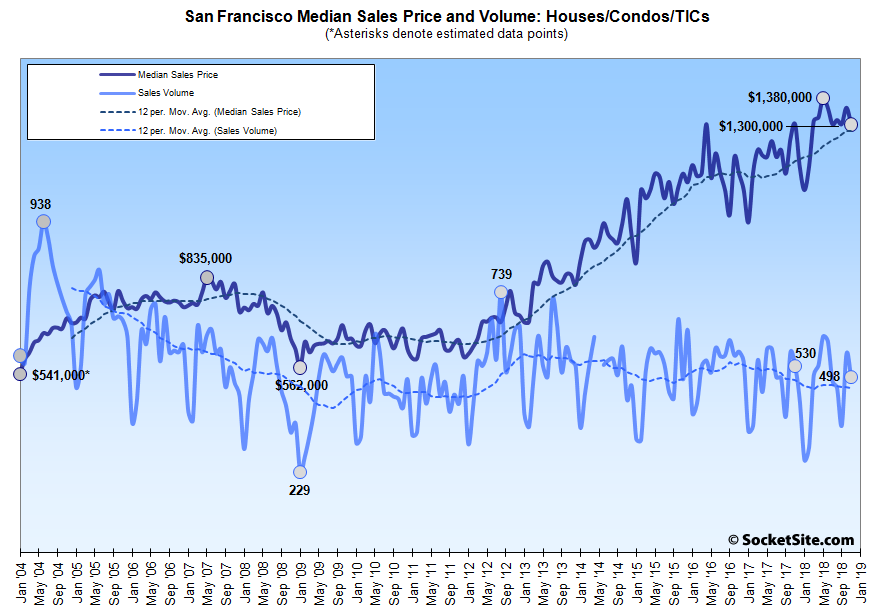

In San Francisco, recorded sales totaled 498 last month, representing a drop of 11.5 percent from September and 6.0 percent lower versus the same time last year while inventory levels are running at a 7-year high and pending sales volume is dropping.

Across the bay, homes sales totaled 1,271 in Alameda County, down 18.1 percent on a year-over-year basis, sales in Contra Costa County totaled 1,194, down 15.1 percent, and sales in Solano County totaled 509, down 7.7 percent versus the same time last year.

Home sales in Santa Clara County totaled 1,364 in November, down 11.9 percent on a year-over-year basis, while sales in San Mateo totaled 491, down 20.8 percent versus the same time last year.

And up north, home sales in Napa totaled 114 last month, down 5.8 percent versus the same time last year, sales in Sonoma totaled 484, down 19.1 percent, and sales in Marin totaled 219, down 32.0 percent on a year-over-year basis.

The median price paid for those aforementioned 498 homes in San Francisco was $1,300,000 in November, down 3.7 percent from the month before, 5.8 percent below the record $1,380,000 set in May and unchanged (0.0 percent) versus the same time last year.

The median sale price in Alameda County dropped 1.2 percent to $815,000 last month but remains 3.8 percent higher on a year-over-year basis; the median sale price in Contra Costa County dropped 1.6 percent to $600,000 but remains 6.5 percent higher versus the same time last year; and the median sale price in Solano County increased 4.7 percent to $445,000, which is 9.9 percent higher on a year-over-year basis.

The median sale price in Santa Clara County dropped 5.0 percent last month to $1,050,000 but remains 6.6 percent above its mark at the same time last year, while the median sale price in San Mateo County shed 3.0 percent to $1,289,000 but remains 1.1 percent higher, year-over-year.

The median sale price up in Marin dropped 10.1 percent to $1,033,750 last month but remains 8.6 percent above its mark at the same time last year. The median in Napa inched up 0.1 percent to $605,500 but dropped 6.8 percent on a year-over-year basis and the median sale price in Sonoma dropped 1.5 percent to $581,000, which is 5.3 percent lower versus the same time last year.

And as such, the median home sale price across the greater Bay Area dropped 3.8 percent in November to $815,000, which is 3.8 percent above its mark at the same time last year but 6.9 percent below its peak of $875,000 which was set this past May as well.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

San Francisco median YoY : Unchanged

Alamedia County median YoY: 6.5% higher

Solano County median YoY: 9.9% higher

Marin County median YoY: 8.6% higher

Napa County median YoY: 6.8% higher

Sonoma County median YoY: 5.3% lower <-

greater bay area median YoY: 3.8% higher

I'm just going to agree that we disagree on the headline, as month-over-month changes are very seasonal, but YoY tells the trend. I don't want to see the prices go up — but as a reader, the headlines here don't match the content. Regardless, median is not necessarily a great measure which is why it's reported on

” as month-over-month changes are very seasonal, but YoY tells the trend.”

Look at last year. Huge difference -7.5% Delta. And that is monthly.

SF Nov MoM 2018: -3.7%

2017: +3.8%

Bay Area Nov MoM 2018: -3.8%

2017: +1.5%

https://socketsite.com/archives/2017/12/median-bay-area-home-sale-price-hits-an-all-time-high-sales-slip.html

Case Shiller showed an 8% gain over the past year, second highest in the country. This shows flat over the past year. But there has supposedly been a big decline somewhere in there? About straight three years of being wrong on that. But eventually there will be a decline, and I’m sure socketsite will say “see, told you so.”

People here have been predicting an imminent drop in prices since 2013 at least.

Trump’s recession is going to make their dreams come true. The future looks dark.

The future looks dark? Is that a joke?

The US economy will print a very solid 2.5% – 3.0% growth in 2019. US markets are oversold right now (can get lower but are at the cheapest forward PEs since 2013). I suspect there will be a meaningful bounce either before or after Q1 earnings. The future looks darker for China whose manufacturing is now in contraction mode and has meaningfully slowing GDP. But China’s leadership is very smart and I suspect will find a way to stimulate growth. At some point in the next couple months Brexit will be resolved and so (hopefully) will China/US trade tensions, especially since China is far more willing to make a deal to rescue their economy….and at that point global growth becomes more synchronized.

I hope you’re right. But tariffs and an exploding deficit aren’t encouraging.

If YoY tells the trend, compare ‘graph eight above with this from The Mercury News on Friday:

Emphasis mine. Personally, I am predicting a slower rate of increase, not a drop in prices or a more general recession in 2019.

Has anyone here been looking at homes to buy in the past 9 months? I have and I’ve noticed softness in the sub-$1 million price range in southern Marin and Real San Francisco.

Trying to draw conclusions based on economic data is one thing but several agents told me at open houses that the market was soft.

Anecdotally, many of the homes that haven’t sold in my area simply went off market, leading to a lack of inventory yet again. My bet is most sellers are waiting for market conditions to improve in the spring before re-listing.

Market conditions are projected to further deteriorate in 2019.

Things in Bernal seem steady, at least at the high end. Some sub 1.5 homes are taking longer to sell than before, but 1000/sq ft sale prices are still the norm. However, my gut agrees with other comments that we are due for a pause in rapid value increases. Seems like if things were gangbusters then we’d be seeing 1100 or 1200 per sq ft values popping regularly in South Bernal, but that isn’t really happening.

My personal RealSF map has only 1 house for sale under $1m. This one, and it’s 1100 a foot. where are you seeing the softness of that market

I am looking at condos in 1920s buildings in Marina, Cow Hollow, Russian Hill, North Beach. Sausalito and Tiburon (newer buildings) too. Several months ago when there was more product on the market it was moving slowly and I saw some price cuts, as have been documented by the publisher of this site.

Rapidly increasing prices on slowly declining volume was never sustainable. A correction is overdue.

The implementation of the Feds Fincen – Financial Crimes Enforcement Network fraud rules on real estate transactions in 2019 – plus the changes in the tax laws on capping deductions – leads me to believe it’s going to affect the over $1 million price range more than the bottom end…

With demand softening, the question is how will sellers react. If sellers refuse to offer concessions, we will continue to see softening in volume as the market will converge to those that really need to buy or sell.

This isn’t an overdue correction. Trump is bringing about a recession with his policies, and he’s doubling down, so it will get worse.

you cannot imagine the power of lessening regulations and bureaucracy. It’s like taking Obama’s 127 pounds off my back. Yes, you guys control California and your pensions and regs will grow, but that’s not new information. Prop 13 remains a huge protection. I pay about 1.17% here – in Hartford CT it’s 7.43%. If Prop 13 goes, you will be gleeful at the collapse in prices, and will buy a house, but then you’d find out you’re still a renter, effectively just renting from the state.

Obama’s 127 pounds [?] of regulation resulted in a booming stock market. Trump’s fiscal policies are resulting in a recession. I know which I prefer if one wants to make money.

Most of the regulations on Real Estate are state/local, not federal. Fincen and the SALT tax being notable – and probably good – exceptions.

Have you tried to get a new residential building through our local permit process? It’s a mess. They are the main player driving prices and volume in the Bay Area. Not Washington DC.