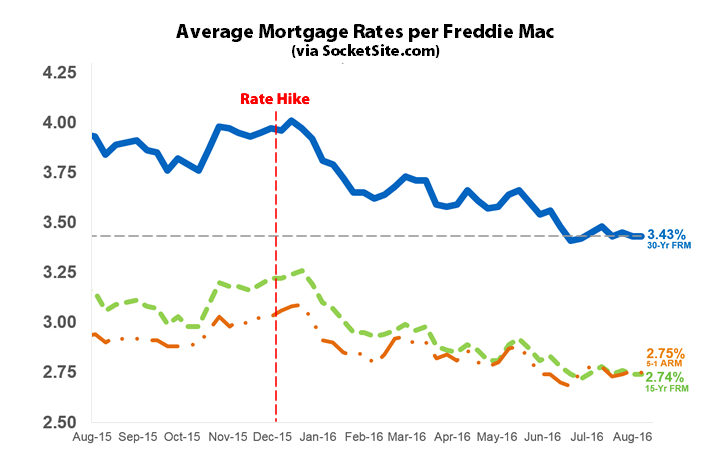

The average rate for a 30-year mortgage (3.43 percent) hasn’t moved much over the past month. But with traders poised to dissect tomorrow’s scheduled “Monetary Policy Toolkit” speech by Federal Chair Janet Yellen, looking for hints of whether – or rather when – the Fed will hike the Federal Funds rate, expect some movement over the next couple days.

And while the probability of the Fed enacting a hike by the end of the year had dropped below 35 percent at the beginning of August, according to the futures market, the current probability is 54 percent and trending up.

A hike here would be a mistake.

Why, they haven’t blown enough asset bubbles, or stoked enough inequality yet? Or do you mean we need to punish workers, savers, and retirees some more?

They are obviously going to wait until December so as not to disturb Hillary’s election. But really the mistake was not tightening back in 2010. Because the QE and ZIRP have failed to have the desired effect, but they had lots of undesirable effects. And now they have painted themselves into a corner.

So the plan is:

1. Raise rates

2. Plunge economy into tailspin, increase unemployment above 10%, etc

3. Party?

What’s the #3 here? What is raising rates supposed to fix?

You can either take your medicine, fix the mal-investment, and set the stage for real growth and consumer spending. Or you can end up like Japan. Forest managers now know that allowing regular smaller fires is necessary to prevent massive destructive ones. It’s just like capitalism, read here and learn.

Today’s Wall Street Journal also pretty much repeats everything I just said.

To be fair, let’s not put all the blame on the Fed. Unfortunately, it all falls on them as there is no political will for fiscal stimulus.

Agreed. Although I think people are coming around. It’s funny to see Republicans changing their tune.

Still, people grossly underestimate what the American people can do on their own if the crony capitalists would just get the heck out of the way. There have been hundreds of economic downturns in modern times and people always find a way to come back. Small business led hiring out of the recession for the first few years, and who knows what might have happened if they had a level playing field. Fed as lender of last resort, fine, a year or two of low rates, sure. Pedal to the metal for eight years, not good.

You haven’t explained how raising the fed funds rate fixes “mal-investment”. The focus on a single number is very, very strange. Never reason from a nominal interest rate.

The focus on a single number is strange? Point your browser to any financial news site tonight and tell me what you see in the top headlines.

As far as I can tell, the argument is that raising interest rates will [through mystery process nobody can or will explain] “make America great again.”

Yes, there is plenty of criticism for the inaction of many players to prevent the housing/financial bubble of 2003-07. But that says nothing about what the Fed should do now. Classic models support fiscal spending and low rates until we see greater employment, wages, and inflation. Then we can start dampening things through rate increases and scaling back spending. Those models have been right so far. Of course, the Fed has no control over fiscal stimuli (which the republicans have shut down), and little control over most interest rates, so it is doing what it can with the tools it has – keeping the rates it can control down until we see improvements. Yep, that is an imperfect response with some side effects. But raising rates to dampen an already fragile economy certainly doesn’t seem to be a useful alternative.

Sabbie, yes I agree that financial news sites focus on a single number. That doesn’t make it right.

You claimed a few days ago that CPI wasn’t the best measure of inflation, but I guarantee you that every financial news site focuses on that number. Does that make it right in your book?

The number is so important because the stock market’s not so sexy cousin, the bond market, is what really rules the world. By the way, what do you think all those negative bond holders are going to do if and when the Fed raises rates?

JR- your entire argument is predicated on the assumption that lower rates lead to growth, while a preponderance of evidence now shows that this assumption is wrong, at least in today’s world. Insanity is doing the same thing over and over, and expecting different results.

Low rates have definitely led to big growth in my real estate portfolio! And my consumption of good wine, foreign travel and Wagyu beef has increased 500% since the recession hit. So it’s not all bad news down here.

“As far as I can tell, the argument is that raising interest rates will [through mystery process nobody can or will explain] “make America great again.”

The 2007 housing bubble and it’s aftermath have been unprecedented. So the policy response of extremely large long term QE might work and it might not, but the idea that merely questioning if the policy is working is akin to goldbuggery and/or Trumpism is fairly ridiculous.

My general opinion is that the financial system should be considered a tool to help advance the real economy and that the financial system should incentivize productive activity.

And so the main problem with having an implicit policy of bailing out any economic weakness is that it removes the incentive for investors and some workers to be productive.

If you will get bailed out by the central bank, why worry about a companies business model and ability to pay back debt if you’re a bond investor? If housing prices always go up, why worry about a house’s construction quality, the local economy or your own job prospects? If a greater fool will buy shares of your company why worry about making a solid business?

And while we currently have an implicit policy of central banks bailing out the real economy some people, such as “anona”, advocate policies such as NGDP targeting which essentially amount to an explicit policy of propping up the real economy. For those who aren’t econ geeks, NGDP targeting involves the central bank picking some “natural” rate of GDP growth in dollar terms. And the central bank simply prints money to inflate whatever real GDP growth occurs into the target nominal GDP (NGDP) range. One advantage of this is that you need not calculate a figure for the inflation rate, which is actually somewhat subjective and complicated to measure.

But the key question is, Will forcing NGDP up at a smooth “natural” rate actually spur the real economy to grow and be more productive?

If a company offers 5% yearly raises to all employees regardless of performance or profitability will that company magically become more productive and profitable?

I absolutely agree that doing the same thing over and over again and expecting different results is insanity, which is why I say that it’s insanity to look at the low fed funds rate and assume “easy money”. Or equivalent ridiculous notions like “a low fed funds rate hurts savers”, as if the fed raising rates is going to do nothing except pay more on senior citizens’ savings accounts at the local bank.

incog, I understand, and share, the “moral hazard” concern. But that’s a different issue from the question of whether the Fed should keep the few interest rates it controls at a low level in the face of a deflation risk, low growth, and pretty stagnant wages. I’ve still never seen any model to explain how raising rates in the face of these issues could do anything but slow the economy further and increase unemployment. “Magic” and “Austria” (the zerohedge explanations) don’t work for me.

Also, while there were certainly a lot of bad players getting “bailed out” who probably shouldn’t have in the financial crisis 8 years ago, a lot of the criticism is 20-20 hindsight of actions taken in a panic when we were faced with a real risk of a serious, worldwide depression. Fair enough. But who is getting bailed out now? Who is just getting all their money back when they invest in bad businesses? Just look at all the bankruptcies in the oil services industry to see that pouring money into high risk endeavors certainly can result in huge losses. Low central bank interest rates aren’t protecting those bondholders from anything.

75% of the economy is the consumer. Back in the day when they lowered rates from seven to five percent, for example, it worked out alright. But at these newly experimental zero rates, the consumers feel the squeeze and begin to save and not spend, the proof is in the pudding. Time to scale back the failed experiment.

Raising rates would force companies to focus on growth and productivity instead of stock buybacks. If they can’t cut the muster operating a real business then they need to liquidate and get out of the way of new and better businesses that can. Do you think the Fed is going to reach their magic targets and then the economy will just cruise along? No, it’s called the business cycle, and this one is already long in the tooth. The main reason it has been so weak, besides the larger demographic and productivity trends, is that these low rates mostly created a “wealth effect” for the top 5% and it has only trickled down slightly to help grow the low wage service economy. All this is readily quantifiable. The market and its cheerleaders are a bunch of spoiled toddlers that throw a tantrum whenever the free money spigot is turned down, it’s time to put on the big boy pants and take off the training wheels folks!

So again, your plan is:

1. Raise rates

2. Plunge economy into tailspin, increase unemployment above 10%, etc

3. Party?

Explain what the next step is after raising rates. Businesses aren’t going to “focus on growth and productivity”, because your #2 above would force the economy into an instant gigantic contraction. There isn’t any evidence that higher rates are some kind of panacea.

I’m also not clear on why consumers feel more “squeezed” because of low fed funds rates. They feel squeezed because wage growth has been incredibly low. One way to fix that is simply a higher inflation rate, but unfortunately the fed has been unwilling to do what’s necessary to hit 2% inflation, let alone the catchup 3-5% that we’ve really needed for years now.

The zero bound does indeed create difficulties. But consumers who would spend away when the banks are offering them 5% to park their money are now saving when the banks offer 0% to park it? In what universe?

I still have not heard anything to explain how, as has been hypothesized, raising interest rates will grow the economy, improve wages, or lower unemployment. It would have the opposite effect. I agree that the central banks are in a bind (the zero bound problem again), and I also agree that ZIRP has some bad side effects since nobody can control where the cheap money flows. But raising interest rates is not the way out.

From everything I’ve seen, fiscal stimulus is the needed punch. Once that primes the pump and gets things accelerating, then rates can begin to rise to keep things from overheating. Straight Keynes. On the plus side, this view seems to be (finally) getting some traction after 8 years of financial pain and suffering for way too many.

It doesn’t matter what you or I think, because in the December the Fed is going to hike 1/4 point and this bubble is going to come crashing down, as it should. We’ll have to employ that fiscal stimulus during the next cycle.

You guys have drunk so much kool aid that you just keep repeating yourselves, it’s somehow inconceivable to your brain that there exists a natural rate of interest set by the market, or that taking zombie businesses off of life support is a net positive in the long run.

Your implication is that the Wicksellian rate is significantly higher than what the Fed has set right now? I don’t know of any economists that would agree with that.

Similarly, you keep implying that there’s this common belief among economists that the Fed should raise rates and that we’re the ones on the fringe. I don’t know of any prominent economists that are advocating raising rates significantly right now. Even those that would prefer the market setting rates (market monetarists like myself) or those that would prefer massive fiscal stimulus don’t think that the next best option is for the Fed to kill the economy through jacking up rates.

As for drinking the kool aid, I don’t reject that possibility. That’s why I keep asking for a model, or some explanation, as to how raising rates will help the economy, or workers, or the unemployed. You’re not the first I’ve heard make this argument about “artificially low” rates and the need to raise them. So far, all I’ve heard in response are mutterings about “misallocated resources,” and “bubbles” and “Austria” and “inequality.” On the other hand, I’ve seen very good models, and very sound explanations, for how and why low interest rates (and, even better, fiscal stimulus) are beneficial on almost all fronts, notwithstanding some unfortunate effects.

Most of the people I know calling for higher interest rates are very wealthy, and they simply want a risk-free place to generate a couple million dollars annually, year after year, like they used to enjoy. I get that — that would be good for them. But not for the broader economy.

The idea that you can fix issues such as unemployment, poor productivity and low GDP growth by essentially forcing the nominal variables to where you want them to be is essentially rent control writ large.

If the SF BOS was unconstrained by state or federal law, it could pass all sorts of laws to make housing “affordable” by rolling back rents or tying them to a person’s income. And of course this would “work” in the sense that with police powers you can force prices to be whatever you want and initially people would be happy with cheaper rents. And the longer that you held on to this rent control policy the more actual rents would diverge from what they would be in a free market. And thus the more of an initial shock it would be to remove rent control.

The longer you manipulate prices, the more you could make an “anona” argument that: 1) Remove RC, 2) Rents shoot up, people lose homes, 3) ?

But maybe the real takeaway here is that if perusing a policy for a long time produces no real benefit and makes it increasingly costly to exit the policy, then maybe that policy isn’t really a good idea.

If housing becomes more affordable, due to increased builder productivity, better land use, better transportation that increases the effective area that job holders can be housed in, that’s a positive outcome. But merely forcing down prices without having any real productivity gains in housing production is a negative outcome.

It similarly seems to me that forcing nominal GDP and employment to where you want them to be without the underlying gains in corporate and individual productivity will not lead to sustainable positive outcomes.

And if you think that the only people who disagree with you are a few random internet commenters, I would recommend taking a look at the article that Sabbie posted.

In particular the three points called out here: “The Fed’s own uncertainty about the economy’s underpinnings is more than a decade in the making and traces back to three key developments that have thrown officials for a loop. First, officials missed signs that a more complex financial system had become vulnerable to financial bubbles, and bubbles had become a growing threat in a low-interest-rate world. Secondly, they were blinded to a long-running slowdown in the growth of worker productivity, or output per hour of labor, which has limited how fast the economy could grow since 2004. Thirdly, inflation hasn’t responded to the ups and downs of the job market in the way the Fed expected.”

@incog – I advocate full NGDP targeting with the level targeting determined by NGDP futures. So…that’s fully market-determined, no “setting” of rates at all. Sabbie’s plan of raising rates is “manipulating” rates just as much as they’re being manipulated now, just in a different direction.

Also, I never claimed that no one disagrees with the Fed’s behavior. I claimed that there is not broad consensus on the need to raise rates. You and Sabbie seem to think that there is.

How do you have a futures market in something which is mostly deterministic?

If you’re advocating that the fed will deterministicly force NGDP to the target, then how will you have a future market on that.

i.e. if the SF BOS decrees that 1Br’s should rent for $400psf in 2017 then where’s the room to take bets on what 1Br rents will be in 2017?

Or if I’m a rent bookie and the city asks for my estimate of next years rents and then forces rents to that level, what does it matter what number I give them?

Once again, I’m not advocating that the fed will deterministicly force NGDP to the target. That’s what you and Sabbie are arguing, only with higher fed funds rates than currently exist. Details here.

You need to get your story straight and read your links.

The link you sent is just an possible implementation for having the fed force NGDP to it’s target: “For example, if the central bank’s goal were 5 percent nominal GDP growth, then it would adjust its policy instruments until the futures market also forecast 5 percent nominal GDP growth. In most cases, its policy instruments would be buying and selling government bonds on the open market.”

In your papers example the central bank just decides that NGDP growth should be 5% and sets up a futures market to provide feedback to help it force NGDP to target. The market feed back is just an implementation detail for how they will force the nominal variable to their target.

Just like the SF rent board deciding by fiat that rents should rise 1.6% this year. The actual details of the rent board are not really relevant and if they created a market system of ‘rent privateers’ with the power to monitor rents and fine offenders it woulld’t change the fundamental economics of trying to fix a problem by forcing a nominal variable.

You need to click through some of the links within the links.

I still haven’t seen your solution though? You’re going to have the fed raise rates because the fed raising rates is not “manipulation”? But keeping them low is? I’m rather confused.

Sorry, but your paper is clearly talking about a method to force NGDP to a target vis changing (inflating or deflating) the value of a currency.

Maybe it’s a good method, maybe it isn’t, but the salient problem with trying to improve the real economy by forcing a nominal variable isn’t your ability to force the variable with maximum accuracy.

The map is not the territory and hiring a world renowned artist to draw a beautiful bridge on the map does nothing to help you get across the river in the real world.

Still not reading the full paper, I see…

Whatever, stick with your “non-manipulation” method of the fed forcing interest rates higher because bubbles or something yo.

Are you referring to an academic paper or a dan brown novel? Is there a puzzle within an anagram with a link within a link that reveals that the clear language of the paper is a ruse and lays out the actual proposal?

Because the paper clearly lays out a proposal to have the Fed pick a target for nominal GDP, setup a futures market to act as a prediction market to get the market’s expectation for NGDP and then adjust policy to push NGDP to the Fed’s chosen target.

Given that you’re prone to railing against gold bugs during threads in which no one has suggested anything of the sort, it’s particularly ironic that in the author’s concluding remarks he states: “NGDP futures targeting has many of the advantages of the old gold standard system, without its disadvantages. Between 1879 and 1933, the US government kept the nominal price of gold fixed at $20.67 per ounce. Unfortunately, the real value of gold (its purchasing power) was often unstable, resulting in cycles of inflation and deflation, rising NGDP and falling NGDP. The United States needs a rules-based system that works automatically, as the classical gold standard did, but also one that stabilizes NGDP growth over time.”

So you are basically advocating a system modeled after the gold standard. And the paper’s author correctly illustrates a huge problem with the gold standard, that of forcing the nominal value gold to an arbitrary value while the real value fluctuates. But then goes on to advocate forcing the nominal value of the entire economy’s GDP irrespective of the state of real GDP!

Fixing a price is not the same as fixing the underlying problem and googling a paper is not the same as understanding a paper.

My opposition to the gold standard has nothing to do with it being a fixed amount – that’s the good part about it! My opposition is that it shifts the stance of monetary policy to the whims of the global gold market, which is insanity.

Rules-based monetary policy is exactly what I’d like to see.

Now you’ve lost the plot. To suggest that the natural rate of interest is zero or negative, today or any day in history of the world, is laughable. And I guess you don’t trade or you would have heard that Stan Fischer himself just today said the Fed is very much considering raising rates as early as September.

Raising rates is not the same as your idea to raise rates substantially.

I would absolutely suggest that the natural rate of interest can be zero or negative. When the economic outlook is negative I would expect it (seems strange that you wouldn’t).

That doesn’t mean that I think that it’s negative now, I just don’t think it’s much above inflation, which means that the fed funds rate is probably higher than the market would set it.

Anona, there is no such thing as a ‘natural’ rate of interest. The economy is not natural like chemical reactions or plate tectonics. The economy is human-created. The rate of interest is what we choose. And in the dollar economy, with a Federal Reserve in control of a balance sheet of infinite size, they can set the interest rate to any positive nominal interest rate (and possibly some negative rates) all along the yield curve. Thanks, Joel

Believe what you well. The Wicksellian rate is widely accepted as a “thing” in economics.

The main problem here is people’s faith in pencil necked, paper pushing, ivory tower academics vs capitalism and the American people. I don’t care about their models, let’s switch to common sense for a moment. You’re a lender, you exist to make profit, why would ever loan money at zero or negative interest? I can’t find the link just now but a historian did a study and could not find one other instance of negative rates ever.

What you call common sense is also a model, it’s just simpler than the already oversimplified models that the academics are using. But if you really prefer “common sense” to pencil-necked paper pushers, the GOP has just the candidate for you.

You didn’t answer the question, just diverted into politics. Why would anyone loan money at zero or negative interest? And the buyer of that paper is only holding it for speculation, how do we know if liquidity exists in this uncharted scenario?

Oh, my common sense agrees with yours. But when it comes to something as insanely complicated as the economy, my experience is that common sense has very little to do with it. Most of the experts think negative rates are still a necessary evil. I’m not sure your “common sense” model is nuanced enough to include the idea of a necessary evil.

Has all lending stopped in Switzerland? How about Germany? No? Weird, they’ve had negative rates for quite some time now.

Listen, I absolutely agree that we should attempt to raise the market interest rates, but that has nothing to do with forcing the Fed to raise the Fed funds rate prematurely. We should instead be forcing the Fed to hit or exceed their inflation target. For a central bank that literally prints the money of the country, this is not difficult to do.

We are still nowhere near the target 2% inflation rate. Raising rates now pumps the brakes on a slightly growing economy. Recession in 2017, anyone?

They are never going to be able to raise the interest rates again. Welcome to the new normal!

I am waiting to see interest rates drop below 2% like they have in Canada.

I’m waiting for negative mortgage rates.

Hahaha, wouldn’t that be nice.

“Hello. I would like to borrow infinity gazillion dollars, please. I’ll pay it back in regular installments, minus the interest I’m owed.”