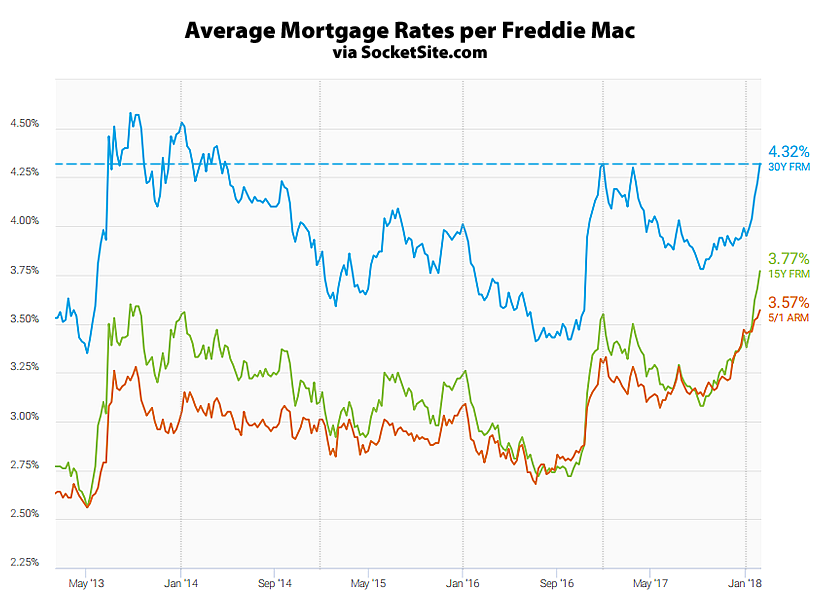

In a move that shouldn’t catch any plugged-in readers by surprise, the average rate for a benchmark 30-year mortgage moved up another 10 basis points over the past week to 4.32 percent, which is 37 basis points higher than at the beginning of the year, 15 basis points higher on a year-over-year basis and effectively a four-year high, according to Freddie Mac’s Primary Mortgage Market Survey data.

Keep in mind that the seemingly innocuous rise in interest rates, which remain near historic lows, has unnerved the equity markets (to which the property market in San Francisco is highly correlated).

And according to an analysis of the futures market, the probability of the Fed raising the federal funds rate next month has slipped 10 percentage points over the past week to 72 percent.

“has unnerved the equity markets (to which the property market in San Francisco is highly correlated).”

This is quite a broad statement. For instance, SF condo prices by your reports have peaked previously, but the market certainly hasn’t. 5-10% drops in the market, when they happen since the 2008 crash do not translate into 5-10% drops in housing. Nobody knows if tomorrow brings pain or relief to the markets, so this is drawing a lot of conclusions. Although the tech sector of the stock market is a reflection of company performance in our area, as is the housing market, the housing market does not follow stock market volatility as it moves much more slowly.

Nobody can deny, however, the mortgage rate to borrowing power of the consumer. So we’ll see how rising rates affect housing prices

Correlation doesn’t mean 1-to-1, not all segments move in lockstep and condos tends to be a leading indicator for the market overall.

“highly correlated” implies more “1 to 1” than a loose correlation, which is what the overall stock market is to SF RE. Again, you’re reaching; drawing conclusions to meet your own agenda.

An “r” in the range 0.7 < r < 0.9 seems to meet the normal definition of “highly correlated” and while there's no law requiring use of that definition, it does free the editors from charges of "agenda building"…assuming of course they've taken the time to calculate the value (and it lies therein).

You are both a little bit off the mark. While there are many specific definitions, lets take the common ‘linear pearson correlation’ mentioned in your link.

Colloquially, the amount of correlation is how closely the data resembles a line. But that does not imply what the slope of that line is.

As the paper in your link says, temperatures in C and F are perfectly (r=1) correlated, but that does not imply that 1 degree C is 1 degree F. (1 to 1)

While mortgage rates and the stock market undoubtedly have great influence on the housing market, it’s very notable that many of the price declines we’ve seen have happened before the recent rise in rates and stock market turmoil. It’s a hallmark of momentum based price cycles that they can start to turn of their own accord and need not be “caused” by anything. While a pin can certainly pop a balloon, a balloon can also be popped simply by being over-inflated.

Rate increases were inevitable despite the fact that the Fed held rates artificially low for so long The stock market gyrations will flatten out as the acceptance of increased interest rates gets baked into the market..

Real estate will, as always, be hampered to a degree as rates rise, but that is par for the course. In terms of prices in the most expensive markets such as SF and NYC, this will be one factor that slows upward appreciation going forward. It will not result in a large drop in prices IMO and probably at worst a flattening of price appreciation – but perhaps for the newer built condo market. This eventuality is one of a number of factors people purchasing BA RE should have been aware of, seen coming and included in their calculations when purchasing RE.

“It will not result in a large drop in prices IMO and probably at worst a flattening of price appreciation”

Seeing some 2015/2014 pricing now apropos nothing, it’s seems unlikely that a major economic event (interest rate rise, stock market correction, tech fallout,…) wouldn’t drive things further in that direction.

It seems hard to argue that a house can weather any storm when shingles start blowing off and windows blowing open after a light summer breeze.

Kinda agreeing with Dave here…rates are always a factor; low rates won’t be here forever; prime RE markets normally don’t collapse due to rising (and anticipated) rate changes.

What’s the difference between a bank giving you a teaser/adjustable rate that will inevitably go higher and the Fed giving you a rate which will inevitably go higher?

In theory people should look to the long term and anticipate reversion to the mean when financial factors are out of whack. But in practice, since the 2007-era many buyers have become payment focused and don’t go much beyond: ‘Can I afford the payments?’

Besides, if we should anticipate interest rates reverting to the mean, should we also anticipate the stock market CAPE reverting to the mean? Housing price-income ratio? Tech stock P/E valuations?

The big difference is that you can lock in that super low rate for the next 30 years…

IMHO stock prices, tech company valuations, and Bay Area RE are grossly overvalued. All supercharged by very low interest rates for almost a decade. I think we are in uncharted territory.

Will the DOW get back to 22,000 or lower?

I started buying/adding a bit of stocks today and would be thrilled if the Dow kept tanking cause I’ll be loading up even more.

As for Interest rates I also think a move up a bit more won’t impact housing much here, especially in the desireable core area.

If rates start getting to 6-7% on a 30year maybe we see some softening.

That and young funny money equity (that is taking a beating now)used to buy RE on the hi side could cause some problems but I think those are more isolated cases.

I for one am looking forward to lower prices. I sold last year. I’d love to come back at a 25 to 35% discount like last time.

What makes you think that’s a reasonable possibility? Financial black swan event? Earthquake?

Free money at rock bottom rates plus stock market that almost quadrupled since bottom, plus end of global growth cycle, plus a crazy clown in the WH who confuses reigning with leading, plus a delusional GOP digging us into a debt hole for no valid reason aside from class wealth transfer. Pick your poison. It happened before and it will happen again. Then it will resume its growth, as usual.

I think 2009 was a once in a lifetime buying opportunity because real estate itself was the bubble. Now we have the Everything Bubble, but the coming recession (probably within a year or so) won’t impact housing across the board. The lower end, working class type of markets will get hit hardest (lots of 3% down loans with money back in closing costs, because it’s cheaper than renting) and the urban markets like SOMA that saw a lot of new condo construction. The rest will probably see a milder dip, more like 2001 after the dot com bust.

By the way, Trump did say he was the “King of Debt” during the campaign, so anyone who is surprised that he is spending your grandkid’s future like a drunken sailor wasn’t really paying attention. While he is simply doing the sort of fiscal stimulus that should have been done in 2009, the timing is really bad, because the monetary stimulus went far too long and now there is a huge debt bubble that cannot handle normalized rates.

“Lifetime buying opportunity”. There is no such thing. I bought during 2 downturns in my 23 year investor experience. I hope to live long enough to go through maybe another 2 or 3 or more. The time is ripe to have another dip in the next 2 years. That would make it a 10-11 year cycle which is fairly reasonable.

Maybe if your lifespan is 15 years. But with real estate for the purpose of housing we are dealing with 20 years and much much more.

Fun fact: 100% of the people who live in San Francisco could afford to move here at some point in their lives.

Another fun fact: 100% of the people 50 years from now will also be in the same situation. They managed to afford SF 5, 10, 25 years before either as buyers or as tenants.

For instance what will happen when the generation of rent controlled tenants who got locked in in 79 are starting to move out to nursing homes or simply pass away? Extra rental supply? And what happens when the big downturn happens?

’79 rent control demographic is a very interesting idea, I wonder how big it is. But there is also lots of pent up demand in the rental market because so many people are making do with sub-optimal living situations right now, they will be looking to trade up on the next dip.

I am not saying the only opportunity in our lifetime to buy a dip in real estate, I’m saying it was probably the best. I mean, there were cities in America that had over 50% foreclosure rate. You could buy a SFR in Richmond on your credit card. But in SF it was only the marginal markets that got hit hard (Bayview, TICs, etc). I hope you’re not waiting to pick a desirable property in a good neighborhood for 50% off because it’s probably not going to happen.

During the next crash the governments and CBs are going to step in with ever more extreme interventions to keep the markets from doing their job. Betting on massive deflation right now is betting against some pretty big players.

If you look at a long term Case-Shiller chart (National), you’ll see that what is ‘twice in a lifetime’ is the amplitude of the last two booms. I’ve talked to people who are certain that 2007 was a irrational bubble, but are certain that it’s different this time. But if prices were irrational and crazy last time, it certainly is an odd coincidence that we just happened to “organically” grow prices to about the same level this time, with a similar slope and even with the CS lower tier pulling away.

” I mean, there were cities in America that had over 50% foreclosure rate.”

But that doesn’t always mean a good buying opportunity. Many homes are still underwater, and that’s even with a massive government bailout.

This WSJ report tells his narrative of being dragged underwater which I think is quite representative of D-list market housing crashes.

Price is what you pay and value is what you get. What makes quality markets like SF better is not that the price can’t drop, but rather that the price won’t drop so low that you get into a downward cycle of value destruction such as mentioned in the WSJ article. If a $1.5M condo drops to $1M, likely nothing will change about the neighborhood.

“During the next crash the governments and CBs are going to step in with ever more extreme interventions to keep the markets from doing their job. ”

I think that really depends on the details. The one thing about the 2007 bubble was that it was national and across all income (or lack of income) levels. Most lower income people have been cut off from this cycle. And the political calculus of bailing out what are perceived to be wealthy coastal elites is very different from that of bailing out the whole nation.

There are always buying opportunities in RE. Sometimes they are quite broad and at other times they are narrower and confined to fewer markets. Really, “once in a lifetime” deals can always be found. Sometimes it is easy as during the last crash and at other times not so. But deals are always out there.

RE going forward, despite a potential recession, will continue to see markets with good investment potential. The population is growing quite quickly in Seattle, Atlanta, the Texas metros and other places. People need a place to live and, during a recession, these growth markets will see, if not an upsurge in ownership, certainly an upsurge in demand for rental homes. Couple that with affordability – markets that are not in a potential bubble right now, low foreclosure rates and job growth and the making of a good RE deal is there.

Yes there is a pent up demand and as far as I know it’s not going anywhere. The Sf Bay Area has best of breed in many segments of the tech sector. There is critical mass.

But there was pent up demand in 2009 too. Except banks and buyers were frozen in fear and sellers panicked. Even the 2007 bears couldn’t believe it would be so brutal in early 2009.

Next downturn will be different, because replaying 2009 is impossible technically. But a correction to bring us back to a more reasonable growth curve? Probably.

Several factors that mitigate against a countrywide RE bubble and, at the same time, bode well for single family rental properties in dynamic markets..

1.Too much inventory? There is too little today.

2.Easy credit? Lending guidelines are more strict today.

3.Job Loss? There is job and wage growth.

4.Population loss? There is population growth and household growth due to the very large Millennial generation and immigration. In some metros the population growth is huge. Seattle and Phoenix are growing at 3%/year or more in populations. More than 4 times the sluggish population growth rate of the BA. A good number of other metros are experiencing growth significantly above the national average.

5.Since the Great Recession the percentage of households renting has gone from 35% to 37%. Per the Census Bureau. 35% of those rent single family homes.

IMO a crash as occurred in 2009 is not going to happen. A pullback in home prices? In some markets yes. Some markets are in a bubble – though generally most markets are not. Yes, there are some headwinds such as rising interest rates and the new tax law but many of the best markets are so, in part, precisely because they will be minimally impacted by these changes.

Dave, I agree with all your points. One element in assessing the hardiness of a bull market is akin to driving by looking in the rear view mirror. 2007 bulls looked at the hard gold numbers of the last 15 years and figured a downturn was impossible. But markets do not exist in a vacuum and we tend to be amazed when something unexpected happens yet again.

Me, I am looking at the following:

– 1 – right now, could all people living in San Francisco right now afford to rent at current market rate. It’s a resounding no. We’re probably under 15% affordability and have been for a while.

2 – How big is this pent up demand? Would it be enough to fill all the units occupied by SF dwellers theoretically priced out? That’s around 700K people and I do not think you’d find that many people ready to pounce on SF if that many units would be priced out.

This means that in a perfect free-flowing market, a market free of rent control, prop 13 and all sorts of built in protections, market rents would settle to a much lower amount and sale prices should adjust to the real demand.

Since the market is distorted by artificial elements, we are not at fair value. We have seen the 2009 collapse in action. Sale prices probably overshot “fair value”. The next correction will come from somewhere yet TBD but it will create great buying opportunities. Again.

I’ve been positive for a long time, but this disastrous budget bill (huge deficit spending at exactly the wrong time) might be enough to push us into recession.

I’m with sabbie on this one

It looks like to me fear is taking hold in the markets, and people on margin and those who bought ridiculous things like the invesre VIX (XIV) are getting wiped out. That and the bitcoin thing, I think is getting shaken out now. 22k Dow may be here sooner vs later. This is all good for me!

Now I saw another bloomberg article this morning talking about how default rates on FMA or FHA or whaterever those mortgages are (The ones the govt helps out with that only need like 3% down) are starting to see default spikes….and people scratching thier heads on this.

So there are some cracks.

My shopping list is ready but I haven’t seen much that screams deal to me yet. It will need to tank 2000 points more points before I think it is a steal. For now, I am buying incrementally like a snail, and working on other projects.

No one predicted the rapid rise up in the stock market in early January. It looked good on paper but completely irrational.

Beyond irrational. We are talking about a 30% increase in just over a year; and this was on top of an already overvalued market.

Some of that increase is justified (not just froth) because of the rollback in regulation and overall positive business sentiment from a pro-business administration. Many of the companies had aggressive growth and revenue estimates which they handily beat. That should continue for the rest of 2018 as businesses and individuals take into account the new tax laws.

The only thing that concerns me with late day rallies are companies buying back their own stock, giving the illusion the market has bottomed.

UPDATE: Mortgage Rates Continue to Rise, Short-Term Rates near 7-Year Highs