While Bay Area home sales typically drop around 6 percent from June to July with normal seasonality in play, the sale volume dropped over 17 percent in 2017, from 9,114 sales in June to 7,534 in July which is down 2.6 percent versus the same time last year and the lowest recorded sales volume for a July since 2011 when 7,014 homes traded hands and versus an average of 9,181 since 1988.

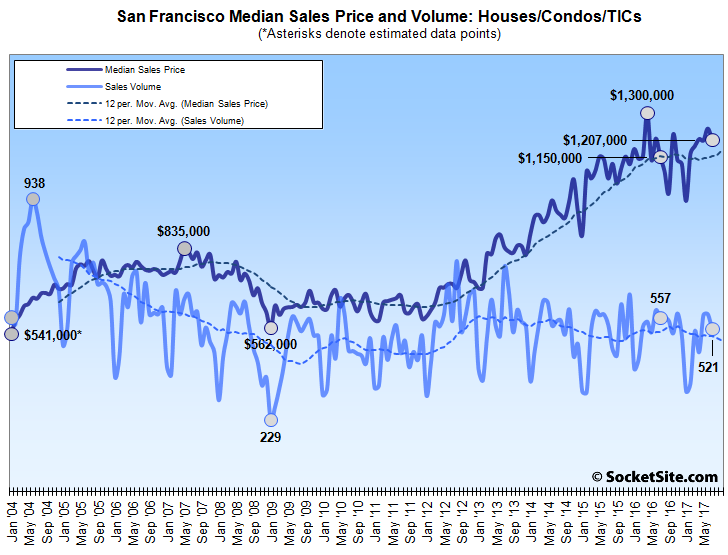

In San Francisco proper, the number of single-family homes and condos that traded hands dropped 8.4 percent, from 569 in June to 521 in July, which is three times a typical seasonal decline of 2.7 percent and 6.5 percent lower versus the same time last year, according to recorded sales data from CoreLogic.

In Alameda County, recorded homes sales dropped 16.9 percent from 1,906 in June to 1,584 in July and were 5.2 percent lower versus the same time last year; sales in Contra Costa County dropped 20.9 percent to 1,508 in July which is 4.2 percent lower on a year-over-year basis; and sales in Solano County dropped 12.5 percent to 589 in July which is 7.7 percent lower, year-over-year.

Home sales in Santa Clara County dropped 15.9 percent from 2,073 in June to 1,744 in July but were 9.3 percent higher versus the same time last year while recorded sales in San Mateo County dropped 24.3 percent to 587 in July and were down 5.5 percent, year-over-year.

Up in Marin County, sales dropped 12.6 percent to 320 in July but were 5.3 percent higher on a year-over basis; sales in Napa dropped 23.8 percent to 128 which is 16.3 percent lower versus the same time last year; and home sale in Sonoma County dropped 18.3 percent to 553 which was 9.6 percent lower, year-over-year.

The median price paid for those aforementioned 521 homes in San Francisco last month dropped 3.1 percent from $1,246,000 in June to $1,207,000 in July, which is 7.1 percent below the record $1.3 million median price recorded in April of 2016 but 5.0 percent higher versus the same time last year.

The median sale price in Alameda County was $760,500 in July and 10.2 percent higher versus the same time last year, the median sale price in Contra Costa County was $565,000 and 6.6 percent higher on a year-over-year basis, and the median sale price in Solano was $405,000 and 8.0 percent higher, year-over-year.

The median sale price in Santa Clara County was $950,000 and 9.2 percent higher versus the same time last year and the median sale price in San Mateo County was $1,150,000 and 6.6 percent higher, year-over-year.

The median sale price in Marin ($930,000) was 2.1 percent lower versus the same time last year while the median in Napa ($600,000) was 3.6 percent higher and the median in Sonoma ($570,500) was 13.4 percent higher, year-over-year.

And across the greater Bay Area, the median home sale price slipped 1.6 percent from $770,500 June to $758,000 in July but remains 9.1 percent higher versus the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

Why would weakening prices be met with lower demand?

Is this consistent with the ‘endless summer’ theories of a few years back, that held that the frenzied buyer bidding for properties represented a deep bench of buyers that would keep the boom going on forever? That even more would buy “but there’s just no inventory out there”?

Or is this more consistent with boom-bust dynamics? Where rising prices created demand with global capital piling into the perceived gold rush that was the market then? And then when the expectation of appreciation fades, demand fades along with it?

Weakening prices? From the post: “5.0 percent higher versus the same time last year.” True, the median did drop a tad from the last month, but you can see from the editor’s chart that month-to-month variations are very wide.

And, of course, sales volume ≠ demand. A common error.

And the editor’s nice moving average curve shows that sales volume has been basically steady (very slight downslope) since about early 2013 while the moving average price curve has shot up since them. Pretty much no correlation. All you can read from this is that SF prices continue to rise a bit, or, at the most pessimistic, have plateaued.

A much more common and dangerous error is simply conflating movements in the median sales price with underlying values or “appreciation.” And, of course, thinking sales volume ≠ demand.

Well, medians are certainly one measure of prices. Nobody ever said they are the be-all and end-all (and if they are completely irrelevant, why include a monthly post reporting on median selling prices?). It’s a pretty good measure of things over long periods of time. And no, “demand” is not measured by sales volume. That’s just a fundamental misunderstanding of econ 1 principles. Sales volume measures one thing — closed transactions. It’s not a difficult concept. If you have two homes for sale and they both sell immediately with 10 bids each, you do not have a “demand of two.”

Main take away:

San Francisco: +5% Y-o-Y appreciation

Bay Area: +9% Y-o-Y appreciation

This is still a strong real estate market.

Looking at the San Francisco diagram above, Prices has stabilized at a high level where not all that many people can afford to buy. The incentive for short term investors to buy is gone, since there is no immediate appreciation on their investment, only taxes and headaches.

The NAR says “The share of consumers who believe it’s a good time to buy a home is at an all-time low, at 23%.” If you asked the same question in SF, I’ll bet it would be even lower. So who’s buying? That’s a rhetorical question by the way.

There are some great markets to buy rental property in. Good ROI and good appreciation over the next decade. SF, yes – not good for RE investors and especially small/medium level investors. It depends on the market as to whether this is a good time.

I’m going to go out on a limb and suggest that the people are buying are people who work here and want to buy their house.

[Editor’s Note: Speaking of which, Employment in San Francisco Nearing Negative Growth.]

“Nearing Negative Growth”

i.e. “Positive Growth”

Thought, really, it’s not relevant. Sabbie asked who’s buying. I suggest it’s people who work here and want to buy a house. It’s pretty straightforward.

I suggest that these buyers may be “price insensitive” for various reasons. Most folks who actually work for their money like to get a good value when they buy something. The large majority does not feel the housing market represents a good value today.

“The large majority does not feel the housing market represents a good value today.”

People have been saying this exact thing every single year for the last 25 years. And yet prices keep going up. Your “large majority” may not quite be as large as you think.

“People have been saying this exact thing every single year for the last 25 years.” That’s not true at all. For example, lots of people including myself said in 2011-2012 that it’s a great time to buy.

Do you have a statistical basis for this ‘large majority’ opinion?

I guess you didn’t read the original post, the NAR does a quarterly survey and only 23% said it’s a good time to buy a house. For SF, since only 12% of residents can even afford to buy the media home in the first place (compared to 29% statewide) it’s probably safe to assume the number is much lower.

San francisco is like gold. Those who can afford it are prepared to accept it’s volatility. The alternative is silver, which has upside potential as well for those who cannot afford gold. However, gold will most likely never equal the price of silver, and that’s just life…

Well, it smells like urine but is priced like gold. I would say it’s a composite material containing both gold and baser elements.