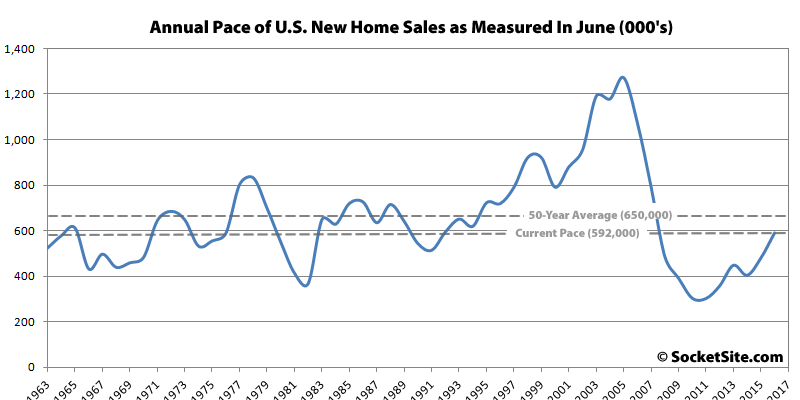

With a downward revision to April’s pace, and an upward revision to May’s, the pace of new single-family home sales in the U.S. ticked up 3.5 percent in June to an annual rate of 592,000 sales, which is 25.4 percent higher versus the same time last year (472,000) and the fastest pace since February 2008.

But the current pace, which is roughly half the record-high June pace of 1,274,000 annual sales set in 2005, remains 8.9 percent below the long-term average rate for this time of the year (650,000).

In terms of inventory, the number of new single-family homes for sale across the county is now 244,000, up 1.2 percent from the month before and 13.0 percent higher versus the same time last year.

And having dropped a revises 9.9 percent from April to May, the pace of new single-family home sales in the West rebounded 10.9 percent in June to an annual rate of 152,000 sales, 24.6 percent higher versus the same time last year.

The million dollar question is if home prices will stall out without rates near zero and inventory low. In other words, can this housing market collapse under its own weight or will something unforeseen at the moment trigger an inventory spike? I don’t see what forces in this economy can cause inventory to skyrocket which will be needed for prices to soften up.

You don’t need an inventory spike, recessionary panic selling into dried up demand will do the job.

Good thing that the population or the number of houses hasn’t changed since 1963, otherwise it wouldn’t be a good idea to take a flat line as the average over that period.

In other news, average U.S. college graduations/year keep rocketing up for some reason, way above 50 year trend!