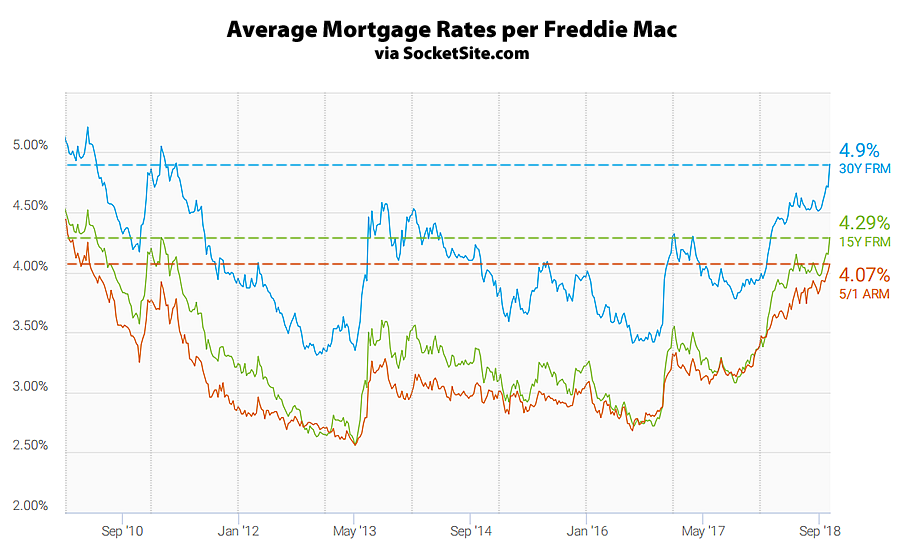

The average rate for a benchmark 30-year mortgage jumped 18 basis points over the past two weeks to 4.90 percent, which is now 99 basis points above its mark at the same time last year, the highest average rate since April of 2011 and within 15 basis points on an eight-year high, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage jumped 13 basis points to 4.29 percent, which is 108 basis points (1.08 percentage points) above its mark at the same time last year, which equals its eight-year high, and the average rate for a 5-year adjustable jumped up 10 basis points as well to 4.07 percent which is 91 basis points above its mark at the same time last year and an eight-year high.

And according to an analysis of the futures market, the probability of the Fed instituting another rate hike by the end of this year is currently running around 83 percent.

Interest rates rising, stocks crashing! Property prices will decline (a little) soon enough.

Wow — glad I was able to re-fi into a 30-year fixed jumbo at 3.5% last winter.

Yet another reason why sales volumes are likely to remain subdued. Not only do sellers have high price expectations left over, there will be fewer homes for sale as owners will be reluctant to give up the good deals they have. An upward rate trend has the same effect on housing mobility as rent control. Incumbents, at the margin, choose not to move.

And yet, the actual inventory of homes for sale in San Francisco has been ticking up since 2015 and recently hit a 7-year high.

Yes but it’s not a significant marker. It’s only a trickle over ’16, which was by all accounts a very robust market. It would need to double and get back to 10-11 type volume in order for there to be steep price discounts.

To put it in your individualized Socketsite vocabulary where actual transactions are “demand.”

Actual “demand” will be low because few houses will be offered at prices that are market-clearing. The continued build of inventory at unrealistic price levels is a reflection of the leftover expectations of sellers who remember being told for most of the past 10 years that San Francisco real estate is constantly ripping higher, and who haven’t internalized the impact of higher rates.

Please note I do not equate transaction volume with “demand,” but our fearless editor does. I would characterize sales transaction dollars as market volume, the intersection of supply and demand.

Any yet despite higher average rates, the number of homes listed for sale in San Francisco over the past quarter was roughly 25 percent higher than at the same time last year (versus the counterfactual “fewer homes for sale as owners will be reluctant to give up the good deals they have,” as you stated above).

And at the same time, despite the increase in supply, sales/demand has actually dropped while price cuts are on the rise.

I understand that you want to emphasize that inventory is increasing but I don’t think it disproves my point. I think it is natural to expect inventory to continue increasing as sales volume slows. If we move from a market where 60 days is the normal time to market to one where 120 or 150 days is, inventory will naturally accrue. My point is that that inventory would actually be much higher if rates were the same or lower than in the recent past.

I think having a homeowner with a low rate loan on his home which could not be replaced at the same price by a new loan, will have a lower incentive to sell than an owner who could ‘recreate’ his financing at current market rates. Perhaps I am wrong – you know more about this stuff than I do.