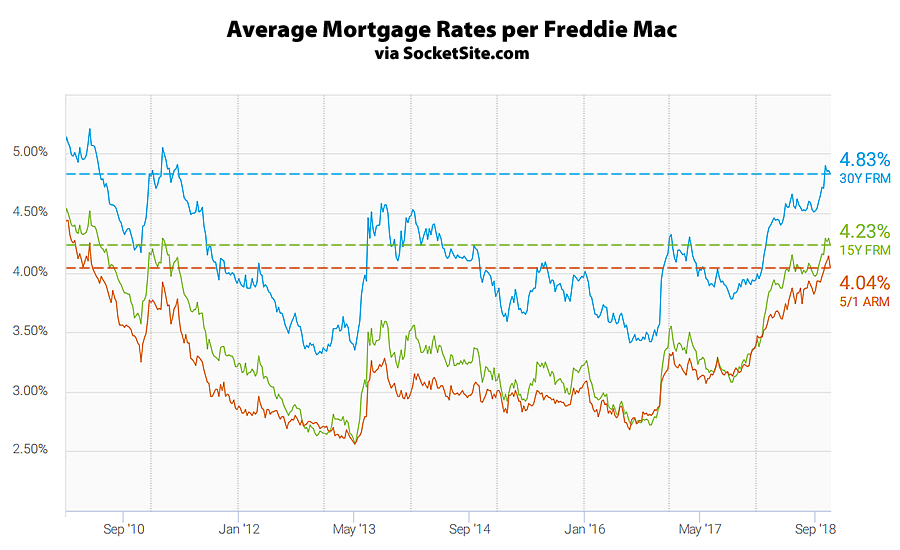

Having jumped to 4.9 percent in early October, which was the highest average rate since early 2011, the average rate for a benchmark 30-year mortgage has slipped 7 basis points over the past three weeks to 4.83 percent, which is still 89 basis points above its mark at the same time last year and within 22 basis points of an eight-year high, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has slipped 6 basis points to 4.23 percent but remains 96 basis points above its mark at the same time last year, and the average rate for a 5-year adjustable has slipped 3 basis points from its eight-year high to 4.04 percent but remains 81 basis points above its mark at the same time last year.

And according to an analysis of the futures market, the probability of the Fed instituting another rate hike by the end of this year is currently running around 71 percent, down 12 percentage points over the past month.