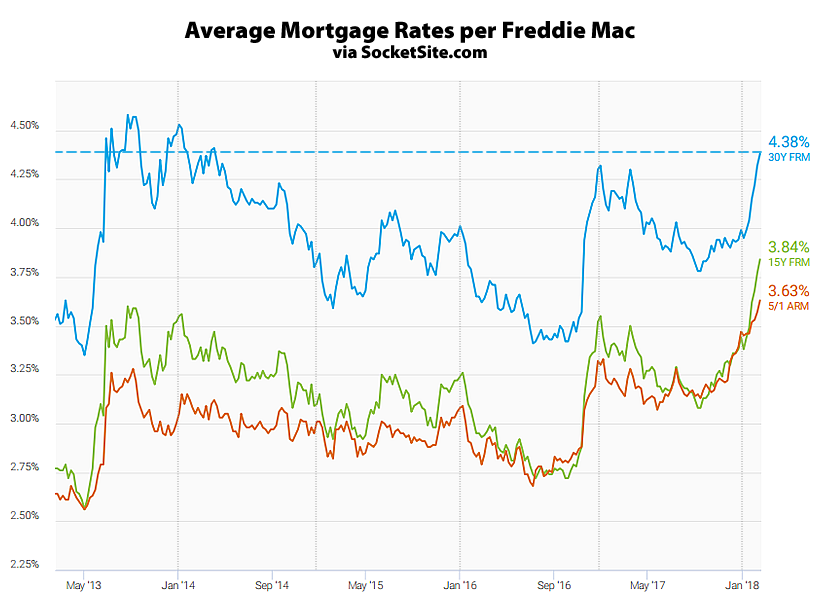

Continuing a trend that shouldn’t catch any plugged-in readers by surprise, the average rate for a benchmark 30-year mortgage ticked up another 6 basis points over the past week to 4.38 percent, which is now 43 basis points higher than at the beginning of the year, 23 basis points higher on a year-over-year basis and within 3 basis points of the 4.41 percent four-year high, according to Freddie Mac’s Primary Mortgage Market Survey data.

At the same time, the average rates for 15-year fixed (3.84 percent) and 5-year adjustable rate mortgages (3.63 percent) are nearing 7-year highs, up from as low as 2.72 percent and 2.68 percent last year, respectively.

Keep in mind that the seemingly innocuous rise in interest rates, which remain near historic lows, have already unnerved the equity markets, to which the property market in San Francisco is highly correlated.

And according to an analysis of the futures market, the probability of the Fed raising the federal funds rate next month has jumped 11 percentage points over the past week to 83 percent.

I’m quite happy to have re-fi’d into a super-jumbo 30-year fixed at 3.5% two months ago.

Are you Air BnBing the servant’s quarters to get past the SALT deduction limits?