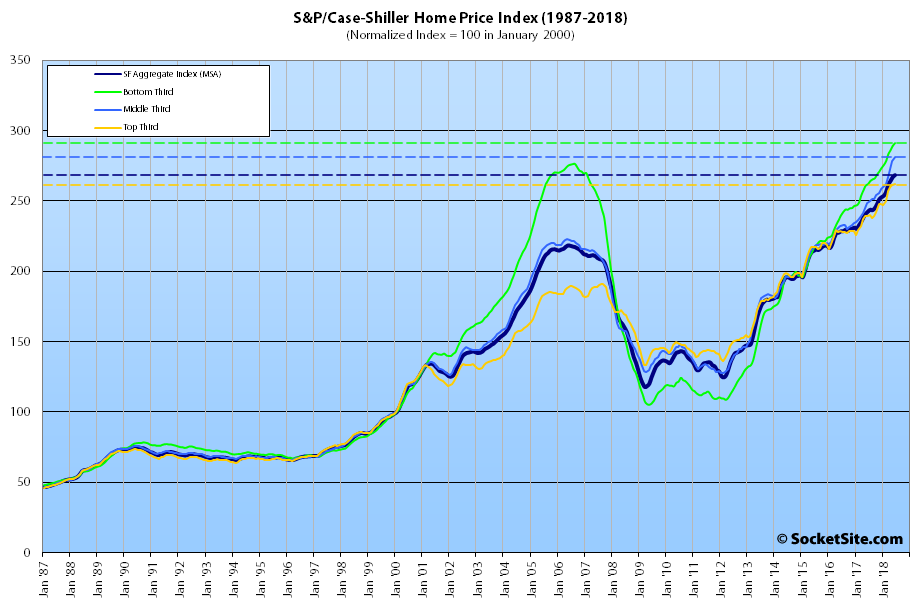

Having ticked up 1.1 percent in May, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – inched up 0.5 percent in June to an all-time high and is running 10.7 percent higher versus the same time last year, but with uneven gains across the market.

While the index for the bottom third of the Bay Area market inched up 0.6 percent and is running 11.1 percent higher versus the same time last year, the index for the middle third of the market ticked up 0.9 percent and is 13.2 percent higher, year-over-year, and the index for the top third of the market inched up a nominal 0.1 percent and is now running 9.3 percent above its mark at the same time last year.

As such, while the index for the top third of the market is 36.9 percent above its previous peak, which was reached in third quarter of 2007, the middle tier is running 26.2 percent above its previous peak set in the second quarter of 2006, and the index for the bottom third of the market, which had dropped over 60 percent from 2006 to 2012, is 5.3 percent above its previous high water mark.

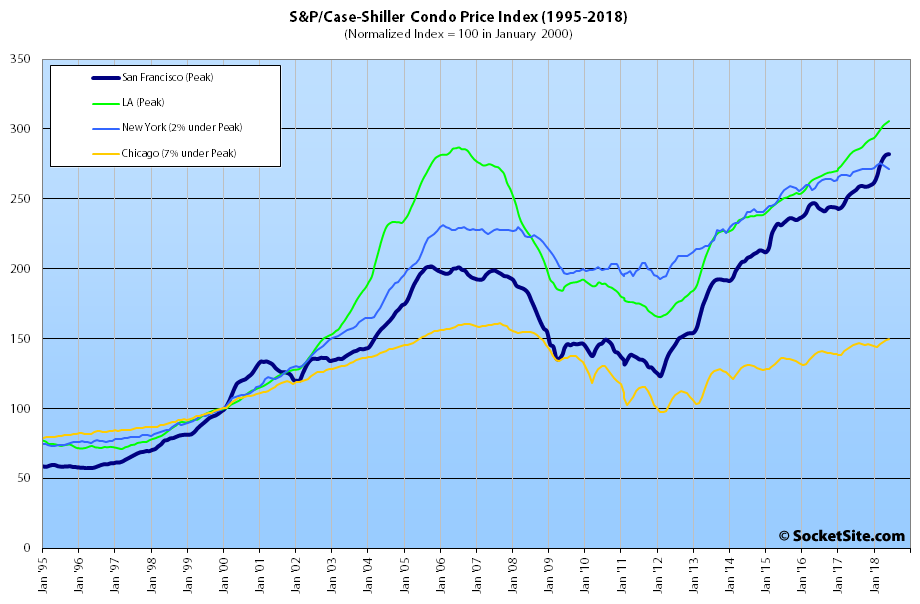

And having inched up a near nominal 0.2 percent in June, the index for Bay Area condo values is running 10.6 percent higher on a year-over-year basis and 39.8 percent above its previous cycle peak in the fourth quarter of 2005.

It’s worth noting that condo values in New York appear to have peaked this past March and have dropped 2 percent since. And Las Vegas is now leading the nation in terms of home price gains, up 13.0 percent year-over-year versus a national average of 6.2 percent.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

I also follow the NY market to an extent and the downturn in prices in prime areas is notable. I’ve not spoken to any local realtor predicting a sustainable increase in pricing and am told anecdotally (but have no verification) that East Bay prices have leveled and/or declining. Financial planners I’ve spoken with caution of a deflating central bank bubble next year, which should put some pressure on the housing market.

That said, there are some people taking huge gambles on the local market, which terrifies me. I’ve said this repeatedly, but there are private individuals and developers putting unprecedented amounts of money into homes. Look one (or more) single family homes pushing 50mm to hit the market.

The condo market in SF seems to be bifurcated with prices down a bit in the SOMA area for non-luxury condos. The RH unit featured today at SS is one such example. Older condos in outlying areas are mixed. Some selling for gains over recent prices while others are selling a bit off of their previous recent sale. The luxury price condo market seems to be garnering gamble offers and hopes. The top floor penthouse at 181 Fremont is expected to go for 40 million, Another units recently sold there for 10 million plus. Of course if one can afford a 40 million condo maybe it is not really gambling.

There has been a bifurcation in the market. But other than being loosely correlated, the dividing lines aren’t between neighborhoods, or new versus old, but rather price points, with the lower half of the market outperforming the top and lifting/muddling market metrics overall.